Intel 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

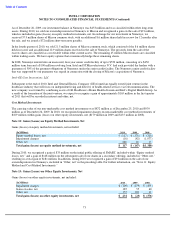

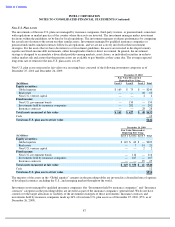

Note 22: Retirement Benefit Plans

Retirement Contribution Plans

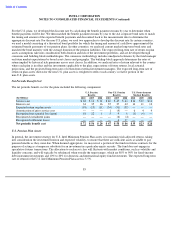

We provide tax-qualified retirement contribution plans for the benefit of eligible employees, former employees, and retirees in

the U.S. and certain other countries. The plans, which are funded by annual discretionary contributions from Intel, are

designed to provide employees with an accumulation of funds for retirement on a tax-deferred basis. Our Chief Executive

Officer (CEO) determines the amounts to be contributed to the U.S. Intel Retirement Contribution Plan, formerly known as the

U.S. Profit Sharing Plan, under delegation of authority from our Board of Directors, pursuant to the terms of the U.S. Intel

Retirement Contribution Plan. As of December 25, 2010, 56% of our U.S. Intel Retirement Contribution Plan was invested in

equities, 38% was invested in fixed-income instruments, and 6% was invested in real assets. A substantial majority of assets

are managed by external investment managers.

For the benefit of eligible U.S. employees, we also provide a non-tax-qualified supplemental deferred compensation plan for

certain highly compensated employees. This plan is designed to permit certain discretionary employer contributions and to

permit employee deferral of a portion of compensation in addition to their Intel 401(k) Savings Plan deferrals. This plan is

unfunded.

We expensed $319 million for the qualified and non-qualified U.S. Intel Retirement Contribution Plan in 2010 ($260 million

in 2009 and $289 million in 2008). In the first quarter of 2011, we funded $297 million for the 2010 contribution to the

qualified U.S. Intel Retirement Contribution Plan.

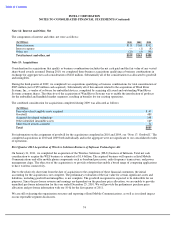

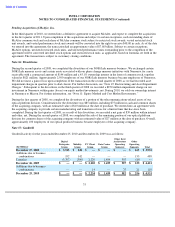

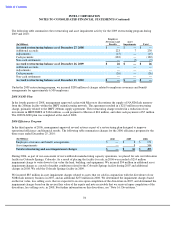

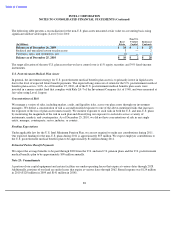

Pension and Postretirement Benefit Plans

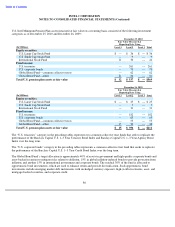

U.S. Pension Benefits. We provide a tax-qualified defined-benefit pension plan, the U.S. Intel Minimum Pension Plan, for the

benefit of eligible employees, former employees, and retirees in the U.S. The U.S. Intel Minimum Pension Plan benefit is

determined by a participant’s years of service and final average compensation (taking into account the participant’s social

security wage base), reduced by the participant’s balance in the U.S. Intel Retirement Contribution Plan (which is funded by

discretionary employer contributions). The plan generates a minimum pension benefit if the participant’s U.S. Intel Minimum

Pension Plan benefit exceeds the annuitized value of his or her U.S. Intel Retirement Contribution Plan benefit. If participant

balances in the U.S. Intel Retirement Contribution Plan do not grow sufficiently, the projected benefit obligation of the U.S.

Intel Minimum Pension Plan could increase significantly.

As of January 1, 2011 (the effective date), Intel closed its U.S. Intel Minimum Pension Plan and U.S. Intel Retirement

Contribution Plan to employees hired on or after the effective date. Employees hired on or after the effective date will receive

discretionary employer contributions via the Intel 401(k) Savings Plan.

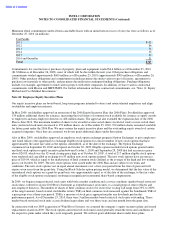

Non

-U.S. Pension Benefits. We also provide defined-benefit pension plans in certain other countries. Consistent with the

requirements of local law, we deposit funds for certain plans with insurance companies, with third-party trustees, or into

government-managed accounts, and/or accrue for the unfunded portion of the obligation.

U.S. Postretirement Medical Benefits. Upon retirement, eligible U.S. employees are credited with a defined dollar amount,

based on years of service, into a U.S. Sheltered Employee Retirement Medical Account (SERMA). In 2010, we approved a

plan amendment, effective January 1, 2011, to expand use of these credits to pay all or a portion of the cost to purchase

coverage in the retiree’s choice of medical plan. Prior to 2011, these credits could only be used to pay all or a portion of the

cost to purchase coverage in an Intel-sponsored medical plan. If the available credits are not sufficient to pay the entire cost of

the coverage, the remaining cost is the retiree’s responsibility.

Funding Policy.

Our practice is to fund the various pension plans and the U.S. postretirement medical benefits plan in

amounts sufficient to meet the minimum requirements of U.S. federal laws and regulations or applicable local laws and

regulations. Additional funding may be provided as deemed appropriate. Depending on the design of the plan, local customs,

and market circumstances, the liabilities of a plan may exceed qualified plan assets.

82