Home Depot 2006 Annual Report Download - page 52

Download and view the complete annual report

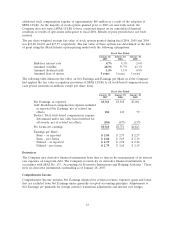

Please find page 52 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating cost of the Company’s distribution centers and the cost of deferred interest programs offered

through the Company’s private label credit card program.

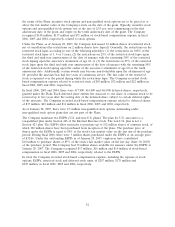

The cost of handling and shipping merchandise from the Company’s stores, locations or distribution

centers to the customer is classified as SG&A. The cost of shipping and handling, including internal

costs and payments to third parties, classified as SG&A was $741 million, $563 million and $499 million

in fiscal 2006, 2005 and 2004, respectively.

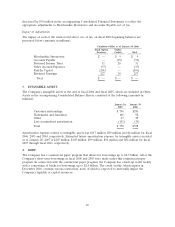

Goodwill and Other Intangible Assets

Goodwill represents the excess of purchase price over the fair value of net assets acquired. The

Company does not amortize goodwill, but does assess the recoverability of goodwill in the third quarter

of each fiscal year by determining whether the fair value of each reporting unit supports its carrying

value. The fair values of the Company’s identified reporting units were estimated using the expected

present value of discounted cash flows.

The Company amortizes the cost of other intangible assets over their estimated useful lives, which

range from 1 to 14 years, unless such lives are deemed indefinite. Intangible assets with indefinite lives

are tested in the third quarter of each fiscal year for impairment. The Company recorded no

impairment charges for fiscal 2006, 2005 or 2004.

Impairment of Long-Lived Assets

The Company evaluates the carrying value of long-lived assets when management makes the decision to

relocate or close a store or other location, or when circumstances indicate the carrying amount of an

asset may not be recoverable. Losses related to the impairment of long-lived assets are recognized to

the extent the sum of undiscounted estimated future cash flows expected to result from the use of the

asset are less than the asset’s carrying value. If the carrying value is greater than the future cash flows,

a provision is made to write down the related assets to the estimated net recoverable value. Impairment

losses were recorded as a component of SG&A in the accompanying Consolidated Statements of

Earnings. When a location closes, the Company also recognizes in SG&A the net present value of

future lease obligations, less estimated sublease income.

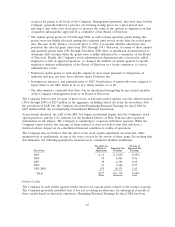

In fiscal 2005, the Company recorded $91 million in SG&A related to asset impairment charges and

on-going lease obligations associated with the closing of 20 of its EXPO stores. Additionally, the

Company recorded $29 million of expense in Cost of Sales in fiscal 2005 related to inventory

markdowns in these stores. The Company also recorded impairments on other closings and relocations

in the ordinary course of business, which were not material to the Consolidated Financial Statements of

the Company in fiscal 2006, 2005 and 2004.

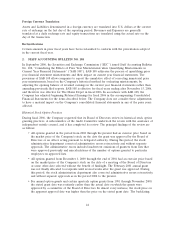

Stock-Based Compensation

Effective February 3, 2003, the Company adopted the fair value method of recording stock-based

compensation expense in accordance with Statement of Financial Accounting Standards (‘‘SFAS’’)

No. 123, ‘‘Accounting for Stock-Based Compensation’’ (‘‘SFAS 123’’). The Company selected the

prospective method of adoption as described in SFAS No. 148, ‘‘Accounting for Stock-Based

Compensation – Transition and Disclosure,’’ and accordingly, stock-based compensation expense was

recognized for stock options granted, modified or settled and expense related to the Employee Stock

Purchase Plan (‘‘ESPP’’) after the beginning of fiscal 2003. Effective January 30, 2006, the Company

adopted the fair value recognition provisions of SFAS No. 123(R), ‘‘Share-Based Payment’’

(‘‘SFAS 123(R)’’), using the modified prospective transition method. Under the modified prospective

transition method, the Company began expensing unvested options granted prior to fiscal 2003 in

addition to continuing to recognize stock-based compensation expense for all share-based payments

awarded since the adoption of SFAS 123 in fiscal 2003. During fiscal 2006, the Company recognized

42