Konica Minolta 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 38

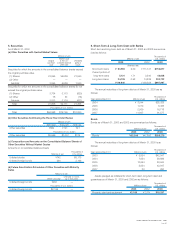

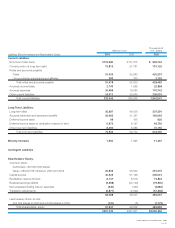

Assumptions used in calculation of the above information are as follows:

a. Method of attributing the retirement benefits

to periods of service Straight-line basis

b. Discount rate Mainly 3.0%

c. Expected rate of return on plan assets Mainly 1.5%

d. Amortization of unrecognized prior service cost Mainly 10 years

e. Amortization of unrecognized actuarial differences Mainly 10 years

f. Amortization of transition amount The Company: Fully amortized

Subsidiaries: 5 years

13. Subsequent Events

The general shareholders’ meeting held on June 25, 2003 approved the fol-

lowing agenda:

(a) Share Exchange Agreement with Minolta Co., Ltd.

The share exchange agreement with Minolta Co., Ltd. (Minolta) was resolved

at the board of directors’ meeting held on May 15, 2003 and the Company

made a contract with Minolta immediately. The details of the share exchange

agreement are as follows:

Purpose

The Company and Minolta reached an agreement that in order to enhance

business competitiveness, improve profitability, and to maximize corporate

value as an entire group, it is the best solution to integrate all the business

resources of the two companies into one by share exchange. The purpose of

the business integration is to survive in the severe competition in the global

market, to maximize further corporate value, and to place the Company in a

leading position in the industry.

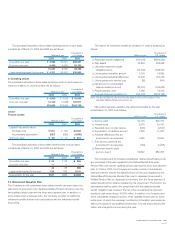

The Method and Outline of the Share Exchange

1) The stocks of the Company are exchanged with those of Minolta, and

thus the Company will become the full parent, and Minolta will become

the full subsidiary. After the share exchange, the Company will become

a new integrated holding company, Konica Minolta Holdings, Inc.

The Company will allocate 0.621 common share to those who

own one common share of Minolta.

2) The Company will newly issue 174,008.969 common shares to the

shareholders on Minolta’s shareholders list (including beneficial share-

holders) as of the end of the day immediately before the date of share

exchange.

3) Dividends for the newly issued common shares will be calculated

effective from April 1, 2003.

4) The Company will not pay share exchange grant to Minolta’s share-

holders.

5) The Company will not increase its stated capital for the share transac-

tions. Capital reserve will be increased by the amount pursuant to

Clause 1-2 of Article 288-2 of the Commercial Code of Japan.

Timing of the share exchange

The share exchange will be effective on August 5, 2003. However, the date is

subject to change by the mutual agreement between the Company and

Minolta, due to the reasons including administrative matters relating to share

exchange process.

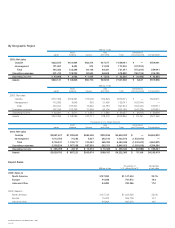

Outline of Minolta

Head office: Chuo-ku, Osaka

Representative: Yoshikatsu Ota, President

Capital: ¥25,832 million

1) Business: Manufacture and sale of products including copiers, print-

ers, cameras, optical units, radiometric instruments, and planetariums.

2) Sales and net income for the year ended March 31, 2003

Sales: ¥296,329 million

Net income: ¥11,969 million

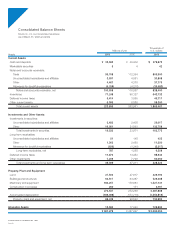

3) Assets, liabilities and shareholders’ equity as of March 31, 2003

Current assets ¥127,815 million

Non-current assets ¥141,381 million

Total assets ¥269,196 million

Current liabilities ¥125,397 million

Non-current liabilities ¥57,420 million

Total liabilities ¥182,818 million

Shareholders’ equity ¥86,378 million

(b) Purchase of Treasury Stock

In order to flexibly respond to the change in the management environment,

pursuant to article 210 of the Commercial Code of Japan the shareholders

approved a maximum limit to potentially acquire treasure stocks during the

period from immediately after the shareholders’ meeting to the next general

shareholders’ meeting. The outlines of the treasury stocks to be acquired are

as follows:

(1) Type of stock to be acquired: Common stock of the Company

(2) Number of shares to be acquired: maximum 35 million shares

(3) Amount of shares to be acquired: maximum ¥20 billion