Home Depot 2006 Annual Report Download - page 37

Download and view the complete annual report

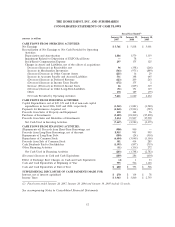

Please find page 37 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In March 2006, we entered into a forward starting interest rate swap agreement with a notional amount

of $2.0 billion, accounted for as a cash flow hedge, to hedge interest rate fluctuations in anticipation of

the issuance of the 5.40% Senior Notes due March 1, 2016. Upon issuance of the hedged debt, we

settled our forward starting interest rate swap agreement and recorded a $12 million decrease, net of

income taxes, to Accumulated Other Comprehensive Income, which will be amortized to interest

expense over the life of the related debt.

In May 2006, we entered into a $2 billion accelerated share repurchase agreement with a financial

institution pursuant to which we repurchased approximately 53 million shares of our common stock.

Under the agreement, the financial institution purchased an equivalent number of shares of our

common stock in the open market. The shares repurchased by us were subject to a future purchase

price adjustment based upon the weighted average price of our common stock over an agreed period,

subject to a specified collar. In August 2006, we settled the accelerated share repurchase. We elected

settlement in cash and received $61 million from the financial institution, which was recorded as an

offset to our cost of treasury stock.

In October 2006, we entered into a forward starting interest rate swap agreement with a notional

amount of $1.0 billion, accounted for as a cash flow hedge, to hedge interest rate fluctuations in

anticipation of the issuance of the 5.875% Senior Notes due December 16, 2036. Upon issuance of the

hedged debt in December 2006, we settled our forward starting interest rate swap agreement and

recorded an $11 million decrease, net of income taxes, to Accumulated Other Comprehensive Income,

which will be amortized to interest expense over the life of the related debt.

In December 2006, we entered into a $3 billion accelerated share repurchase agreement with a

financial institution pursuant to which we repurchased approximately 75 million shares of our common

stock. Under the agreement, the financial institution purchased an equivalent number of shares of our

common stock in the open market. The shares repurchased by us were subject to a future purchase

price adjustment based upon the weighted average price of our common stock over an agreed period.

In March 2007, we settled the accelerated share repurchase. We elected settlement in cash and received

$36 million from the financial institution, which was recorded as an offset to our cost of treasury stock

in fiscal 2007.

27