Home Depot 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

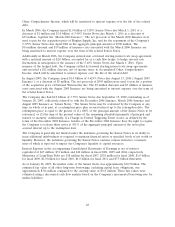

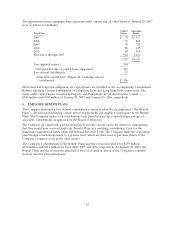

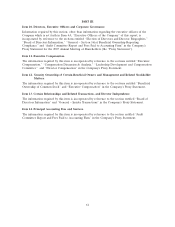

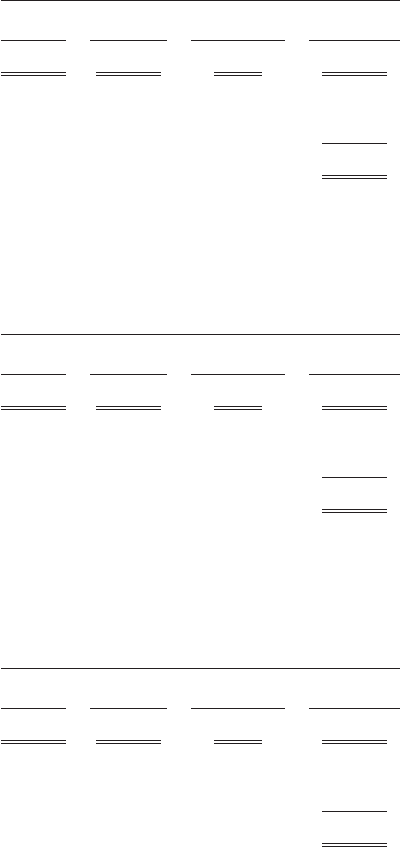

short-term investments and intersegment eliminations. Additionally, Operating Income under

Eliminations/Other for the fiscal year ended January 28, 2007 includes $129 million of cost associated

with executive severance and separation agreements. The following tables present financial information

by segment for the fiscal years ended January 28, 2007, January 29, 2006 and January 30, 2005,

respectively (amounts in millions):

Fiscal Year Ended January 28, 2007

Eliminations/

Retail HD Supply Other Consolidated

Net Sales $79,027 $12,070 $(260) $90,837

Operating Income $ 9,024 $ 800 $(151) $ 9,673

Interest, net (365)

Earnings Before Provision for Income Taxes $ 9,308

Depreciation and Amortization $ 1,682 $ 194 $ 10 $ 1,886

Total Assets $42,094 $10,021 $ 148 $52,263

Capital Expenditures $ 3,321 $ 221 $ — $ 3,542

Payments for Businesses Acquired, net $ 305 $ 3,963 $ — $ 4,268

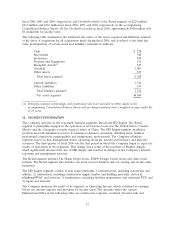

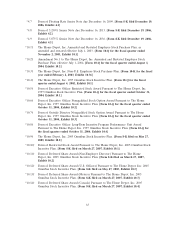

Fiscal Year Ended January 29, 2006

Eliminations/

Retail HD Supply Other Consolidated

Net Sales $77,022 $ 4,614 $(125) $81,511

Operating Income $ 9,058 $ 319 $ (14) $ 9,363

Interest, net (81)

Earnings Before Provision for Income Taxes $ 9,282

Depreciation and Amortization $ 1,510 $ 63 $ 6 $ 1,579

Total Assets $39,827 $ 4,517 $ 61 $44,405

Capital Expenditures $ 3,777 $ 104 $ — $ 3,881

Payments for Businesses Acquired, net $ 190 $ 2,356 $ — $ 2,546

Fiscal Year Ended January 30, 2005

Eliminations/

Retail HD Supply Other Consolidated

Net Sales $71,101 $ 2,040 $ (47) $73,094

Operating Income $ 7,812 $ 122 $ (8) $ 7,926

Interest, net (14)

Earnings Before Provision for Income Taxes $ 7,912

Depreciation and Amortization $ 1,296 $ 20 $ 3 $ 1,319

Total Assets $36,902 $ 1,406 $ 712 $39,020

Capital Expenditures $ 3,905 $ 43 $ — $ 3,948

Payments for Businesses Acquired, net $ 202 $ 525 $ — $ 727

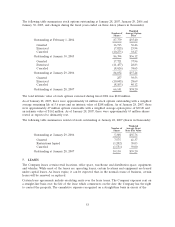

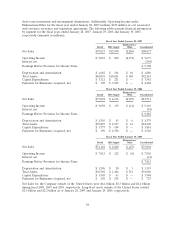

Net Sales for the Company outside of the United States were $6.4 billion, $5.3 billion and $4.2 billion

during fiscal 2006, 2005 and 2004, respectively. Long-lived assets outside of the United States totaled

$2.5 billion and $2.2 billion as of January 28, 2007 and January 29, 2006, respectively.

58