Konica Minolta 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 36

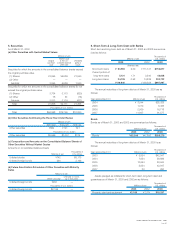

7. Income Taxes

The statutory tax rate used for calculating deferred tax assets and deferred

tax liabilities as of March 31, 2003 and 2002 was 42.1%.

At March 31, 2003 and 2002, the reconciliation of the statutory tax rate

to the effective income tax rate is as follows:

2003 2002

Statutory tax rate 42.1% 42.1%

Unrecognized tax effect (8.5) —

Accumulated deficit —(13.6)

Other, net (0.5) (2.7)

Effective tax rate 33.1% 25.8%

Statutory effective tax rate used for the calculation of non-current

deferred tax assets and liabilities is mainly 40.5% (prior fiscal year was

42.1%). Due to the change in the tax rate, amounts of deferred tax assets

(net of deferred tax liabilities) decreased by ¥346 million and deferred income

taxes increased by ¥367 million.

At March 31, 2003 and 2002, significant components of deferred tax

assets and liabilities are as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

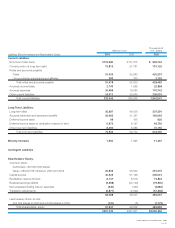

Gross deferred tax assets:

Tax effect on loss of a consolidated

subsidiary previously not recognized

¥ 3,810 ¥ 3,057 $ 31,697

Tax loss carryforwards

4,820 9,459 40,100

Reserve for employees’ retirement

allowance

15,046 15,451 125,175

Inventories, etc

6,970 2,631 57,987

Other, net

20,439 16,477 170,042

Subtotal

51,085 47,075 425,000

Valuation allowance

(6,587) (6,764) (54,800)

Deferred tax assets total

44,497 40,311 370,191

Total gross deferred tax liabilities

(7,517) (8,521) (62,537)

Net deferred tax assets

¥36,980 ¥31,789 $307,654

Deferred tax assets relating to operating losses are recorded because

the Japanese accounting standard requires that the benefit of tax loss carry-

forwards be estimated and recorded as an asset, with deduction of a valua-

tion allowance if it is expected that some portion or all of the deferred tax

assets will not be realized.

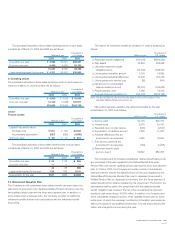

8. Research and Development Expenses

Total amounts charged to income for the fiscal years ended March 31, 2003

and 2002 are ¥30,308 million (US$252,153 thousand) and ¥29,171 million,

respectively.

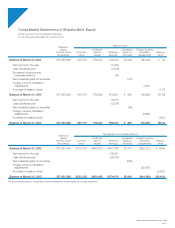

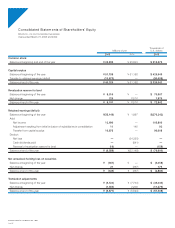

9. Shareholders’ Equity

Retained earnings at March 31, 2003 and 2002 include a legal reserve of

¥69,052 million and ¥56,251 million, respectively. The Japanese Commercial

Code provides that an mount equal to at least 10 percent of cash dividends

and other distribution from retained earnings paid by the Company and its

subsidiaries be appropriated as a legal reserve. No further appropriation is

required when the total amount of the additional paid-in capital and the legal

reserve equals 25 percent of their respective stated capital.

On June 25, 2003 the ordinary general shareholders’ meeting approved

a cash dividend to be paid to shareholders on record as of March 31, 2003

totaling ¥1,786 million, at rate of ¥5.00 per a share. The meeting also

approved a treasury stock purchase program in which the Company is

authorized to repurchase up to 35 million shares within the acquisition cost of

¥20 billion later than the date of the next ordinary general shareholders’

meeting to reduce the outstanding shares.

10. Contingent Liabilities

The Company and its subsidiaries were contingently liable, as of March 31,

2003, for loans guaranteed of ¥122 million (US$1,015 thousand).

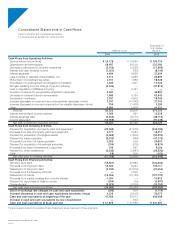

11. Lease Transactions

Information on the Company’s and consolidated subsidiaries’ finance lease

transactions (except for those which are deemed to transfer the ownership of

the leased assets to the lessee) and operating lease transactions is as

follows:

Accounting for Finance Leases

Finance leases other than those which are deemed to transfer the ownership

of the leased assets to lessees are accounted for mainly by a method similar

to that used for ordinary operating leases.

Lessee

1. Finance Leases

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Machinery and equipment ¥10,724 ¥11,826 $ 89,218

Tools and furniture 9,369 6,913 77,945

Others 507 451 4,218

20,601 19,192 171,389

Less: Accumulated depreciation (10,570) (9,392) (87,937)

Net book value 10,031 9,799 83,453

Depreciation ¥4,311 ¥ 3,463 $ 35,865

Depreciation is based on the straight-line method over the lease terms of

the lease assets.