Home Depot 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

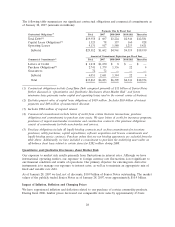

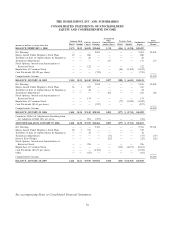

The following table summarizes our significant contractual obligations and commercial commitments as

of January 28, 2007 (amounts in millions):

Payments Due by Fiscal Year

Contractual Obligations(1) Total 2007 2008-2009 2010-2011 Thereafter

Total Debt(2) $19,358 $ 607 $3,224 $2,946 $12,581

Capital Lease Obligations(3) 1,323 78 157 160 928

Operating Leases 9,131 917 1,580 1,213 5,421

Subtotal $29,812 $1,602 $4,961 $4,319 $18,930

Amount of Commitment Expiration per Fiscal Year

Commercial Commitments(4) Total 2007 2008-2009 2010-2011 Thereafter

Letters of Credit $ 1,238 $1,230 $ 8 $ — $ —

Purchase Obligations(5) 2,741 1,379 1,336 22 4

Guarantees 72 72 — — —

Subtotal 4,051 2,681 1,344 22 4

Total $33,863 $4,283 $6,305 $4,341 $18,934

(1) Contractual obligations include Long-Term Debt comprised primarily of $11 billion of Senior Notes

further discussed in ‘‘Quantitative and Qualitative Disclosures about Market Risk’’ and future

minimum lease payments under capital and operating leases used in the normal course of business.

(2) Excludes present value of capital lease obligations of $419 million. Includes $8.0 billion of interest

payments and $69 million of unamortized discount.

(3) Includes $904 million of imputed interest.

(4) Commercial commitments include letters of credit from certain business transactions, purchase

obligations and commitments to purchase store assets. We issue letters of credit for insurance programs,

purchases of import merchandise inventories and construction contracts. Our purchase obligations

consist of commitments for both merchandise and services.

(5) Purchase obligations include all legally binding contracts such as firm commitments for inventory

purchases, utility purchases, capital expenditures, software acquisition and license commitments and

legally binding service contracts. Purchase orders that are not binding agreements are excluded from the

table above. Additionally, we have included a commitment to purchase the underlying asset under an

off-balance sheet lease related to certain stores for $282 million during 2008.

Quantitative and Qualitative Disclosures about Market Risk

Our exposure to market risk results primarily from fluctuations in interest rates. Although we have

international operating entities, our exposure to foreign currency rate fluctuations is not significant to

our financial condition and results of operations. Our primary objective for entering into derivative

instruments is to manage our exposure to interest rates, as well as to maintain an appropriate mix of

fixed and variable rate debt.

As of January 28, 2007 we had, net of discounts, $10.9 billion of Senior Notes outstanding. The market

values of the publicly traded Senior Notes as of January 28, 2007, were approximately $10.9 billion.

Impact of Inflation, Deflation and Changing Prices

We have experienced inflation and deflation related to our purchase of certain commodity products.

During fiscal 2006, lumber prices decreased our comparable store sales by approximately 43 basis

28