Intel 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

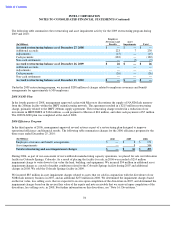

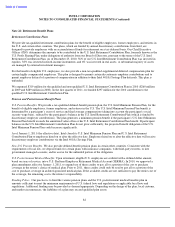

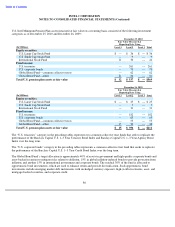

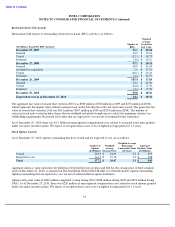

U.S. Intel Minimum Pension Plan assets measured at fair value on a recurring basis consisted of the following investment

categories as of December 25, 2010 and December 26, 2009:

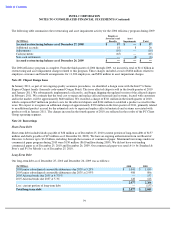

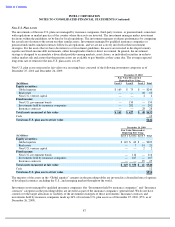

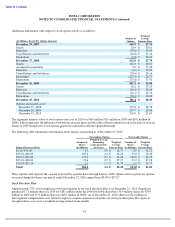

The “U.S. treasuries” category in the preceding tables represents two common collective trust funds that seek to replicate the

performance of the Barclays Capital U.S. 1–3 Year Treasury Bond Index and Barclays Capital U.S. 1–3 Year Agency Bond

Index over the long term.

The “U.S. corporate bonds” category in the preceding tables represents a common collective trust fund that seeks to replicate

the performance of the Barclays Capital U.S. 1–3 Year Credit Bond Index over the long term.

The Global Bond Fund’s target allocation is approximately 40% of assets in government and high-quality corporate bonds and

asset-backed securities to mitigate risks related to deflation, 15% in global inflation-indexed bonds to provide protection from

inflation, and another 15% in international government and corporate bonds. The residual 30% of the fund is allocated to

opportunistic bond investments, which are used to enhance return and provide diversification. Such opportunistic bond

investments include emerging market debt instruments with un-hedged currency exposure, high-yield investments, asset- and

mortgage-backed securities, and corporate credit.

86

December 25, 2010

Fair Value Measured at

Reporting Date Using

(In Millions)

Level 1

Level 2

Level 3

Total

Equity securities:

U.S. Large Cap Stock Fund

$

—

$

36

$

—

$

36

U.S. Small Cap Stock Fund

—

9

—

9

International Stock Fund

11

30

—

41

Fixed income:

U.S. treasuries

—

261

—

261

U.S. corporate bonds

—

79

—

79

Global Bond Fund

—

common collective trusts

—

62

—

62

Global Bond Fund

—

other

21

60

—

81

Total U.S. pension plan assets at fair value

$

32

$

537

$

—

$

569

December 26, 2009

Fair Value Measured at

Reporting Date Using

(In Millions)

Level 1

Level 2

Level 3

Total

Equity securities:

U.S. Large Cap Stock Fund

$

—

$

25

$

—

$

25

U.S. Small Cap Stock Fund

—

7

—

7

International Stock Fund

—

31

—

31

Fixed income:

U.S. treasuries

—

182

—

182

U.S. corporate bonds

—

65

—

65

Global Bond Fund

—

common collective trusts

—

53

—

53

Global Bond Fund

—

other

15

33

—

48

Total U.S. pension plan assets at fair value

$

15

$

396

$

—

$

411