Intel 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Advertising

Cooperative advertising programs reimburse customers for marketing activities for certain of our products, subject to defined

criteria. We accrue cooperative advertising obligations and record the costs at the same time that the related revenue is

recognized. We record cooperative advertising costs as marketing, general and administrative expenses to the extent that an

advertising benefit separate from the revenue transaction can be identified and the fair value of that advertising benefit

received is determinable. We record any excess in cash paid over the fair value of the advertising benefit received as a

reduction in revenue. Advertising costs, including direct marketing costs, recorded within marketing, general and

administrative expenses were $1.8 billion in 2010 ($1.4 billion in 2009 and $1.9 billion in 2008).

Employee Equity Incentive Plans

We have employee equity incentive plans, which are described more fully in “Note 24: Employee Equity Incentive Plans.”

We

use the straight-line attribution method to recognize share-based compensation over the service period of the award. Upon

exercise, cancellation, forfeiture, or expiration of stock options, or upon vesting or forfeiture of restricted stock units, we

eliminate deferred tax assets for options and restricted stock units with multiple vesting dates for each vesting period on a

first-in, first-out basis as if each vesting period were a separate award.

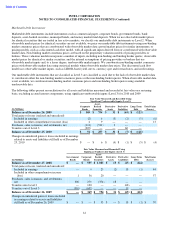

Note 3: Accounting Changes

2010

In the first quarter of 2010, we adopted new standards for determining whether to consolidate a variable interest entity. These

new standards eliminated a mandatory quantitative approach in favor of a qualitative analysis, and require an ongoing

reassessment. The adoption of these new standards did not impact our consolidated statements of income or balance sheets.

2009

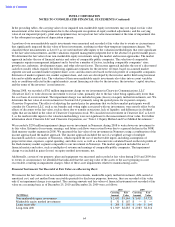

In the first quarter of 2009, we adopted new standards that changed the accounting for convertible debt instruments with cash

settlement features. As of adoption, these new standards applied to our junior subordinated convertible debentures issued in

2005 (the 2005 debentures). Under the previous standards, our 2005 debentures were recognized entirely as a liability at

historical value. In accordance with adopting these new standards, in 2009 we retrospectively recognized both a liability and

an equity component of the 2005 debentures at fair value. The liability component is recognized as the fair value of a similar

instrument that does not have a conversion feature at issuance. The equity component, which is the value of the conversion

feature at issuance, is recognized as the difference between the proceeds from the issuance of the 2005 debentures and the fair

value of the liability component, after adjusting for the deferred tax impact. The 2005 debentures were issued at a coupon rate

of 2.95%, which was below that of a similar instrument that did not have a conversion feature (6.45%). Therefore, the

valuation of the debt component, using the income approach, resulted in a debt discount. The debt discount is reduced over the

expected life of the debt, which is also the stated life of the debt. These new standards are also applicable in accounting for our

convertible debt issued during 2009. See “Note 21: Borrowings” for further discussion.

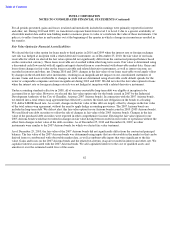

In the first quarter of 2009, we adopted revised standards for business combinations. These revised standards generally require

an entity to recognize the assets, liabilities, contingencies, and contingent consideration at their fair value on the acquisition

date. For circumstances in which the acquisition-date fair value for a contingency cannot be determined during the

measurement period and it is concluded that it is probable that an asset or liability exists as of the acquisition date and the

amount can be reasonably estimated, a contingency is recognized as of the acquisition date based on the estimated amount.

The revised standards further require that acquisition-related costs be recognized separately from the acquisition and expensed

as incurred, restructuring costs generally be expensed in periods subsequent to the acquisition date, and changes in estimates

for accounting of deferred tax asset valuation allowances and acquired income tax uncertainties that occur subsequent to the

measurement period be reflected in income tax expense (benefit). In addition, acquired in-

process research and development is

capitalized as an intangible asset. These new standards became applicable to business combinations on a prospective basis

beginning in the first quarter of 2009. Our acquisitions completed during 2010 and 2009 have been accounted for using these

revised standards. See “Note 15: Acquisitions.”

57