Intel 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

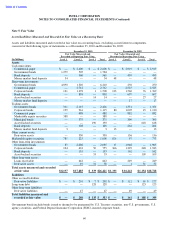

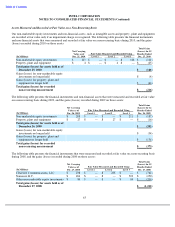

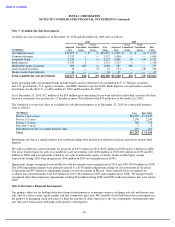

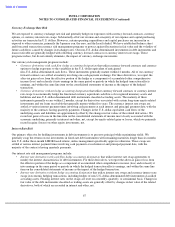

Note 7: Available-for-Sale Investments

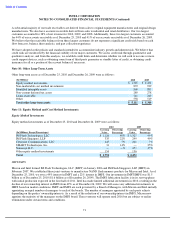

Available-for-sale investments as of December 25, 2010 and December 26, 2009 were as follows:

In the preceding table, government bonds include bonds issued or deemed to be guaranteed by U.S. Treasury securities,

non-U.S. governments, U.S. agency securities, and FDIC-insured corporate bonds. Bank deposits were primarily issued by

institutions outside the U.S. as of December 25, 2010 and December 26, 2009.

As of December 25, 2010, $12 million of the $19 million gross unrealized losses were related to individual securities that had

been in a continuous loss position for 12 months or more ($26 million of the $33 million as of December 26, 2009).

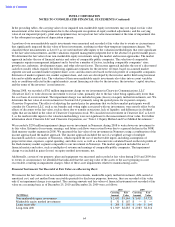

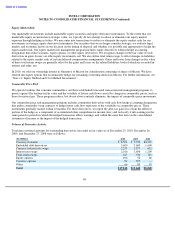

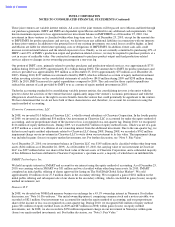

The amortized cost and fair value of available-for-sale debt investments as of December 25, 2010, by contractual maturity,

were as follows:

Instruments not due at a single maturity date in the preceding table include asset-backed securities and money market fund

deposits.

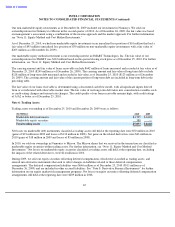

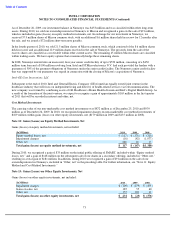

We sold available-for-sale investments for proceeds of $475 million in 2010 ($192 million in 2009 and $1.2 billion in 2008).

The gross realized gains on sales of available-for-sale investments were $160 million in 2010 ($43 million in 2009 and $38

million in 2008) and were primarily related to our sales of marketable equity securities. Gains on third-party merger

transactions during 2010 were insignificant ($56 million in 2009 and insignificant in 2008).

Impairment charges recognized on available-for-sale investments were insignificant in 2010 and 2009 ($354 million in 2008).

The 2008 impairment charges were primarily related to a $176 million impairment charge on our investment in Clearwire

Corporation and $97 million of impairment charges on our investment in Micron. Gross realized losses recognized on

available-for-sale investments were $13 million in 2010 ($64 million in 2009 and insignificant in 2008). We had previously

recognized other-than-temporary impairments totaling $34 million during 2008 and 2009 on the investments that were sold in

2009.

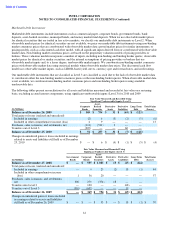

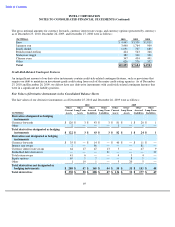

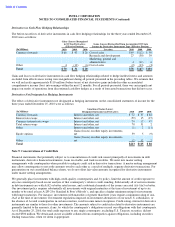

Note 8: Derivative Financial Instruments

Our primary objective for holding derivative financial instruments is to manage currency exchange rate risk and interest rate

risk, and, to a lesser extent, equity market risk and commodity price risk. We currently do not hold derivative instruments for

the purpose of managing credit risk since we limit the amount of credit exposure to any one counterparty and generally enter

into derivative transactions with high-credit-quality counterparties.

66

2010

2009

Gross

Gross

Gross

Gross

Adjusted

Unrealized

Unrealized

Fair

Adjusted

Unrealized

Unrealized

Fair

(In Millions)

Cost

Gains

Losses

Value

Cost

Gains

Losses

Value

Government bonds

$

10,075

$

9

$

(5

)

$

10,079

$

2,205

$

11

$

(1

)

$

2,215

Commercial paper

5,312

—

—

5,312

5,444

—

—

5,444

Corporate bonds

2,250

9

(4

)

2,255

3,688

38

(14

)

3,712

Bank deposits

1,550

1

—

1,551

1,317

1

—

1,318

Marketable equity securities

380

629

(1

)

1,008

387

386

—

773

Asset

-

backed securities

76

—

(

9

)

67

154

—

(

18

)

136

Money market fund deposits

34

—

—

34

65

—

—

65

Total

available

-

for

-

sale

investments

$

19,677

$

648

$

(19

)

$

20,306

$

13,260

$

436

$

(33

)

$

13,663

(In Millions)

Cost

Fair Value

Due in 1 year or less

$

16,225

$

16,225

Due in 1

–

2 years

2,190

2,200

Due in 2

–

5 years

769

770

Due after 5 years

3

2

Instruments not due at a single maturity date

110

101

Total

$

19,297

$

19,298