Intel 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

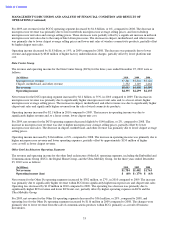

Inventory

The valuation of inventory requires us to estimate obsolete or excess inventory as well as inventory that is not of saleable

quality. The determination of obsolete or excess inventory requires us to estimate the future demand for our products. The

estimate of future demand is compared to work-in-process and finished goods inventory levels to determine the amount, if

any, of obsolete or excess inventory. As of December 25, 2010, we had total work-in-process inventory of $1.9 billion and

total finished goods inventory of $1.4 billion. The demand forecast is included in the development of our short-term

manufacturing plans to enable consistency between inventory valuation and build decisions. Product-specific facts and

circumstances reviewed in the inventory valuation process include a review of the customer base, the stage of the product life

cycle of our products, consumer confidence, and customer acceptance of our products, as well as an assessment of the selling

price in relation to the product cost. If our demand forecast for specific products is greater than actual demand and we fail to

reduce manufacturing output accordingly, we could be required to write off inventory, which would negatively impact our

gross margin.

In order to determine what costs can be included in the valuation of inventory, we must determine normal capacity at our

manufacturing and assembly and test facilities, based on historical loadings compared to total available capacity. If the factory

loadings are below the established normal capacity level, a portion of our manufacturing overhead costs would not be included

in the cost of inventory, and therefore would be recognized as cost of sales in that period, which would negatively impact our

gross margin. We refer to these costs as excess capacity charges. Over the past 12 quarters, excess capacity charges ranged

from zero to $680 million per quarter.

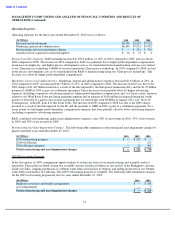

Loss Contingencies

We are subject to various legal and administrative proceedings and asserted and potential claims, accruals related to repair or

replacement of parts in connection with product errata, as well as product warranties and potential asset impairments (loss

contingencies) that arise in the ordinary course of business. An estimated loss from such contingencies is recognized as a

charge to income if it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated.

Disclosure of a loss contingency is required if there is at least a reasonable possibility that a loss has been incurred. The

outcomes of legal and administrative proceedings and claims, and the estimation of product warranties and asset impairments,

are subject to significant uncertainty. Significant judgment is required in both the determination of probability and the

determination as to whether a loss is reasonably estimable. With respect to estimating the losses associated with repairing and

replacing parts in connection with product errata, we make judgments with respect to customer return rates, costs to repair or

replace parts, and where the product is in our customer’s manufacturing process. At least quarterly, we review the status of

each significant matter, and we may revise our estimates. These revisions could have a material impact on our results of

operations and financial position.

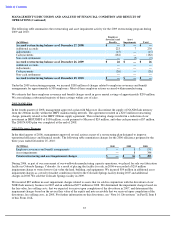

Accounting Changes and Recent Accounting Standards

For a description of accounting changes and recent accounting standards, including the expected dates of adoption and

estimated effects, if any, on our consolidated financial statements, see “Note 3: Accounting Changes” and “Note 4: Recent

Accounting Standards” in Part II, Item 8 of this Form 10-K.

30