Home Depot 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

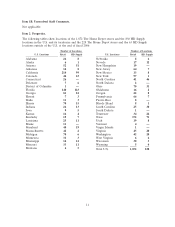

Store Growth

United States. At the end of fiscal 2006, we were operating 1,872 The Home Depot stores in the

U.S., including the territories of Puerto Rico and the Virgin Islands. During fiscal 2006, we opened 86

new The Home Depot stores, including eight relocations, in the U.S.

Canada. At the end of fiscal 2006, we were operating 155 The Home Depot stores in ten Canadian

provinces. Of these stores, 20 were opened during fiscal 2006, including two relocations.

Mexico. At the end of fiscal 2006, we were operating 61 The Home Depot stores in Mexico. Of these

stores, seven were opened during fiscal 2006.

China. In fiscal 2006, we acquired The Home Way, a Chinese home improvement retailer, including

12 stores in six cities.

Credit Services. We offer credit purchase programs through third-party credit providers to professional,

D-I-Y and D-I-F-M customers. In fiscal 2006, approximately 4.5 million new The Home Depot credit

accounts were opened, bringing the total number of The Home Depot account holders to

approximately 17 million. Proprietary credit card sales accounted for approximately 28% of store sales

in fiscal 2006. We also offer an unsecured Home Improvement Loan program through third-party

credit providers that gives our customers the opportunity to finance the purchase of products and

services in our stores. We believe this loan program not only supports large sales, such as kitchen and

bath remodels, but also generates incremental sales from our customers.

Logistics. Our logistics programs are designed to ensure excellent product availability for customers,

effective use of our investment in inventory and low total supply chain costs. At the end of fiscal 2006,

we operated 18 import distribution centers located in the U.S. and Canada. At the end of fiscal 2006,

we also operated 30 lumber distribution centers in the U.S. and Canada to support the lumber

demands of our stores and 10 transit facilities to receive merchandise from manufacturers for

immediate delivery to our stores. At the end of fiscal 2006, approximately 40% of the merchandise

shipped to our stores flowed through our network of distribution centers and transit facilities. As our

networks evolve, we expect to increase our flow-through. The remaining merchandise will be shipped

directly from our suppliers to our stores. In addition to replenishing merchandise supplies at our stores,

we also provide delivery services directly to our customers.

Seasonality. Our business is seasonal to a certain extent. Generally, our highest volume of sales occurs

in our second fiscal quarter and the lowest volume occurs during our fourth fiscal quarter.

Competition. Our business is highly competitive, based in part on price, store location, customer

service and depth of merchandise. In each of the markets we serve, there are a number of other home

improvement stores, electrical, plumbing and building materials supply houses and lumber yards. With

respect to some products, we also compete with discount stores, local, regional and national hardware

stores, mail order firms, warehouse clubs, independent building supply stores and, to a lesser extent,

other retailers. In addition to these entities, our EXPO Design Center stores compete with specialty

design stores or showrooms, some of which are only open to interior design professionals. Due to the

variety of competition we face, we are unable to precisely measure the impact on our sales by our

competitors.

HD Supply Segment

Operating Strategy. Our operating strategy is to provide a total solution for every phase of a building

project, from infrastructure to construction to lifetime maintenance and repair and remodel. We believe

that our broad product and service offering, our highly knowledgeable sales force and our reputation

for superior customer service enable us to be a single-source supplier to our customers for the entire

project lifecycle.

4