Honda 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Japan

Total industry demand for motorcycles in Japan* was

approximately 470 thousand units in fiscal year 2014, an

increase of roughly 7% from the previous fiscal year. This

was attributable to an increase in sales of scooters and

small to lightweight motorcycles, with engines ranging from

50cc to 250cc, due mainly to a spike in demand ahead of

an increase in Japan’s consumption tax rate. Honda’s con-

solidated unit sales in Japan were 226 thousand units in

fiscal year 2014, up 4.1% from the previous fiscal year,

owing to the launch of models such as the DUNK 50cc

scooter and the GROM sporty motorcycle.

* Source: JAMA (Japan Automobile Manufacturers Association)

North America

Total demand for motorcycles and all-terrain vehicles (ATVs)

in the United States*, the principal market within North

America, increased approximately 1% from the previous

year to approximately 690 thousand units in calendar year

2013. Unit sales growth reflected an improvement in con-

sumer sentiment in line with falling unemployment rates.

Under these circumstances, Honda’s consolidated unit

sales in North America increased 10.4% from the previous

fiscal year to 276 thousand units in fiscal year 2014, mainly

due to steady sales of models such as the CB500 series of

middleweight road machines and the CRF250L on/off-road

model, as well as favorable effects from the introductions of

the all new sporty model, GROM and full model changes of

utility ATVs such as FourTrax Rancher 4x4 ES and FourTrax

Foreman 4x4 in the United States.

* Source: MIC (Motorcycle Industry Council)

Europe

Total demand for motorcycles in Europe* declined around

11% from the previous fiscal year, to approximately 690

thousand units in calendar year 2013. Weak consumer

sentiment due to continually high unemployment rates

adversely affected demand.

Under these circumstances, Honda’s consolidated unit

sales in Europe decreased 7.3% from the previous fiscal

year to 166 thousand units in fiscal year 2014, mainly

reflecting the lackluster market as a whole. This was despite

brisk sales of the CB500 series of middleweight road

machines, and a positive impact from the introduction of

the sporty MSX125 model.

* Based on Honda research: this only includes the following 10 countries—the

United Kingdom, Germany, France, Italy, Spain, Switzerland, Portugal, the

Netherlands, Belgium and Austria.

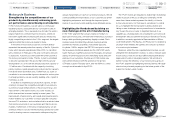

GROM

(Japan)

FourTrax Rancher 4x4 ES

(North America)

Honda Motor Co., Ltd. Annual Report 2014 15

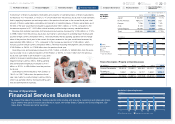

4 Review of Operations

1 The Power of Dreams

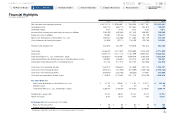

2 Financial Highlights

3 To Our Shareholders

5 Corporate Governance

6 Financial Section

7

Investor Relations

Information

Return to last

page opened

Go to

contents page