Honda 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Japan

Total demand for automobiles in Japan*1 rose around 9%

from the previous fiscal year to approximately 5,690 thou-

sand units in fiscal year 2014. This was mainly due to sales

receiving a boost in the second half of the fiscal year from a

last-minute rise in demand before an increase in Japan’s

consumption tax rate. Gains were offset in part by a back-

lash from the termination of eco-car subsidies.

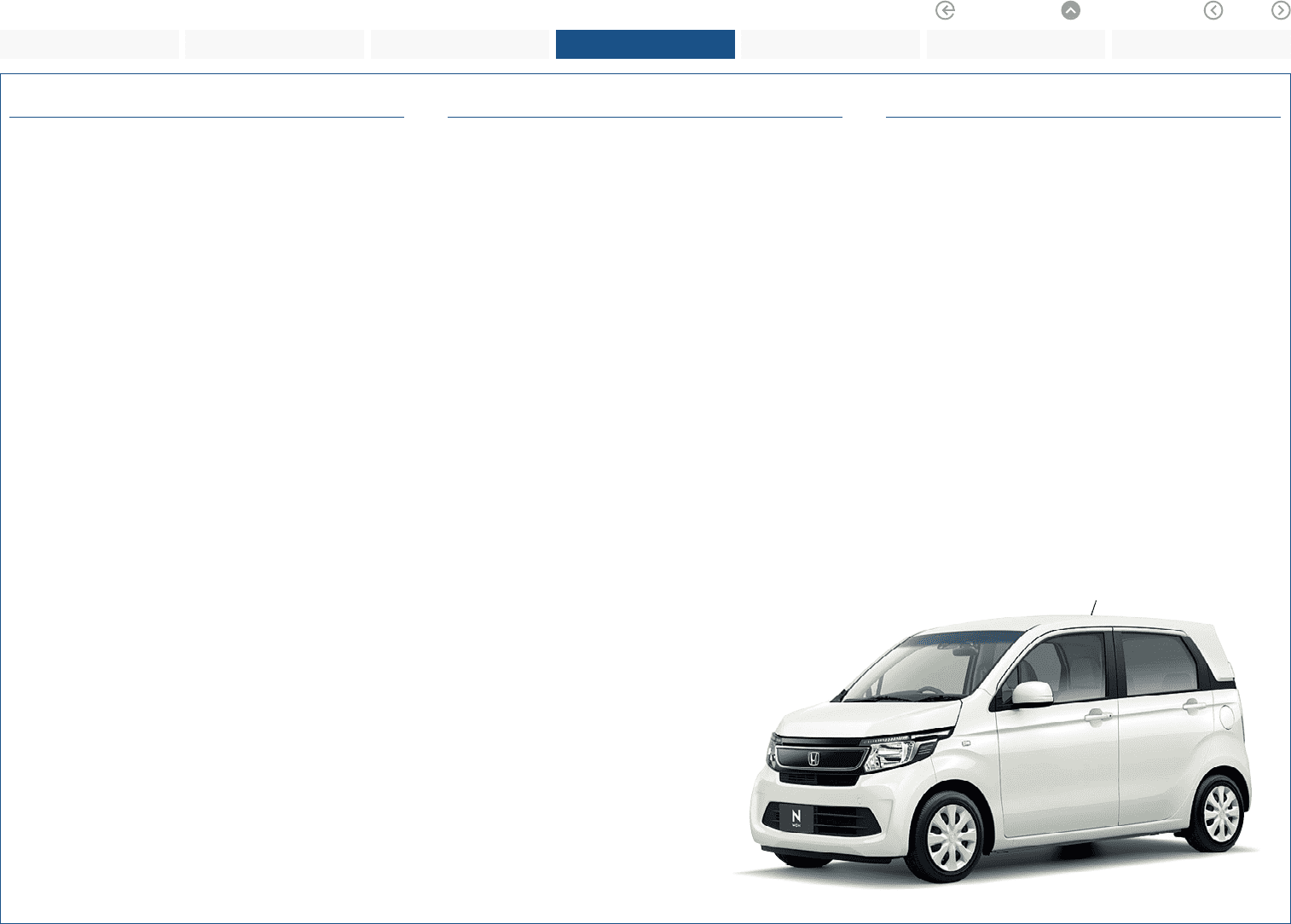

Honda’s consolidated unit sales in Japan rose 18.5%

from the previous fiscal year to 812 thousand units*2. This

result was attributable to the introduction of the N–WGN

and VEZEL and full model change of the Fit and Odyssey.

In production activities, Honda’s unit production of auto-

mobiles increased 6.9% from the previous fiscal year to 936

thousand units in fiscal year 2014, mainly due to higher sales

in Japan, despite the shift of some production overseas.

The Saitama Factory’s Yorii automobile plant, which had

been under construction in Yorii-machi, Osato-gun, Saitama,

began operation in July 2013. The manufacturing capacity

of the Yorii Plant, which mainly produces the Fit and VEZEL,

is 250 thousand units per year.

*1 Source: JAMA (Japan Automobile Manufacturers Association): (as measured by

the number of regular vehicle registrations (661cc or higher) and mini vehicles

(660cc or lower))

*2 Certain sales of automobiles that are financed with residual value-type auto

loans by our Japanese finance subsidiaries are accounted for as operating

leases in conformity with U.S. generally accepted accounting principles and are

not included in consolidated net sales to the external customers in our auto-

mobile business. As a result, they are not included in consolidated unit sales.

North America

Total industry demand for automobiles in the United

States*, the principal market within North America, rose

around 8% from the previous year to approximately 15,600

thousand units in calendar year 2013. This was mainly

attributable to improvements in employment conditions and

upswings in consumer sentiment that led to a substantial

increase in light truck sales and also a rise in small passen-

ger car sales.

Under these circumstances, Honda’s consolidated unit

sales in North America increased 1.5% from the previous

fiscal year to 1,757 thousand units in fiscal year 2014. This

was mainly due to strong sales of the Accord, Civic, CR-V

and other models, as well as a full model change of the

Acura MDX.

In production activities, Honda manufactured 1,777

thousand units, up 5.3% from the previous fiscal year.

Honda de Mexico, S.A. de C.V., a consolidated subsid-

iary in Mexico, built a new plant with an annual production

capacity of 200 thousand units in order to meet expected

market expansion for small cars in North America. This new

plant went into operation in February 2014.

* Source: WardsAuto

Europe

Total demand for automobiles in Europe*1 decreased roughly

2% from the previous year to approximately 12,300 thousand

units in calendar year 2013. The market diminished as a whole

due mainly to unemployment rates remaining high and the

weakness of the real economy in the eurozone, excluding the

U.K. The market’s decline was offset in part by an economic

recovery in the U.K., resulting in a pocket of growth in

demand for automobiles. On the other hand, total demand

for automobiles in Russia*2 decreased around 5% from the

previous year to approximately 2,770 thousand units.

Honda’s consolidated unit sales in Europe decreased 1.2%

from the previous year to 169 thousand units in fiscal year

2014. This was mainly due to a decline in unit sales of the Civic

which offset sales generated by the launch of a new diesel

engine equipped CR-V.

On the production front, unit output at Honda’s U.K.

plant declined 21.6% from the previous fiscal year to 133

thousand units in fiscal year 2014.

*1 Source: ACEA (Association des Constructeurs Europeens d’Automobiles (the

European Automobile Manufacturers’ Association)) New passenger car registra-

tions cover 27 EU countries and three EFTA countries, excluding Russia.

*2 Source: AEB (The Association of European Businesses)

N–WGN

(Japan)

Honda Motor Co., Ltd. Annual Report 2014 18

4 Review of Operations

1 The Power of Dreams

2 Financial Highlights

3 To Our Shareholders

5 Corporate Governance

6 Financial Section

7

Investor Relations

Information

Return to last

page opened

Go to

contents page