Intel 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

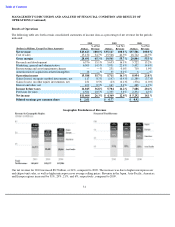

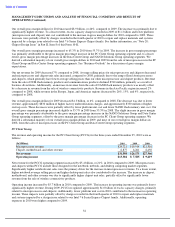

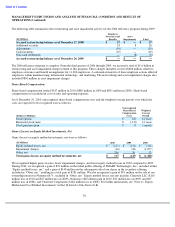

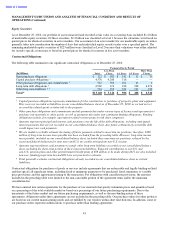

The following table summarizes the restructuring and asset impairment activity for the 2009 restructuring program during

2009 and 2010:

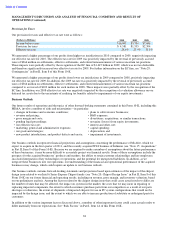

Under the 2009 restructuring program, we incurred $208 million of charges related to employee severance and benefit

arrangements for approximately 6,500 employees. Most of these employee actions occurred within manufacturing.

We estimate that these employee severance and benefit charges result in gross annual savings of approximately $290 million.

We are realizing a substantial majority of these savings within cost of sales.

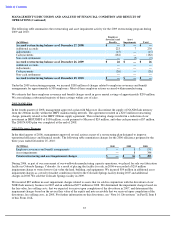

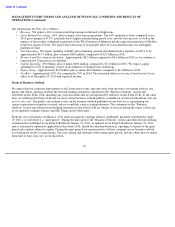

2008 NAND Plan

In the fourth quarter of 2008, management approved a plan with Micron to discontinue the supply of NAND flash memory

from the 200mm facility within the IMFT manufacturing network. The agreement resulted in a $215 million restructuring

charge, primarily related to the IMFT 200mm supply agreement. The restructuring charge resulted in a reduction of our

investment in IMFT/IMFS of $184 million, a cash payment to Micron of $24 million, and other cash payments of $7 million.

The 2008 NAND plan was completed at the end of 2008.

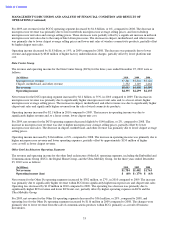

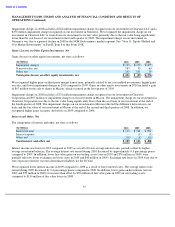

2006 Efficiency Program

In the third quarter of 2006, management approved several actions as part of a restructuring plan designed to improve

operational efficiency and financial results. The following table summarizes charges for the 2006 efficiency program for the

three years ended December 25, 2010:

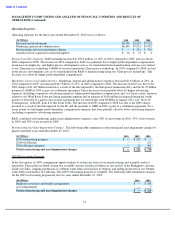

During 2006, as part of our assessment of our worldwide manufacturing capacity operations, we placed for sale our fabrication

facility in Colorado Springs, Colorado. As a result of placing the facility for sale, in 2006 we recorded a $214 million

impairment charge to write down to fair value the land, building, and equipment. We incurred $54 million in additional asset

impairment charges as a result of market conditions related to the Colorado Springs facility during 2007 and additional

charges in 2008. We sold the Colorado Springs facility in 2009.

We incurred $85 million in asset impairment charges related to assets that we sold in conjunction with the divestiture of our

NOR flash memory business in 2007 and an additional $275 million in 2008. We determined the impairment charges based on

the fair value, less selling costs, that we expected to receive upon completion of the divestiture in 2007, and determined the

impairment charges based on the revised fair value of the equity and note receivable that we received upon completion of the

divestiture, less selling costs, in 2008. For further information on this divestiture, see “Note 16: Divestitures” in Part II, Item 8

of this Form 10-K.

35

Employee

Severance and

Asset

(In Millions)

Benefits

Impairments

Total

Accrued restructuring balance as of December 27, 2008

$

—

$

—

$

—

Additional accruals

223

7

230

Adjustments

(15

)

—

(

15

)

Cash payments

(182

)

—

(

182

)

Non

-

cash settlements

—

(

7

)

(7

)

Accrued restructuring balance as of December 26, 2009

$

26

$

—

$

26

Additional accruals

—

—

—

Adjustments

—

—

—

Cash payments

(26

)

—

(

26

)

Non

-

cash settlements

—

—

—

Accrued restructuring balance as of December 25, 2010

$

—

$

—

$

—

(In Millions)

2010

2009

2008

Employee severance and benefit arrangements

$

—

$

8

$

151

Asset impairments

—

8

344

Total restructuring and asset impairment charges

$

—

$

16

$

495