Intel 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

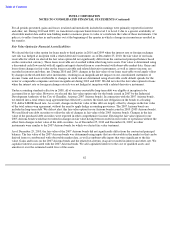

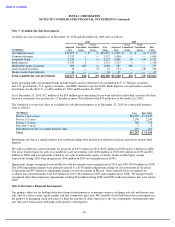

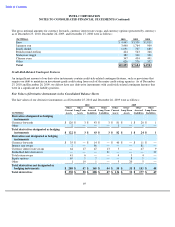

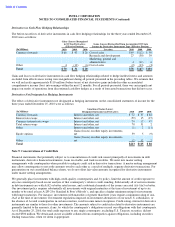

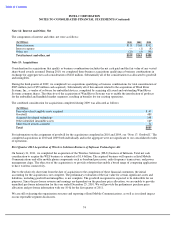

Derivatives in Cash Flow Hedging Relationships

The before-tax effects of derivative instruments in cash flow hedging relationships for the three years ended December 25,

2010 were as follows:

Gains and losses on derivative instruments in cash flow hedging relationships related to hedge ineffectiveness and amounts

excluded from effectiveness testing were insignificant during all periods presented in the preceding tables. We estimate that

we will reclassify approximately $110 million (before taxes) of net derivative gains included in other accumulated

comprehensive income (loss) into earnings within the next 12 months. For all periods presented, there was an insignificant

impact on results of operations from discontinued cash flow hedges as a result of forecasted transactions that did not occur.

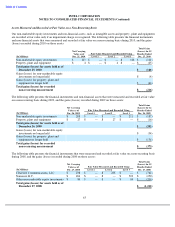

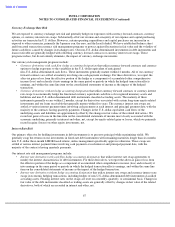

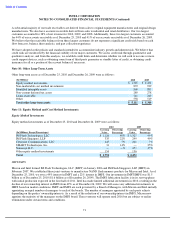

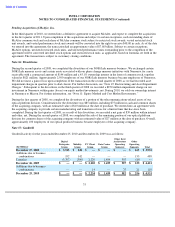

Derivatives Not Designated as Hedging Instruments

The effects of derivative instruments not designated as hedging instruments on the consolidated statements of income for the

three years ended December 25, 2010 were as follows:

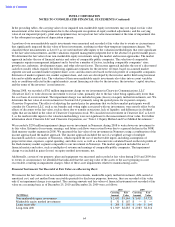

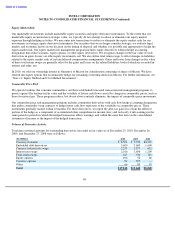

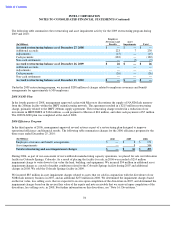

Note 9: Concentrations of Credit Risk

Financial instruments that potentially subject us to concentrations of credit risk consist principally of investments in debt

instruments, derivative financial instruments, loans receivable, and trade receivables. We enter into master netting

arrangements with counterparties when possible to mitigate credit risk in derivative transactions. A master netting arrangement

may allow counterparties to net settle amounts owed to each other as a result of multiple, separate derivative transactions. For

presentation on our consolidated balance sheets, we do not offset fair value amounts recognized for derivative instruments

under master netting arrangements.

We generally place investments with high-credit-quality counterparties and, by policy, limit the amount of credit exposure to

any one counterparty based on our analysis of that counterparty’s relative credit standing. Substantially all of our investments

in debt instruments are with A/A2 or better rated issuers, and a substantial majority of the issuers are rated AA-/Aa3 or better.

Our investment policy requires substantially all investments with original maturities at the time of investment of up to six

months to be rated at least A-2/P-2 by Standard & Poor’s/Moody’s, and specifies a higher minimum rating for investments

with longer maturities. For instance, investments with maturities of greater than three years require a minimum rating of AA-

/Aa3 at the time of investment. Government regulations imposed on investment alternatives of our non-U.S. subsidiaries, or

the absence of A rated counterparties in certain countries, result in some minor exceptions. Credit-rating criteria for derivative

instruments are similar to those for other investments. The amounts subject to credit risk related to derivative instruments are

generally limited to the amounts, if any, by which the counterparty’

s obligations exceed our obligations with that counterparty.

As of December 25, 2010, the total credit exposure to any single counterparty, excluding U.S. Treasury securities, did not

exceed $500 million. We obtain and secure available collateral from counterparties against obligations, including securities

lending transactions, when we deem it appropriate.

Gains (Losses) Recognized

in OCI on Derivatives

Gains (Losses) Reclassified from Accumulated OCI into

(Effective Portion)

Income by Derivative Instrument Type (Effective Portion)

(In Millions)

2010

2009

2008

Location

2010

2009

2008

Currency forwards

$

66

$

43

$

26

Cost of sales

$

49

$

(12

)

$

59

Research and development

27

(30

)

39

Marketing, general and

administrative

4

(12

)

6

Other

4

(12

)

(6

)

Cost of sales

(2

)

(13

)

(3

)

Total

$

70

$

31

$

20

$

78

$

(67

)

$

101

Location of Gains (Losses)

(In Millions)

Recognized in Income on Derivatives

2010

2009

2008

Currency forwards

Interest and other, net

$

72

$

37

$

82

Interest rate swaps

Interest and other, net

(59

)

15

(27

)

Currency interest rate swaps

Interest and other, net

74

(7

)

47

Total return swaps

Interest and other, net

70

51

2

Other

Interest and other, net

(1

)

2

(11

)

Equity options

Gains (losses) on other equity investments,

net

59

5

(9

)

Other

Gains (losses) on other equity investments,

net

(2

)

12

2

Total

$

213

$

115

$

86