Intel 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

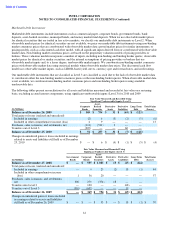

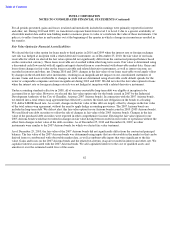

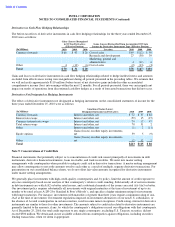

In the preceding tables, the carrying value of our impaired non-marketable equity investments may not equal our fair value

measurement at the time of impairment due to the subsequent recognition of equity method adjustments, and the carrying

value of our impaired property, plant and equipment may not equal our fair value measurement at the time of impairment due

to the subsequent recognition of depreciation expense.

A portion of our non-marketable equity investments were measured and recorded at fair value due to events or circumstances

that significantly impacted the fair value of those investments, resulting in other-than-temporary impairment charges. We

classified these measurements as Level 3, as we used unobservable inputs to the valuation methodologies that were significant

to the fair value measurements, and the valuations required management judgment due to the absence of quoted market prices.

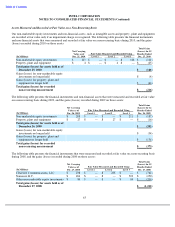

We determine the fair value of our non-marketable equity investments using the market and income approaches. The market

approach includes the use of financial metrics and ratios of comparable public companies. The selection of comparable

companies requires management judgment and is based on a number of factors, including comparable companies’ sizes,

growth rates, industries, development stages, and other relevant factors. The income approach includes the use of a discounted

cash flow model, which requires the following significant estimates for the investee: revenue, based on assumed market

segment size and assumed market segment share; costs; and discount rates based on the risk profile of comparable companies.

Estimates of market segment size, market segment share, and costs are developed by the investee and/or Intel using historical

data and available market data. The valuation of these non-marketable equity investments also takes into account variables

such as conditions reflected in the capital markets, recent financing activities by the investees, the investees’ capital structure,

and the terms of the investees’ issued interests.

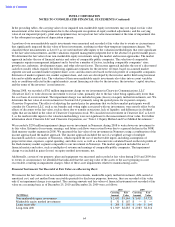

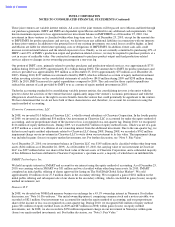

During 2008, we recorded a $762 million impairment charge on our investment in Clearwire Communications, LLC

(Clearwire LLC) to write down our investment to its fair value, primarily due to the fair value being significantly lower than

the cost basis of our investment. The impairment charge was included in gains (losses) on equity method investments, net. We

determine the fair value of our investment in Clearwire LLC primarily using the quoted prices for its parent company,

Clearwire Corporation. The effects of adjusting the quoted price for premiums that we believe market participants would

consider for Clearwire LLC, such as tax benefits and voting rights associated with our investments, were mostly offset by the

effects of discounts to the fair value, such as those due to transfer restrictions, lack of liquidity, and differences in dividend

rights that are included in the value of Clearwire Corporation stock. We classified our investment in Clearwire LLC as Level

2, as the unobservable inputs to the valuation methodology were not significant to the measurement of fair value. For further

information about Clearwire LLC and Clearwire Corporation, see “Note 11: Equity Method and Cost Method Investments.”

We recorded a $250 million impairment charge on our investment in Numonyx during 2008 to write down our investment to

its fair value. Estimates for revenue, earnings, and future cash flows were revised lower due to a general decline in the NOR

flash memory market segment in 2008. We measured the fair value of our investment in Numonyx using a combination of the

income approach and the market approach. The income approach included the use of a weighted average of multiple

discounted cash flow scenarios of Numonyx, which required the use of unobservable inputs, including assumptions of

projected revenue, expenses, capital spending, and other costs, as well as a discount rate calculated based on the risk profile of

the flash memory market segment comparable to our investment in Numonyx. The market approach included the use of

financial metrics and ratios, such as multiples of revenue and earnings of comparable public companies. The impairment

charge was included in gains (losses) on equity method investments, net.

Additionally, certain of our property, plant and equipment was measured and recorded at fair value during 2010 and 2009 due

to events or circumstances we identified that indicated that the carrying value of the assets or the asset grouping was not

recoverable, resulting in impairment charges. Most of these asset impairments related to manufacturing assets.

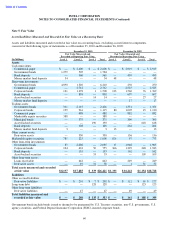

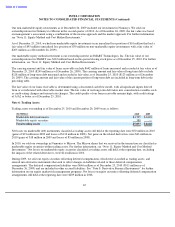

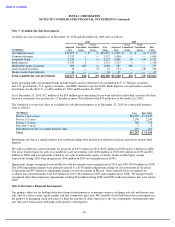

Financial Instruments Not Recorded at Fair Value on a Recurring Basis

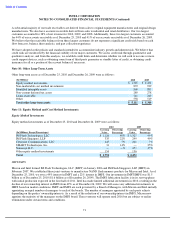

We measure the fair value of our non-marketable equity investments, marketable equity method investment, debt carried at

amortized cost, and cost method loans receivable quarterly for disclosure purposes; however, they are recorded at fair value

only if an impairment charge is recognized. The carrying amounts and fair values of financial instruments not recorded at fair

value on a recurring basis as of December 25, 2010 and December 26, 2009 were as follows:

64

2010

2009

Carrying

Fair

Carrying

Fair

(In Millions)

Amount

Value

Amount

Value

Non

-

marketable equity investments

$

2,633

$

5,144

$

3,411

$

5,723

Marketable equity method investments

$

31

$

167

$

—

$

—

Loans receivable

$

208

$

208

$

100

$

100

Long

-

term debt

$

1,949

$

2,283

$

2,083

$

2,314