Home Depot 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

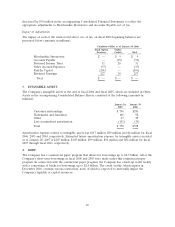

additional stock compensation expense of approximately $40 million as a result of the adoption of

SFAS 123(R). As the majority of stock options granted prior to 2003 are now fully vested, the

Company does not expect SFAS 123(R) to have a material impact on its consolidated financial

condition or results of operations subsequent to fiscal 2006. Results of prior periods have not been

restated.

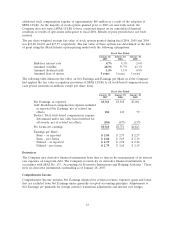

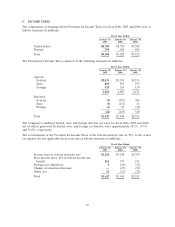

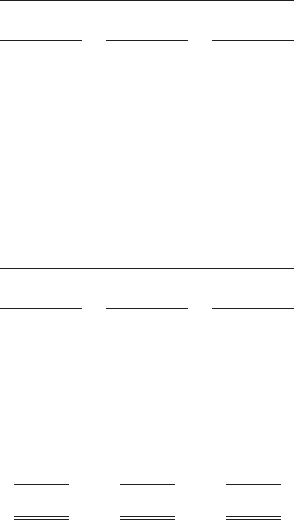

The per share weighted average fair value of stock options granted during fiscal 2006, 2005 and 2004

was $11.88, $12.83 and $13.57, respectively. The fair value of these options was determined at the date

of grant using the Black-Scholes option-pricing model with the following assumptions:

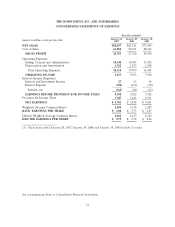

Fiscal Year Ended

January 28, January 29, January 30,

2007 2006 2005

Risk-free interest rate 4.7% 4.3% 2.6%

Assumed volatility 28.5% 33.7% 41.3%

Assumed dividend yield 1.5% 1.1% 0.8%

Assumed lives of option 5 years 5 years 5 years

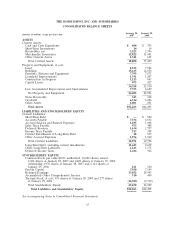

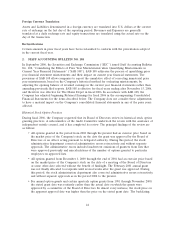

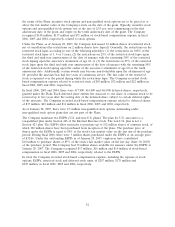

The following table illustrates the effect on Net Earnings and Earnings per Share as if the Company

had applied the fair value recognition provisions of SFAS 123(R) to all stock-based compensation in

each period (amounts in millions, except per share data):

Fiscal Year Ended

January 28, January 29, January 30,

2007 2006 2005

Net Earnings, as reported $5,761 $5,838 $5,001

Add: Stock-based compensation expense included

in reported Net Earnings, net of related tax

effects 186 110 79

Deduct: Total stock-based compensation expense

determined under fair value based method for

all awards, net of related tax effects (186) (197) (237)

Pro forma net earnings $5,761 $5,751 $4,843

Earnings per Share:

Basic – as reported $ 2.80 $ 2.73 $ 2.27

Basic – pro forma $ 2.80 $ 2.69 $ 2.19

Diluted – as reported $ 2.79 $ 2.72 $ 2.26

Diluted – pro forma $ 2.79 $ 2.68 $ 2.19

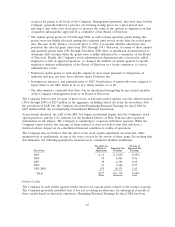

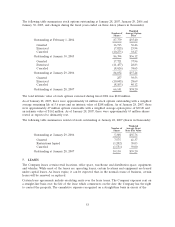

Derivatives

The Company uses derivative financial instruments from time to time in the management of its interest

rate exposure on long-term debt. The Company accounts for its derivative financial instruments in

accordance with SFAS No. 133, ‘‘Accounting for Derivative Instruments and Hedging Activities.’’ There

were no derivative instruments outstanding as of January 28, 2007.

Comprehensive Income

Comprehensive Income includes Net Earnings adjusted for certain revenues, expenses, gains and losses

that are excluded from Net Earnings under generally accepted accounting principles. Adjustments to

Net Earnings are primarily for foreign currency translation adjustments and interest rate hedges.

43