Intel 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

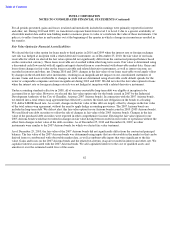

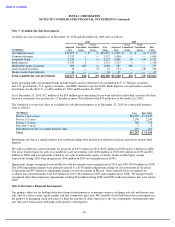

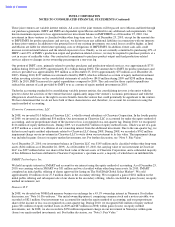

Our non-marketable equity investments as of December 26, 2009 included our investment in Numonyx. We sold our

ownership interest in Numonyx to Micron in the second quarter of 2010. As of December 26, 2009, the fair value was based

on management’s assessment using a combination of the income approach and the market approach. For further information,

see “Note 11: Equity Method and Cost Method Investments.”

As of December 25, 2010, we had non-marketable equity investments in an unrealized loss position of $10 million that had a

fair value of $95 million (unrealized loss position of $30 million on non-marketable equity investments with a fair value of

$205 million as of December 26, 2009).

Our marketable equity method investment is our ownership interest in SMART Technologies, Inc. The fair value of our

ownership interest in SMART was $167 million based on the quoted closing stock price as of December 25, 2010. For further

information, see “Note 11: Equity Method and Cost Method Investments.”

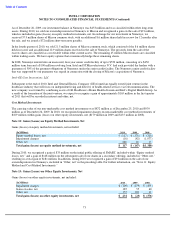

The carrying amount and fair value of loans receivable exclude $642 million of loans measured and recorded at fair value as of

December 25, 2010 ($249 million as of December 26, 2009). The carrying amount and fair value of long-term debt exclude

$128 million of long-term debt measured and recorded at fair value as of December 25, 2010 ($123 million as of December

26, 2009). The carrying amount and fair value of the current portion of long-term debt are included in long-term debt in the

preceding table.

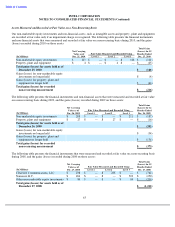

The fair value of our loans receivable is determined using a discounted cash flow model, with all significant inputs derived

from or corroborated with observable market data. The fair value of our long-term debt takes into consideration variables such

as credit-rating changes and interest rate changes. The credit quality of our loans receivable remains high, with credit ratings

of A/A2 or better as of December 25, 2010.

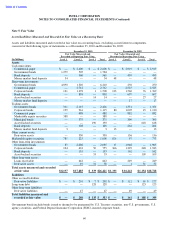

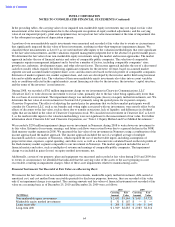

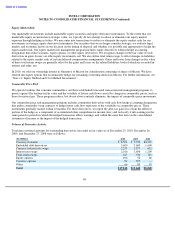

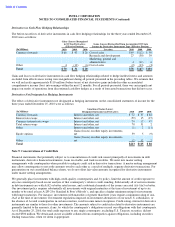

Note 6: Trading Assets

Trading assets outstanding as of December 25, 2010 and December 26, 2009 were as follows:

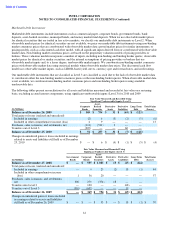

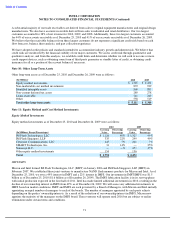

Net losses on marketable debt instruments classified as trading assets still held at the reporting date were $50 million in 2010

(gains of $91 million in 2009 and losses of $132 million in 2008). Net gains on the related derivatives were $43 million in

2010 (gains of $18 million in 2009 and losses of $5 million in 2008).

In 2010, we sold our ownership in Numonyx to Micron. The Micron shares that we received in the transaction are classified as

marketable equity securities within trading assets. For further information, see “Note 11: Equity Method and Cost Method

Investments.” Net losses on marketable equity securities classified as trading assets still held at the reporting date, excluding

the impacts of the related derivatives, were $14 million in 2010.

During 2009, we sold our equity securities offsetting deferred compensation, which were classified as trading assets, and

entered into derivative instruments that seek to offset changes in liabilities related to those deferred compensation

arrangements. The deferred compensation liabilities were $646 million as of December 25, 2010 ($511 million as of

December 26, 2009) and are included in other accrued liabilities. See “Note 8: Derivative Financial Instruments” for further

information on our equity market risk management programs. Net losses on equity securities offsetting deferred compensation

arrangements still held at the reporting date were $209 million in 2008.

65

(In Millions)

2010

2009

Marketable debt instruments

$

4,705

$

4,648

Marketable equity securities

388

—

Total trading assets

$

5,093

$

4,648