Intel 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

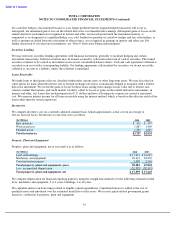

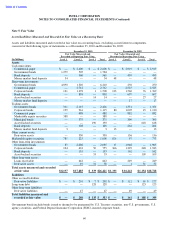

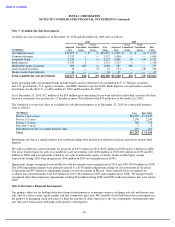

Note 5: Fair Value

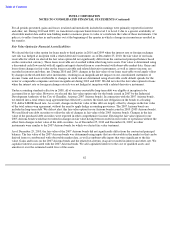

Assets/Liabilities Measured and Recorded at Fair Value on a Recurring Basis

Assets and liabilities measured and recorded at fair value on a recurring basis, excluding accrued interest components,

consisted of the following types of instruments as of December 25, 2010 and December 26, 2009:

Government bonds include bonds issued or deemed to be guaranteed by U.S. Treasury securities, non-U.S. governments, U.S.

agency securities, and Federal Deposit Insurance Corporation (FDIC)-insured corporate bonds.

60

December 25, 2010

December 26, 2009

Fair Value Measured and

Fair Value Measured and

Recorded at Reporting Date Using

Recorded at Reporting Date Using

(In Millions)

Level 1

Level 2

Level 3

Total

Level 1

Level 2

Level 3

Total

Assets

Cash equivalents:

Commercial paper

$

—

$

2,600

$

—

$

2,600

$

—

$

2,919

$

—

$

2,919

Government bonds

1,279

505

—

1,784

—

—

—

—

Bank deposits

—

560

—

560

—

459

—

459

Money market fund deposits

34

—

—

34

48

—

—

48

Short

-

term investments:

Government bonds

4,890

1,320

—

6,210

—

250

—

250

Commercial paper

—

2,712

—

2,712

—

2,525

—

2,525

Corporate bonds

121

1,378

1

1,500

133

1,560

76

1,769

Bank deposits

—

858

—

858

—

697

—

697

Asset

-

backed securities

—

—

14

14

—

—

27

27

Money market fund deposits

—

—

—

—

—

17

—

17

Trading assets:

Government bonds

311

2,115

—

2,426

—

1,351

—

1,351

Corporate bonds

199

916

—

1,115

80

1,005

45

1,130

Commercial paper

—

488

—

488

—

882

—

882

Marketable equity securities

388

—

—

388

—

—

—

—

Municipal bonds

—

375

—

375

—

390

—

390

Asset

-

backed securities

—

—

190

190

—

—

618

618

Bank deposits

—

108

—

108

—

264

—

264

Money market fund deposits

3

—

—

3

13

—

—

13

Other current assets:

Derivative assets

—

330

—

330

—

136

—

136

Marketable equity securities

785

223

—

1,008

676

97

—

773

Other long

-

term investments:

Government bonds

83

2,002

—

2,085

17

1,948

—

1,965

Corporate bonds

104

601

50

755

366

1,329

248

1,943

Bank deposits

—

133

—

133

—

162

—

162

Asset

-

backed securities

—

—

53

53

—

—

109

109

Other long

-

term assets:

Loans receivable

—

642

—

642

—

249

—

249

Derivative assets

—

19

31

50

—

1

31

32

Total assets measured and recorded

at fair value

$

8,197

$

17,885

$

339

$

26,421

$

1,333

$

16,241

$

1,154

$

18,728

Liabilities

Other accrued liabilities:

Derivative liabilities

$

—

$

201

$

7

$

208

$

—

$

112

$

65

$

177

Long

-

term debt

—

—

128

128

—

—

123

123

Other long

-

term liabilities:

Derivative liabilities

—

47

—

47

—

49

—

49

Total liabilities measured and

recorded at fair value

$

—

$

248

$

135

$

383

$

—

$

161

$

188

$

349