Intel 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

We record other-than-temporary impairment charges in gains (losses) on other equity investments, net for non-

marketable cost method investments and in gains (losses) on equity method investments, net for equity method

investments.

Derivative Financial Instruments

Our primary objective for holding derivative financial instruments is to manage currency exchange rate and interest rate risk,

and, to a lesser extent, equity market and commodity price risk. Our derivative financial instruments are recorded at fair value

and are included in other current assets, other long-term assets, other accrued liabilities, or other long-term liabilities.

Our accounting policies for derivative financial instruments are based on whether they meet the criteria for designation as cash

flow or fair value hedges. A designated hedge of the exposure to variability in the future cash flows of an asset or a liability, or

of a forecasted transaction, is referred to as a cash flow hedge. A designated hedge of the exposure to changes in fair value of

an asset or a liability, or of an unrecognized firm commitment, is referred to as a fair value hedge. The criteria for designating

a derivative as a hedge include the assessment of the instrument’s effectiveness in risk reduction, matching of the derivative

instrument to its underlying transaction, and the assessment of the probability that the underlying transaction will occur. For

derivatives with cash flow hedge accounting designation, we report the after-tax gain or loss from the effective portion of the

hedge as a component of accumulated other comprehensive income (loss) and reclassify it into earnings in the same period or

periods in which the hedged transaction affects earnings, and within the same line item on the consolidated statements of

income as the impact of the hedged transaction. For derivatives with fair value hedge accounting designation, we recognize

gains or losses from the change in fair value of these derivatives, as well as the offsetting change in the fair value of the

underlying hedged item, in earnings. Derivatives that we designate as hedges are classified in the consolidated statements of

cash flows in the same section as the underlying item, primarily within cash flows from operating activities.

We recognize gains and losses from changes in fair values of derivatives that are not designated as hedges for accounting

purposes within the line item on the consolidated statements of income most closely associated with the economic underlying,

primarily in interest and other, net and gains (losses) on other equity investments, net. As part of our strategic investment

program, we also acquire equity derivative instruments, such as equity conversion rights associated with debt instruments, that

we do not designate as hedging instruments. We recognize the gains or losses from changes in fair values of these equity

derivative instruments in gains (losses) on other equity investments, net. Gains and losses from derivatives not designated as

hedges are classified in cash flows from operating activities.

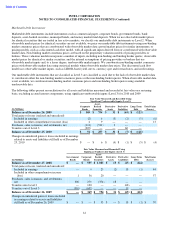

Measurement of Effectiveness

54

•

Non

-marketable equity investments based on our assessment of the severity and duration of the impairment, and

qualitative and quantitative analysis, including:

•

the investee

’

s revenue and earnings trends relative to pre

-

defined milestones and overall business prospects;

•

the technological feasibility of the investee

’

s products and technologies;

• the general market conditions in the investee’s industry or geographic area, including adverse regulatory or

economic changes;

• factors related to the investee’s ability to remain in business, such as the investee’s liquidity, debt ratios, and

the rate at which the investee is using its cash; and

•

the investee

’

s receipt of additional funding at a lower valuation.

•

Effectiveness for forwards

is generally measured by comparing the cumulative change in the fair value of the hedge

contract with the cumulative change in the present value of the forecasted cash flows of the hedged item. For currency

forward contracts used in cash flow hedging strategies related to capital purchases, forward points are excluded, and

effectiveness is measured using spot rates to value both the hedge contract and the hedged item. For currency forward

contracts used in cash flow hedging strategies related to operating expenditures, forward points are included and

effectiveness is measured using forward rates to value both the hedge contract and the hedged item.

•

Effectiveness for options with hedge accounting designation

is generally measured by comparing the cumulative

change in the intrinsic value of the hedge contract with the cumulative change in the intrinsic value of an option

instrument representing the hedged risks in the hedged item for cash flow hedges. For cash flow and fair value hedges,

time value is excluded and effectiveness is measured based on spot rates to value both the hedge contract and the

hedged item.

•

Effectiveness for interest rate swaps and commodity swaps

is generally measured by comparing the change in fair

value of the hedged item with the change in fair value of the swap.