Home Depot 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

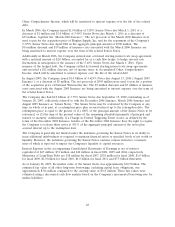

fiscal 2006, 2005 and 2004, respectively, and Goodwill related to the Retail segment of $229 million,

$111 million and $163 million for fiscal 2006, 2005 and 2004, respectively, in the accompanying

Consolidated Balance Sheets. Of the Goodwill recorded in fiscal 2006, approximately $500 million will

be deductible for income taxes.

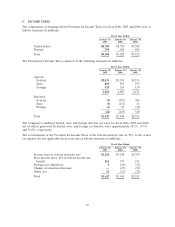

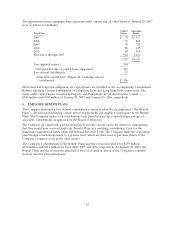

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed

at the dates of acquisition for all acquisitions made during fiscal 2006, and is subject to the final fair

value determination of certain assets and liabilities (amounts in millions):

Cash $ 224

Receivables 948

Inventories 874

Property and Equipment 231

Intangible Assets(1) 547

Goodwill 3,007

Other Assets 187

Total assets acquired 6,018

Current Liabilities 1,321

Other Liabilities 193

Total liabilities assumed 1,514

Net assets acquired $4,504

(1) Primarily customer relationships and tradenames which are included in Other Assets in the

accompanying Consolidated Balance Sheets and are being amortized over a weighted average useful life

of 10 years.

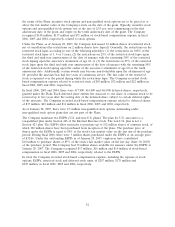

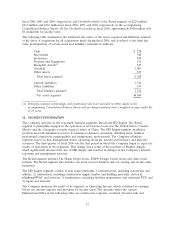

12. SEGMENT INFORMATION

The Company operates in two reportable business segments: Retail and HD Supply. The Retail

segment is principally engaged in the operation of retail stores located in the United States, Canada,

Mexico and the Company’s recently acquired stores in China. The HD Supply segment distributes

products and sells installation services to business-to-business customers, including home builders,

professional contractors, municipalities and maintenance professionals. The Company identifies

segments based on how management makes operating decisions, assesses performance and allocates

resources. The first quarter of fiscal 2006 was the first period in which the Company began to report its

results of operations in two segments. This change was a result of the purchase of Hughes Supply,

which significantly increased the size of HD Supply and resulted in changes in the Company’s internal

reporting and management structure.

The Retail segment includes The Home Depot stores, EXPO Design Center stores and other retail

formats. The Retail segment also includes our retail services business and our catalog and on-line sales

businesses.

The HD Supply segment consists of four major platforms: 1) infrastructure, including waterworks and

utilities; 2) construction, including construction supply, lumber and building materials, electrical,

plumbing/HVAC and interiors; 3) maintenance, including facilities maintenance and industrial PVF; and

4) repair and remodel.

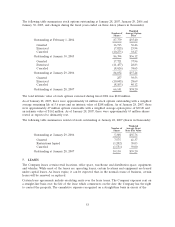

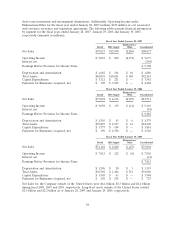

The Company measures the profit of its segments as Operating Income, which is defined as earnings

before net interest expense and provision for income taxes. The amounts under the caption

Eliminations/Other in the following tables are unallocated corporate overhead, invested cash and

57