Home Depot 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

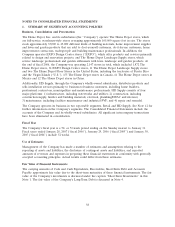

decreased by $30 million in the accompanying Consolidated Financial Statements to reflect the

appropriate adjustments to Merchandise Inventories and Accounts Payable, net of tax.

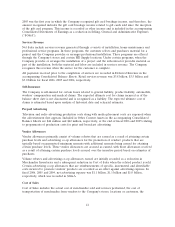

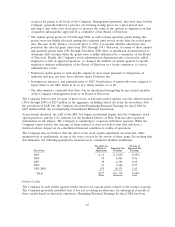

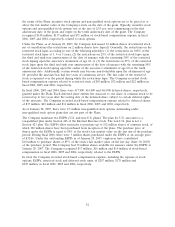

Impact of Adjustments

The impact of each of the items noted above, net of tax, on fiscal 2006 beginning balances are

presented below (amounts in millions):

Cumulative Effect as of January 30, 2006

Stock Option Vendor

Practices Credits Total

Merchandise Inventories $ — $ 9 $ 9

Accounts Payable — (59) (59)

Deferred Income Taxes 11 20 31

Other Accrued Expenses (37) — (37)

Paid-In Capital (201) — (201)

Retained Earnings 227 30 257

Total $ — $ — $ —

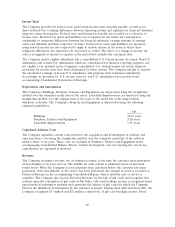

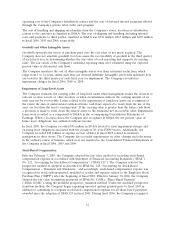

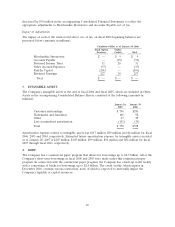

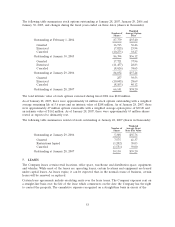

3. INTANGIBLE ASSETS

The Company’s intangible assets at the end of fiscal 2006 and fiscal 2005, which are included in Other

Assets in the accompanying Consolidated Balance Sheets, consisted of the following (amounts in

millions):

January 28, January 29,

2007 2006

Customer relationships $ 756 $283

Trademarks and franchises 106 92

Other 67 58

Less accumulated amortization (151) (35)

Total $ 778 $398

Amortization expense related to intangible assets was $117 million, $29 million and $4 million for fiscal

2006, 2005 and 2004, respectively. Estimated future amortization expense for intangible assets recorded

as of January 28, 2007 is $107 million, $105 million, $99 million, $94 million and $82 million for fiscal

2007 through fiscal 2011, respectively.

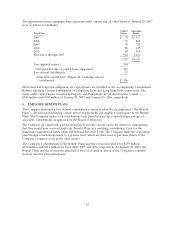

4. DEBT

The Company has a commercial paper program that allows for borrowings up to $2.5 billion. All of the

Company’s short-term borrowings in fiscal 2006 and 2005 were made under this commercial paper

program. In connection with the commercial paper program, the Company has a back-up credit facility

with a consortium of banks for borrowings up to $2.0 billion. The credit facility, which expires in

December 2010, contains various restrictions, none of which is expected to materially impact the

Company’s liquidity or capital resources.

46