Intel 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The conversion rate adjusts for certain events outlined in the indentures governing the 2009 and 2005 debentures, such as

quarterly dividend distributions in excess of $0.14 and $0.10 per share, for the 2009 and 2005 debentures, respectively, but

does not adjust for accrued interest. In addition, the conversion rate will increase for a holder of either the 2009 or 2005

debentures who elects to convert the debentures in connection with certain share exchanges, mergers, or consolidations

involving Intel.

Arizona Bonds

In 2007, we guaranteed repayment of principal and interest on bonds issued by the Industrial Development Authority of the

City of Chandler, Arizona, which constitute an unsecured general obligation for Intel. The aggregate principal amount of the

bonds issued in December 2007 is $125 million due in 2037, and the bonds bear interest at a fixed rate of 5.3%. The 2007

Arizona bonds are subject to mandatory tender, at our option, on any interest payment date beginning on or after December 1,

2012 until their final maturity on December 1, 2037. Upon such tender, we can re-market the bonds as either fixed-rate bonds

for a specified period or as variable-rate bonds until their final maturity. We also entered into a total return swap agreement

that effectively converts the fixed-rate obligation on the bonds to a floating U.S.-dollar LIBOR-based rate. We have elected to

account for the 2007 Arizona bonds at fair value. For further discussion, see “Note 5: Fair Value.”

In 2005, we guaranteed repayment of principal and interest on bonds issued by the Industrial Development Authority of the

City of Chandler, Arizona, which constitutes an unsecured general obligation for Intel. The principal amount, excluding the

premium, of the bonds issued in 2005 was $157 million. The 2005 Arizona bonds were mandatorily tendered and repaid on

November 30, 2010. The bonds bore interest at a fixed rate of 4.375%. In the future, we may re

-market the bonds as either

fixed-rate bonds for a specified period or as variable-rate bonds until their final maturity on December 1, 2035.

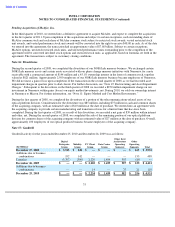

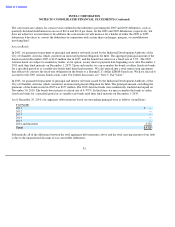

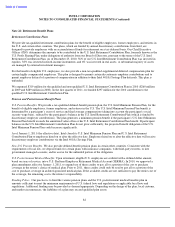

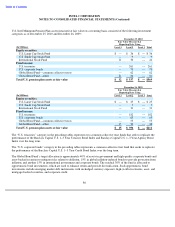

As of December 25, 2010, our aggregate debt maturities based on outstanding principal were as follows (in millions):

Substantially all of the difference between the total aggregate debt maturities above and the total carrying amount of our debt

is due to the unamortized discount of our convertible debentures.

81

Year Payable

2011

$

—

2012

—

2013

—

2014

—

2015

—

2016 and thereafter

3,725

Total

$

3,725