Home Depot 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

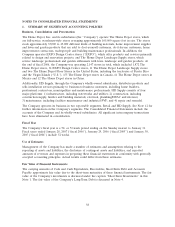

occurred for grants at all levels of the Company. Management personnel, who have since left the

Company, generally followed a practice of reviewing closing prices for a prior period and

selecting a date with a low stock price to increase the value of the options to employees on lists

of grantees subsequently approved by a committee of the Board of Directors.

• The annual option grants in 1994 through 2000, as well as many quarterly grants during this

period, were not finally allocated among the recipients until several weeks after the stated grant

date. Because of the absence of records prior to 1994, it is unclear whether allocations also

postdated the selected grant dates from 1981 through 1993. Moreover, for many of these annual

and quarterly grants from 1981 through December 2000, there is insufficient documentation to

determine with certainty when the grants were actually authorized by a committee of the Board

of Directors. Finally, the Company’s stock administration department also retroactively added

employees to lists of approved grantees, or changed the number of options granted to specific

employees, without authorization of the Board of Directors or a board committee, to correct

administrative errors.

• Numerous option grants to rank-and-file employees were made pursuant to delegations of

authority that may not have been effective under Delaware law.

• In numerous instances, and primarily prior to 2003, beneficiaries of grants who were required to

report them to the SEC failed to do so in a timely manner or at all.

• The subcommittee concluded that there was no intentional wrongdoing by any current member

of the Company’s management team or its Board of Directors.

The Company believes that because of these errors, it had unrecorded expense over the affected period

(1981 through 2005) of $227 million in the aggregate, including related tax items. In accordance with

the provisions of SAB 108, the Company decreased beginning Retained Earnings for fiscal 2006 by

$227 million within the accompanying Consolidated Financial Statements.

As previously disclosed, the staff of the SEC has begun an informal inquiry into the Company’s stock

option practices, and the U.S. Attorney for the Southern District of New York has also requested

information on the subject. The Company is continuing to cooperate with these agencies. While the

Company cannot predict the outcome of these matters, it does not believe that they will have a

material adverse impact on its consolidated financial condition or results of operations.

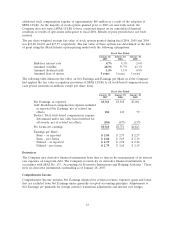

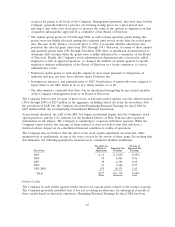

The Company does not believe that the effect of the stock option adjustment was material, either

quantitatively or qualitatively, in any of the years covered by the review of these items. In reaching that

determination, the following quantitative measures were considered (dollars in millions):

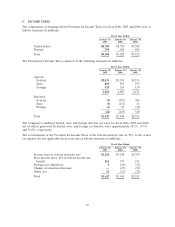

Net After-tax Percent of

Effect of Reported Net Reported Net

Fiscal Year Adjustment Earnings Earnings

2005 $ 11 $ 5,838 0.19%

2004 18 5,001 0.36

2003 18 4,304 0.42

2002 21 3,664 0.57

1981-2001 159 14,531 1.09

Total $227 $33,338 0.68%

Vendor Credits

The Company records credits against vendor invoices for various issues related to the receipt of goods.

The Company previously identified that it was not recording an allowance for subsequent reversals of

these credits based on historical experience. Beginning Retained Earnings for fiscal 2006 has been

45