Konica Minolta 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 37

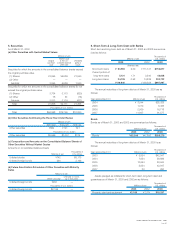

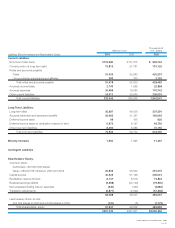

The scheduled maturities of future lease rental payments on such lease

contracts as of March 31, 2003 and 2002 are as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Due within one year ¥ 3,564 ¥3,343 $29,651

Due over one year 6,466 6,456 53,794

10,031 9,799 83,453

Lease rental expenses for the year ¥ 4,311 ¥3,463 $35,865

2. Operating Leases

The scheduled maturities of future lease rental payments on such lease con-

tracts as of March 31, 2003 and 2002 are as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Due within one year ¥ 4,940 ¥ 4,036 $ 41,098

Due over one year 14,745 14,568 122,671

¥19,685 ¥18,604 $163,769

Lessor

Finance Leases

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Leased tools and furniture:

Purchase cost ¥576 ¥766 $4,792

Accumulated depreciation (537) (689) (4,468)

Net book value ¥38 ¥ 77 $ 316

The scheduled maturities of future lease rental income on such lease

contracts as of March 31, 2003 and 2002 are as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Due within one year ¥ 44 ¥ 88 $ 366

Due over one year ———

44 88 366

Lease rental income for the year 618 792 5,141

Depreciation for the year ¥537 ¥689 $4,468

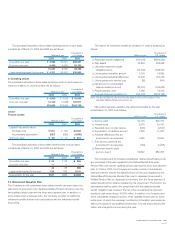

12. Retirement Benefits Plan

The Company and its subsidiaries have defined benefit retirement plans: the

plan which is governed by the Japanese Welfare Pension Insurance Law, the

tax-qualified pension plan and the lump-sum payment plan. In addition, in

some cases when employees retire, the Company provides for additional

retirement benefits that are not in accordance with the retirement benefit

accounting.

The reserve for retirement benefits as of March 31, 2003 is analyzed as

follows:

Thousands of

Millions of yen U.S. dollars

a. Retirement benefit obligations ¥(79,163) $(658,594)

b. Plan assets 34,853 289,958

c. Unfunded retirement benefit

obligations (a+b) (44,309) (368,627)

d. Unrecognized transition amount 2,391 19,892

e. Unrecognized actuarial differences 19,645 163,436

f. Unrecognized prior service cost (65) (541)

g. Net amount on consolidated

balance sheets (c+d+e+f) (22,337) (185,832)

h. Prepaid pension cost 1,965 16,348

i. Accrued retirement benefits (g–h) ¥(24,303) $(202,188)

Note: The above table includes the amounts related to the portion subject to the

Japanese Welfare Pension Insurance Law.

Net pension expense related to the retirement benefits for the year

ended March 31, 2003 is as follows:

Thousands of

Millions of yen U.S. dollars

a. Service costs ¥4,776 $39,734

b. Interest costs 2,975 24,750

c. Expected return on plan assets (545) (4,534)

d. Amortization of transition amount 1,325 11,023

e. Actuarial differences that are

accounted for as expenses 1,285 10,691

f. Prior service costs that are

accounted for as expenses (156) (1,298)

g. Retirement benefit costs

(a+b+c+d+e+f) ¥9,662 $80,383

The Company and its domestic subsidiaries’ defined benefit plans so far

are comprised of the plan regulated by the Defined Benefit Enterprise

Pension Plan Law, the tax-qualified pension plan and the lump-sum payment

plan. In October 2002, the Company and certain number of subsidiaries

were permitted to transfer the defined portion of their plan regulated by the

Defined Benefit Enterprise Pension Plan Law to Japanese Government’s

Welfare Pension Plan by Japanese Government, then the future payment of

related benefit portion shall be replaced by the government. The fund for the

replacement shall be paid to the government and the related projected

benefit obligation was reversed. The net of the reversal and the payment

resulted in gain amounting to ¥8,081 million. In addition, the Company and

some subsidiaries changed a portion of tax-qualified pension plan to contri-

bution plan, of which the necessary contribution at transition was made par-

tially by the assets of tax-qualified pension plan. The rest amounting ¥2,993

million was charged to income during the year.