Intel 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

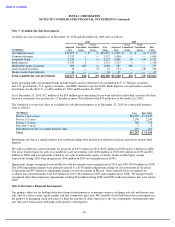

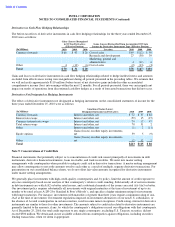

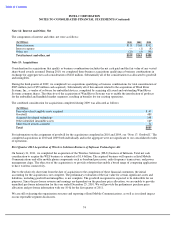

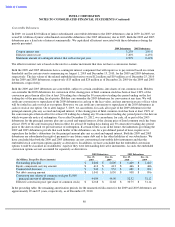

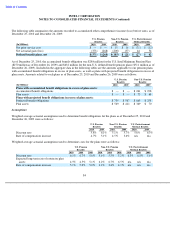

Note 14: Interest and Other, Net

The components of interest and other, net were as follows:

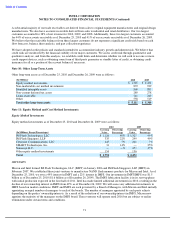

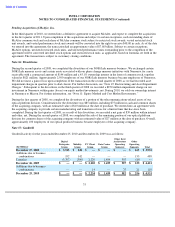

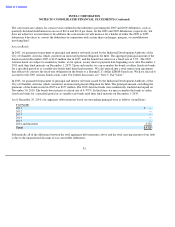

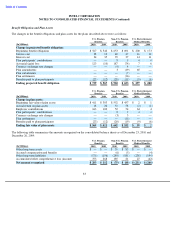

Note 15: Acquisitions

Consideration for acquisitions that qualify as business combinations includes the net cash paid and the fair value of any vested

share-based awards assumed. During 2010, we completed three business acquisitions qualifying as business combinations in

exchange for aggregate net cash consideration of $218 million. Substantially all of the consideration was allocated to goodwill

and intangibles.

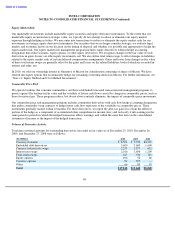

During the third quarter of 2009, we completed two acquisitions qualifying as business combinations for total consideration of

$885 million (net of $59 million cash acquired). Substantially all of this amount related to the acquisition of Wind River

Systems, Inc., a vendor of software for embedded devices, completed by acquiring all issued and outstanding Wind River

Systems common shares. The objective of the acquisition of Wind River Systems was to enable the introduction of products

for the embedded and handheld market segments, resulting in benefits for our existing operations.

The combined consideration for acquisitions completed during 2009 was allocated as follows:

For information on the assignment of goodwill for the acquisitions completed in 2010 and 2009, see “Note 17: Goodwill.”

The

completed acquisitions in 2010 and 2009 both individually and in the aggregate were not significant to our consolidated results

of operations.

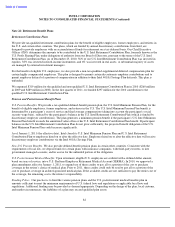

First Quarter 2011 Acquisition of Wireless Solutions Business of Infineon Technologies AG

On January 31, 2011, we completed the acquisition of the Wireless Solutions (WLS) business of Infineon. Total net cash

consideration to acquire the WLS business is estimated at $1.4 billion. The acquired business will operate as Intel Mobile

Communications and offer mobile phone components such as baseband processors, radio frequency transceivers, and power

management chips. The objective of the acquisition is to provide solutions that enable a broad range of computing applications

to have wireless connectivity.

Due to the relatively short time from the date of acquisition to the completion of these financial statements, the initial

accounting for the acquisition is not complete. The preliminary evaluation of the fair value for certain significant assets and

liabilities, including goodwill and intangibles, is not complete. The goodwill recognized is expected to be deductible for tax

purposes. Since the pro forma revenue and earnings are dependent on the purchase price allocation, we are unable to provide

unaudited pro forma information for the year ended December 25, 2010. We will provide the preliminary purchase price

allocation and pro forma information with our 10-Q for the first quarter of 2011.

We are still evaluating the organization structure and reporting of Intel Mobile Communications, as well as its related impact

on our reportable segment disclosures.

74

(In Millions)

2010

2009

2008

Interest income

$

119

$

168

$

592

Interest expense

—

(

1

)

(8

)

Other, net

(10

)

(4

)

(96

)

Total interest and other, net

$

109

$

163

$

488

(In Millions)

Fair value of net tangible assets acquired

$

47

Goodwill

489

Acquired developed technology

148

Other identified intangible assets

169

Share

-

based awards assumed

32

Total

$

885