Konica Minolta 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 26

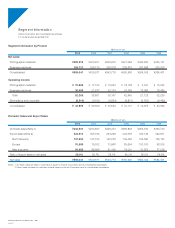

Business Machines

Sales in the Business Machines segment rose 10.7% to ¥264.7

billion. Operating income rose 68.4% over the previous fiscal year to

¥36.5 billion.

The Office Document business, which accounts for the leading

share of this business, posted record sales of ¥204.6 billion, boosted

by the shift in copier sales toward value-added products such as

medium- and high-speed multifunctional peripherals (MFPs) and

strong sales of the next-generation polymerization toners. Operating

income in this business surged to ¥22.4 billion.

The optical pickup lens business of the Optics Technology busi-

ness experienced rapid growth in the first half of the fiscal year under

review due to increasing popularity of DVD players and increased

demand for software. The sharp jump in demand in China and Hong

Kong for video CD players also impacted favorably on results. While

inventory adjustments in the second half reduced unit volume

shipped, total shipments for fiscal 2002 increased by 47% com-

pared with the previous fiscal year. In terms of product composition,

DVD recorders, which have comparatively high unit prices, experi-

enced solid sales volume growth.

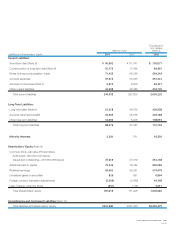

Liquidity and Sources of Capital

The Konica Group has continued to work to increase free cash flow

through increased sales and higher profits. As a result free cash

flows (net cash provided by operating activities minus net cash used

in investing activities) totaled ¥29.1 billion. In the fiscal year under

review Konica reduced interest-bearing debt by ¥24.0 billion to

¥152.1 billion. The debt/equity ratio declined to 0.84 of a point from

1.03 times in the previous fiscal year.

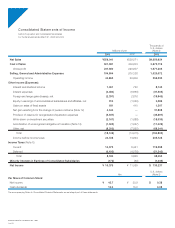

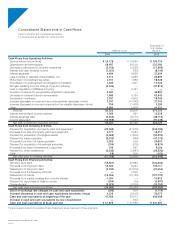

Cash Flows

Net cash provided by operating activities increased ¥18.3 billion to

¥66.4 billion. Income before taxes and minority interests increased

¥9.7 billion to ¥24.7 billion in line with the increase in sales.

Depreciation and amortization expenses increased ¥2.3 billion to

¥28.5 billion, attributed to the start up of operations at the medical

imaging dry film plant in Kofu and the No. 2 line of the TAC film plant

for LCD polarizing plates in Kobe, completed in fiscal 2001.

Accounts receivable fell ¥7.7 billion while inventory declined ¥2.2

billion. Accounts payable increased ¥3.3 billion and operating capital

rose ¥13.2 billion.

Net cash used in investing activities narrowed ¥2.2 billion to

¥37.3 billion. The principal components were mainly related to

investments in the Company’s medical-use dry film production facili-

ties, TAC film for LCD polarization plates, and the acquisition of

property, plant and equipment to strengthen production facilities for

polymerization toner totaling ¥29.5 billion, down ¥12.1 billion from

the previous fiscal year.

Moreover, Konica utilized ¥9.4 billion in investing activities for the

acquisition of intangible fixed assets and an increase in loans

receivable.

Net cash used in financing activities amounted to ¥24.7 billion,

up ¥5.6 billion from the previous fiscal year. This was mainly attribut-

able to the repayment of long-term loans from financial institutions

and the redemption of bonds. As a result, interest-bearing debt

stood at ¥152.1 billion, a decline of ¥24.0 billion from the end of the

previous fiscal year.

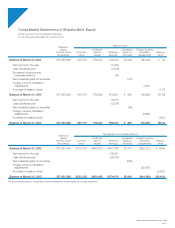

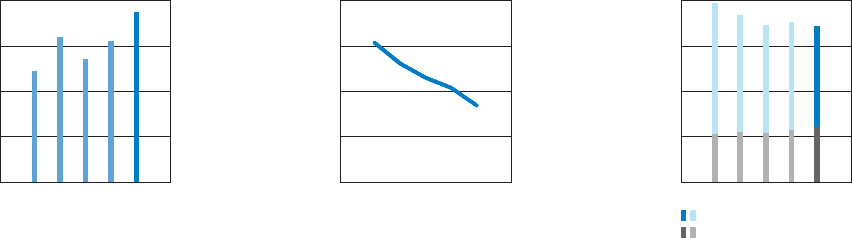

(times)

0

0.5

1

1.5

2

’99 ’00 ’01 ’02 ’03

Debt/Equity Ratio

(Billions of Yen)

0

12

24

36

48

’99 ’00 ’01 ’02 ’03

Gross Cash Flow

(Billions of Yen)

Total Assets

Shareholders’ Equity

0

150

300

450

600

’99 ’00 ’01 ’02 ’03

Total Assets/Shareholders’ Equity