Home Depot 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

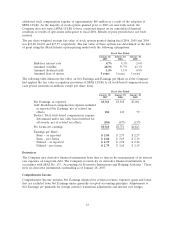

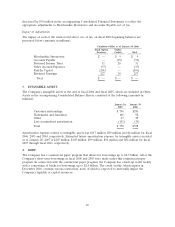

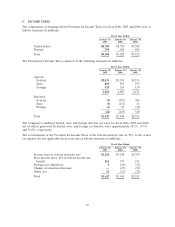

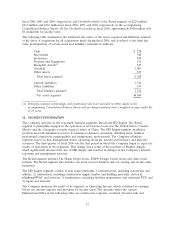

5. INCOME TAXES

The components of Earnings before Provision for Income Taxes for fiscal 2006, 2005 and 2004 were as

follows (amounts in millions):

Fiscal Year Ended

January 28, January 29, January 30,

2007 2006 2005

United States $8,709 $8,736 $7,508

Foreign 599 546 404

Total $9,308 $9,282 $7,912

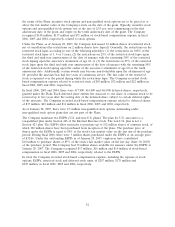

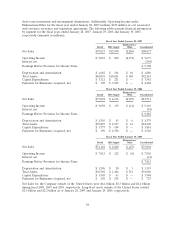

The Provision for Income Taxes consisted of the following (amounts in millions):

Fiscal Year Ended

January 28, January 29, January 30,

2007 2006 2005

Current:

Federal $2,831 $3,394 $2,153

State 409 507 279

Foreign 329 156 139

3,569 4,057 2,571

Deferred:

Federal (9) (527) 304

State (9) (111) 52

Foreign (4) 25 (16)

(22) (613) 340

Total $3,547 $3,444 $2,911

The Company’s combined federal, state and foreign effective tax rates for fiscal 2006, 2005 and 2004,

net of offsets generated by federal, state and foreign tax benefits, were approximately 38.1%, 37.1%

and 36.8%, respectively.

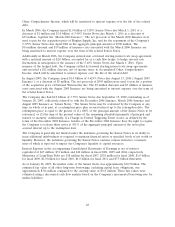

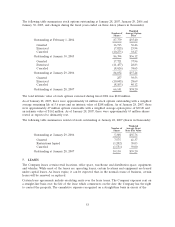

The reconciliation of the Provision for Income Taxes at the federal statutory rate of 35% to the actual

tax expense for the applicable fiscal years was as follows (amounts in millions):

Fiscal Year Ended

January 28, January 29, January 30,

2007 2006 2005

Income taxes at federal statutory rate $3,258 $3,249 $2,769

State income taxes, net of federal income tax

benefit 261 279 215

Foreign rate differences 5(10) (17)

Change in valuation allowance —(23) (31)

Other, net 23 (51) (25)

Total $3,547 $3,444 $2,911

49