Honda 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity

The ¥1,168.9 billion in cash and cash equivalents at the end of the fiscal year

2014 corresponds to approximately 1.2 months of net sales, and Honda believes

it has sufficient liquidity for its business operations.

At the same time, Honda is aware of the possibility that various factors, such

as recession-induced market contraction and financial and foreign exchange

market volatility, may adversely affect liquidity. For this reason, finance subsidiaries

that carry total short-term borrowings of ¥1,566.8 billion have committed lines of

credit equivalent to ¥965.0 billion that serve as alternative liquidity for the com-

mercial paper issued regularly to replace debt. Honda believes it currently has

sufficient credit limits, extended by prominent international banks, as of the date

of the filing of Honda’s Form 20-F.

Honda’s short- and long-term debt securities are rated by credit rating agen-

cies, such as Moody’s Investors Service, Inc., Standard & Poor’s Rating Services,

and Rating and Investment Information, Inc. The following table shows the ratings

of Honda’s unsecured debt securities by Moody’s, Standard & Poor’s and Rating

and Investment Information as of March 31, 2014.

Credit ratings for

Short-term

unsecured

debt securities

Long-term

unsecured

debt securities

Moody’s Investors Service P-1 A1

Standard & Poor’s Rating Services A-1 A+

Rating and Investment Information a-1+ AA

The above ratings are based on information provided by Honda and other

information deemed credible by the rating agencies. They are also based on the

agencies’ assessment of credit risk associated with designated securities issued

by Honda. Each rating agency may use different standards for calculating Honda’s

credit rating, and also makes its own assessment. Ratings can be revised or nulli-

fied by agencies at any time. These ratings are not meant to serve as a recom-

mendation for trading in or holding Honda’s unsecured debt securities.

Off-Balance Sheet Arrangements

Guarantee

As of March 31, 2014, we guaranteed ¥25.3 billion of employee bank loans for

their housing costs. If an employee defaults on his/her loan payments, we are

required to perform under the guarantee. The undiscounted maximum amount of

our obligation to make future payments in the event of defaults is ¥25.3 billion. As

of March 31, 2014, no amount has been accrued for any estimated losses under

the obligations, as it was probable that the employees would be able to make all

scheduled payments.

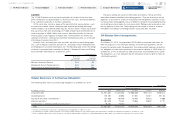

Tabular Disclosure of Contractual Obligations

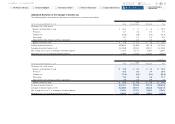

The following table shows our contractual obligations as of March 31, 2014:

Yen (millions)

Payments due by period

As of March 31, 2014 Total Within 1 year 1–3 years 3–5 years Thereafter

Long-term debt ¥4,537,530 ¥1,303,464 ¥2,088,658 ¥851,734 ¥293,674

Operating leases 102,180 18,862 27,567 16,027 39,724

Purchase and other commitments*1131,238 93,448 16,452 16,452 4,886

Interest payments*2181,449 79,061 73,865 25,802 2,721

Contributions to defined benefit pension plans*379,240 79,240 ———

Total ¥5,031,637 ¥1,574,075 ¥2,206,542 ¥910,015 ¥341,005

*1 Honda had commitments for purchases of property, plant and equipment as of March 31, 2014.

*2 To estimate the schedule of interest payments, the company utilized the balances and average interest rates of borrowings and debts and derivative instruments as of March 31, 2014.

*3 Since contributions beyond the next fiscal year are not currently determinable, contributions to defined benefit pension plans reflect only contributions expected for the next fiscal year.

Honda Motor Co., Ltd. Annual Report 2014 37

6 Financial Section

1 The Power of Dreams

2 Financial Highlights

3 To Our Shareholders

4 Review of Operations

5 Corporate Governance

7

Investor Relations

Information

Return to last

page opened

Go to

contents page