Home Depot 2006 Annual Report Download - page 23

Download and view the complete annual report

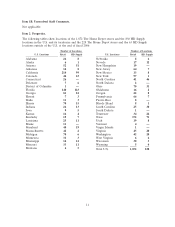

Please find page 23 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Of our 893 HD Supply locations at the end of fiscal 2006, approximately 13% were owned (including

those owned subject to a ground lease) and approximately 87% of such stores were leased. We

generally prefer to lease HD Supply locations as it provides flexibility to relocate or expand with our

HD Supply customer base. Additionally, HD Supply had 66 U.S. warehouses and distribution centers

located in 19 states and two in Canada to support other HD Supply locations. The HD Supply

locations, warehouses and distribution centers utilized approximately 23.7 million square feet, of which

approximately 2.8 million is owned and approximately 20.9 million is leased at the end of fiscal 2006.

Our executive, corporate staff, divisional staff and financial offices occupy approximately 2.0 million

square feet of leased and owned space in Atlanta, Georgia. At the end of fiscal 2006, we occupied an

aggregate of approximately 4.4 million square feet, of which approximately 2.5 million square feet is

owned and approximately 1.9 million square feet is leased, for store support centers and customer

support centers.

We believe that at the end of existing lease terms, our current leased space can be either relet or

replaced by alternate space for lease or purchase that is readily available.

Item 3. Legal Proceedings.

In August 2005, the Company received an informal request from the staff of the SEC for information

related to the Company’s return-to-vendor policies and procedures. The Company has responded to

this and subsequent requests and continues to fully cooperate with the SEC staff. The SEC has

informed the Company that the informal inquiry is not an indication that any violations of law have

occurred. Although the Company cannot predict the outcome of this matter, it does not expect that this

informal inquiry will have a material adverse effect on its consolidated financial condition or results of

operations.

In June 2006, the SEC commenced an informal inquiry into the Company’s stock option granting

practices, and the Office of the U.S. Attorney for the Southern District of New York has also requested

information on this subject. In addition, a subcommittee of the Audit Committee reviewed the

Company’s historical stock option practices and engaged independent outside counsel to assist in this

matter. On December 6, 2006, the Company announced the results of this investigation. The Company

determined that the unrecorded expense from 1981 through the present is approximately $227 million

in the aggregate, including related tax items. In accordance with the provisions of Staff Accounting

Bulletin No. 108, ‘‘Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements,’’ the Company corrected these errors by

decreasing beginning Retained Earnings for fiscal 2006 by $227 million, with offsetting entries to

Paid-In Capital, Other Accrued Expenses and Deferred Income Taxes, within its Consolidated Financial

Statements. The Company and the subcommittee are continuing to cooperate with the SEC and the

Office of U.S. Attorney. Although the Company cannot predict the outcome of these matters, it does

not believe they will have a material adverse effect on its consolidated financial condition or results of

operations.

The following actions have been filed against the Company and, in some cases, against certain of its

current and former officers and directors as described below. Although the Company cannot predict

their outcome, it does not expect these actions, individually or together, will have a material adverse

effect on its consolidated financial condition or results of operations.

In the second quarter of fiscal 2006, six purported, but as yet uncertified, class actions were filed

against the Company and certain of its current and former officers and directors in the U.S. District

Court for the Northern District of Georgia in Atlanta, alleging certain misrepresentations in violation

of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder in

connection with the Company’s return-to-vendor practices. These actions were filed by certain current

and former shareholders of the Company. In the third quarter of fiscal 2006, one of the shareholders

13