Intel 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Marketable Debt Instruments

Marketable debt instruments include instruments such as commercial paper, corporate bonds, government bonds, bank

deposits, asset-backed securities, municipal bonds, and money market fund deposits. When we use observable market prices

for identical securities that are traded in less active markets, we classify our marketable debt instruments as Level 2. When

observable market prices for identical securities are not available, we price our marketable debt instruments using non-binding

market consensus prices that are corroborated with observable market data; quoted market prices for similar instruments; or

pricing models, such as a discounted cash flow model, with all significant inputs derived from or corroborated with observable

market data. Non-binding market consensus prices are based on the proprietary valuation models of pricing providers or

brokers. These valuation models incorporate a number of inputs, including non-binding and binding broker quotes; observable

market prices for identical or similar securities; and the internal assumptions of pricing providers or brokers that use

observable market inputs and, to a lesser degree, unobservable market inputs. We corroborate non-binding market consensus

prices with observable market data using statistical models when observable market data exists. The discounted cash flow

model uses observable market inputs, such as LIBOR-based yield curves, currency spot and forward rates, and credit ratings.

Our marketable debt instruments that are classified as Level 3 are classified as such due to the lack of observable market data

to corroborate either the non-binding market consensus prices or the non-binding broker quotes. When observable market data

is not available, we corroborate non-binding market consensus prices and non-binding broker quotes using available

unobservable data.

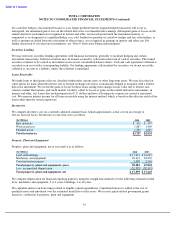

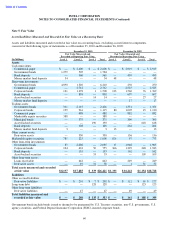

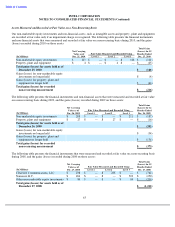

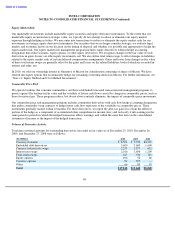

The following tables present reconciliations for all assets and liabilities measured and recorded at fair value on a recurring

basis, excluding accrued interest components, using significant unobservable inputs (Level 3) for 2010 and 2009:

61

Fair Value Measured and Recorded Using

Significant Unobservable Inputs (Level 3)

Asset

-

Corporate

Backed

Derivative

Derivative

Long-

Term

Total Gains

(In Millions)

Bonds

Securities

Assets

Liabilities

Debt

(Losses)

Balance as of December 26, 2009

$

369

$

754

$

31

$

(65

)

$

(123

)

Total gains or losses (realized and unrealized):

Included in earnings

(2

)

6

(3

)

(2

)

(5

)

(6

)

Included in other comprehensive income (loss)

4

9

—

—

—

13

Purchases, sales, issuances, and settlements, net

(113

)

(512

)

3

—

—

Transfers out of Level 3

(207

)

—

—

60

—

Balance as of December 25, 2010

$

51

$

257

$

31

$

(7

)

$

(128

)

Changes in unrealized gains or losses included in earnings

related to assets and liabilities still held as of December

25, 2010

$

—

$

6

$

(4

)

$

(1

)

$

(5

)

$

(4

)

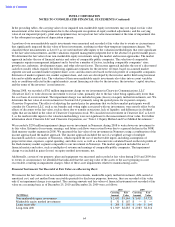

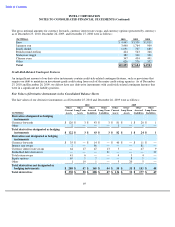

Fair Value Measured and Recorded Using

Significant Unobservable Inputs (Level 3)

Asset

-

Government

Corporate

Backed

Derivative

Derivative

Long

-

Term

Total Gains

(In Millions)

Bonds

Bonds

Securities

Assets

Liabilities

Debt

(Losses)

Balance as of December 27, 2008

$

—

$

555

$

1,083

$

15

$

(25

)

$

(122

)

Total gains or losses (realized and unrealized):

Included in earnings

—

4

25

(2

)

18

(1

)

44

Included in other comprehensive income

(loss)

1

36

20

—

—

—

57

Purchases, sales, issuances, and settlements,

net

300

279

(374

)

18

—

—

Transfers into Level 3

—

100

—

—

(

68

)

—

Transfers out of Level 3

(301

)

(605

)

—

—

10

—

Balance as of December 26, 2009

$

—

$

369

$

754

$

31

$

(65

)

$

(123

)

Changes in unrealized gains or losses included

in earnings related to assets and liabilities

still held as of December 26, 2009

$

—

$

—

$

53

$

—

$

18

$

(1

)

$

70