Intel 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

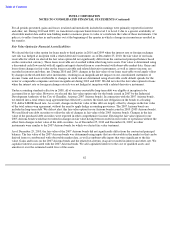

In the first quarter of 2009, we adopted new standards that specify the way in which fair value measurements should be made

for non-financial assets and non-financial liabilities that are not measured and recorded at fair value on a recurring basis, and

specify additional disclosures related to these fair value measurements. The adoption of these new standards did not have a

significant impact on our consolidated financial statements.

In the second quarter of 2009, we adopted new standards that provide guidance on how to determine the fair value of assets

and liabilities when the volume and level of activity for the asset/liability have significantly decreased. These new standards

also provide guidance on identifying circumstances that indicate a transaction is not orderly. In addition, we are required to

disclose in interim and annual periods the inputs and valuation techniques used to measure fair value and a discussion of

changes in valuation techniques. The adoption of these new standards did not have a significant impact on our consolidated

financial statements.

In the second quarter of 2009, we adopted new standards for the recognition and measurement of

other-than-temporary impairments for debt securities that replaced the pre-existing “intent and ability” indicator. These new

standards specify that if the fair value of a debt security is less than its amortized cost basis, an

other-than-temporary impairment is triggered in circumstances in which an entity has an intent to sell the security, it is more

likely than not that the entity will be required to sell the security before recovery of its amortized cost basis, or the entity does

not expect to recover the entire amortized cost basis of the security (that is, a credit loss exists).

Other-than-temporary impairments are separated into amounts representing credit losses, which are recognized in earnings,

and amounts related to all other factors, which are recognized in other comprehensive income (loss). The adoption of these

new standards did not have a significant impact on our consolidated financial statements. For further discussion, see “Note 7:

Available-for-Sale Investments.”

In the third quarter of 2009, we adopted amended standards for the fair value measurement of liabilities. These amended

standards clarify that in circumstances in which a quoted price in an active market for the identical liability is not available, we

are required to use the quoted price of the identical liability when traded as an asset, quoted prices for similar liabilities, or

quoted prices for similar liabilities when traded as assets. If these quoted prices are not available, we are required to use

another valuation technique, such as an income approach or a market approach. These amended standards became effective for

us beginning in the fourth quarter of 2009 and did not have a significant impact on our consolidated financial statements.

2008

In the first quarter of 2008, we adopted new standards for fair value measurements for all financial assets and liabilities

recognized or disclosed at fair value in the consolidated financial statements on a recurring basis (at least annually). The

standards defined fair value, established a framework for measuring fair value, and enhanced fair value measurement

disclosures. The adoption of these new standards did not have a significant impact on our consolidated financial statements,

and the resulting fair values calculated after adoption were not significantly different from the fair values that would have been

calculated under previous guidance. As discussed above, we adopted the fair value measurement standards for our non-

financial assets and liabilities in the first quarter of 2009. For further discussion of our fair value measurements, see “Note 5:

Fair Value.”

In the first quarter of 2008, we adopted new standards that permitted companies to choose to measure certain financial

instruments and other items at fair value using an instrument-by-instrument election. The new standards required unrealized

gains and losses to be reported in earnings for items measured using the fair value option. For further discussion, see “Note 5:

Fair Value.” These new standards also required cash flows from purchases, sales, and maturities of trading securities to be

classified based on the nature and purpose for which the securities were acquired. We assessed the nature and purpose of our

trading assets and determined that our marketable debt instruments will be classified on the statement of cash flows as

investing activities, as they are held with the purpose of generating returns. Activity related to equity securities offsetting

deferred compensation remained classified as operating activities, as they were maintained to offset changes in liabilities

related to the equity market risk of certain deferred compensation arrangements.

58