Konica Minolta 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 25

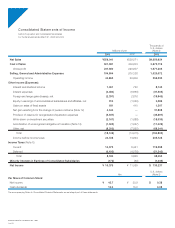

SG&A expenses as a ratio to net sales fell from 37.1% to 34.8%.

Operating Income, Net Income

Operating income increased 44.7% to ¥42.9 billion, reflecting the

increase in gross profit and measures implemented to reduce

expenses. As a percentage of net sales, operating income improved

from 5.5% in the fiscal year ended March 31, 2002, to 7.7%.

Net other expenses totaled ¥18.1 billion, an increase of ¥3.5

billion, impacted by a number of factors. Although the Company

recorded a foreign exchange gain on overseas sales of ¥2.9 billion in

fiscal 2001 due to the depreciation of the yen, Konica incurred an

exchange loss of ¥2.4 billion, a turnaround of ¥5.3 billion, in the fiscal

year under review due to the yen’s appreciation. The Company also

recorded income of ¥4.5 billion from the transfer to a defined con-

tributory pension system. This however was offset by business

restructuring expenses of ¥5.6 billion in preparation for structural

reform of its consumer imaging business. Other income for fiscal

2002 totaled ¥2.9 billion.

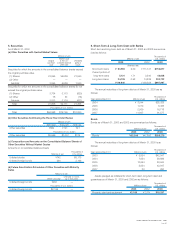

As a result of the preceding factors, income before income taxes

and minority interests increased 64.9% compared with the previous

fiscal year to ¥24.7 billion, and net income increased 48.1% to ¥16.4

billion, a record profit for the Group. Earnings per share of common

stock jumped from ¥30.9 to ¥45.7, return on equity increased from

6.46% to 9.05%, and return on assets rose from 2.10% to 3.17%.

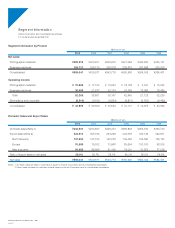

Segment Information

Photographic Materials

Sales in our Photographic Materials segment declined 2.0% com-

pared with the previous fiscal year to ¥294.3 billion. Operating

income in this segment declined 7.3% year on year to ¥15.9 billion.

In the Color Film and Printing Paper fields, sales increased in the

growth markets of Russia and Asia. In mature markets such as

Japan, Europe, and the U.S., however, sales contracted due to the

increased penetration of digital cameras and the impact on tradi-

tional silver-halide film and a decline in product prices. Operating

income in this segment increased year on year due to cutbacks in

production and fixed expenses.

In the Medical and Graphic Imaging business, the trend toward

digital networks continues to increase rapidly. In the midst of these

circumstances, the dry film products of the Company’s medical

imaging business performed steadily. In the graphic imaging busi-

ness, overseas sales of printer film and domestic sales of digital

color proof-related equipment were strong despite market contrac-

tion brought on by the trend to CTP processing. On the earnings

front, operating income in the medical and graphic imaging business

declined year on year significantly impacted by depreciation

expenses following start up of the Company’s Kofu dry film plant.

Sales of tri-acetyl cellulose (TAC) film for use in LCD polarization

plates, designated a strategic business, increased substantially.

Amortization of the No. 2 line at Konica’s Kobe facility, which went

online in August 2002, however, offset contributions to earnings in

the photographic materials business.

(%)

–4

0

4

8

12

’99 ’00 ’01 ’02 ’03

Return on Equity

(Billions of Yen)

–6

0

6

12

18

’99 ’00 ’01 ’02 ’03

Net Income

(Yen)

–16

0

16

32

48

’99 ’00 ’01 ’02 ’03

Net Income per Share