Home Depot 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

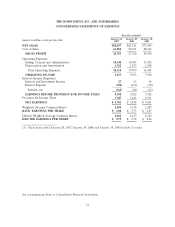

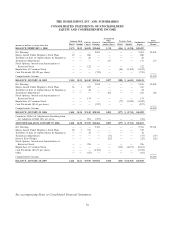

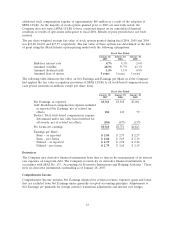

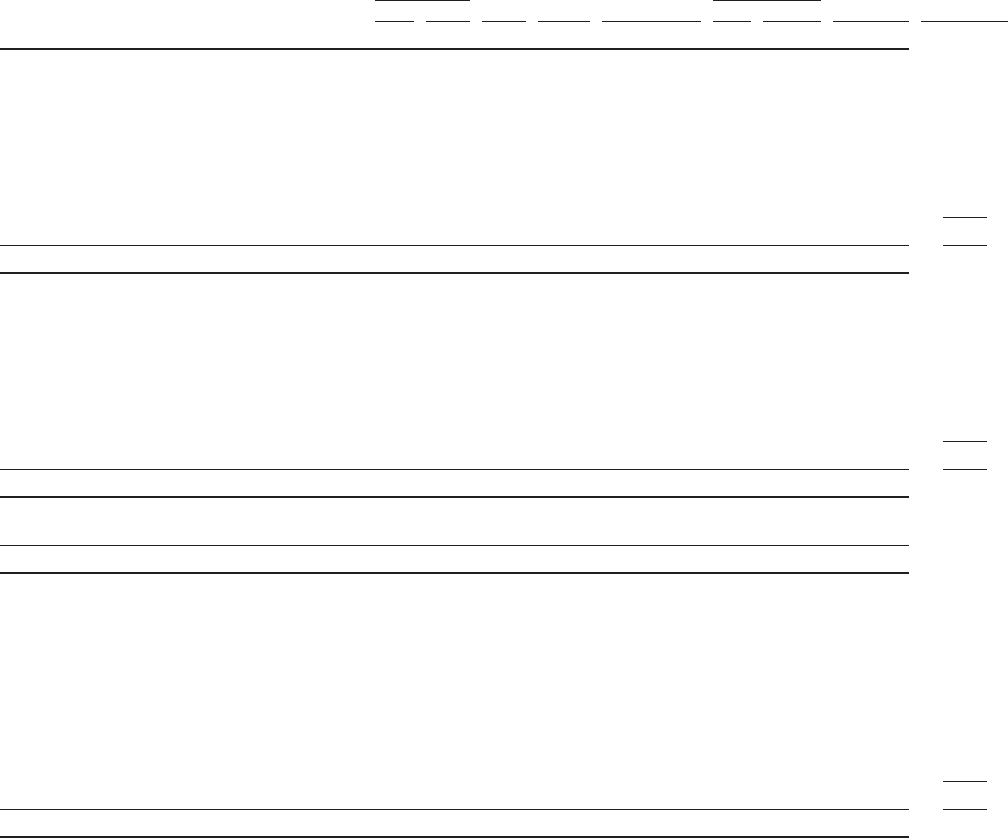

THE HOME DEPOT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY AND COMPREHENSIVE INCOME

Accumulated

Other Total

Common Stock Treasury Stock

Paid-In Retained Comprehensive Stockholders’ Comprehensive

Shares Amount Capital Earnings Income (Loss) Shares Amount Equity Income

amounts in millions, except per share data

BALANCE, FEBRUARY 1, 2004 2,373 $119 $6,108 $19,680 $ 90 (116) $ (3,590) $22,407

Net Earnings — — — 5,001 — — — 5,001 $5,001

Shares Issued Under Employee Stock Plans 12 — 286 — — — — 286

Tax Effect of Sale of Option Shares by Employees — — 26 — — — — 26

Translation Adjustments — — — — 137 — — 137 137

Stock Options, Awards and Amortization of

Restricted Stock — — 122 — — — — 122

Repurchase of Common Stock — — — — — (84) (3,102) (3,102)

Cash Dividends ($0.325 per share) — — — (719) — — — (719)

Comprehensive Income $5,138

BALANCE, JANUARY 30, 2005 2,385 $119 $6,542 $23,962 $227 (200) $ (6,692) $24,158

Net Earnings — — — 5,838 — — — 5,838 $5,838

Shares Issued Under Employee Stock Plans 16 1 409 — — — — 410

Tax Effect of Sale of Option Shares by Employees — — 24 — — — — 24

Translation Adjustments — — — — 182 — — 182 182

Stock Options, Awards and Amortization of

Restricted Stock — — 174 — — — — 174

Repurchase of Common Stock — — — — — (77) (3,020) (3,020)

Cash Dividends ($0.40 per share) — — — (857) — — — (857)

Comprehensive Income $6,020

BALANCE, JANUARY 29, 2006 2,401 $120 $7,149 $28,943 $409 (277) $ (9,712) $26,909

Cumulative Effect of Adjustments Resulting from

the Adoption of SAB 108, net of tax — — 201 (257) — — — (56)

ADJUSTED BALANCE, JANUARY 29, 2006 2,401 $120 $7,350 $28,686 $409 (277) $ (9,712) $26,853

Net Earnings — — — 5,761 — — — 5,761 $5,761

Shares Issued Under Employee Stock Plans 20 1 351 — — — — 352

Tax Effect of Sale of Option Shares by Employees — — 18 — — — — 18

Translation Adjustments — — — — (77) — — (77) (77)

Interest Rate Hedges — — — — (22) — — (22) (22)

Stock Options, Awards and Amortization of

Restricted Stock — — 296 — — — — 296

Repurchase of Common Stock — — — — — (174) (6,671) (6,671)

Cash Dividends ($0.675 per share) — — — (1,395) — — — (1,395)

Other — — (85) — — — — (85)

Comprehensive Income $5,662

BALANCE, JANUARY 28, 2007 2,421 $121 $7,930 $33,052 $310 (451) $(16,383) $25,030

See accompanying Notes to Consolidated Financial Statements.

36