Home Depot 2006 Annual Report Download - page 61

Download and view the complete annual report

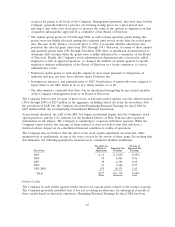

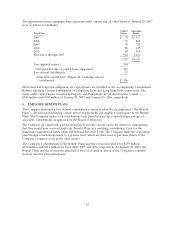

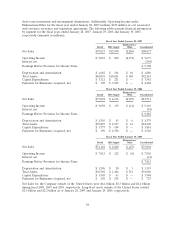

Please find page 61 of the 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At January 28, 2007, the Company had state and foreign net operating loss carry-forwards to reduce

future taxable income, which will expire at various dates from 2010 to 2026. Management has

concluded that it is more likely than not that these tax benefits related to the net operating losses will

be realized and hence no valuation allowance has been provided. The Company has not provided for

U.S. deferred income taxes on $1.2 billion of undistributed earnings of international subsidiaries

because of its intention to indefinitely reinvest these earnings outside the U.S. The determination of

the amount of the unrecognized deferred U.S. income tax liability related to the undistributed earnings

is not practicable; however, unrecognized foreign income tax credits would be available to reduce a

portion of this liability.

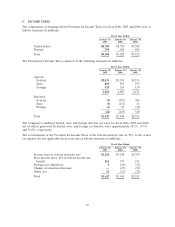

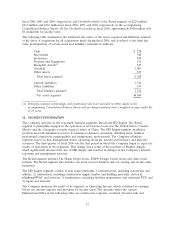

The Company’s income tax returns are routinely under audit by domestic and foreign tax authorities.

These audits include questions regarding its tax filing positions, including the timing and amount of

deductions and the allocation of income among various tax jurisdictions. In 2005, the IRS completed its

examination of the Company’s U.S. federal income tax returns through fiscal 2002. Certain issues

relating to the examinations of fiscal 2001 and 2002 are under appeal, the outcome of which is not

expected to have a material impact on the Company’s financial statements. During 2006, the IRS

initiated an audit of the Company’s fiscal 2003 and 2004 income tax returns. This audit will likely not

be completely settled until after fiscal 2007. At this time, the Company does not expect the results of

the audit to have a material impact on the Company’s financial statements.

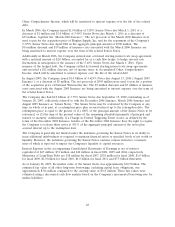

During the second quarter of fiscal 2006, the Quebec National Assembly passed legislation that

retroactively changed certain tax laws that subjected the Company to additional tax and interest. As a

result, the Company received an assessment from Quebec for $57 million in retroactive tax and

$12 million in related interest for the 2002 through 2005 taxable years. This retroactive tax is included

in the Company’s current year foreign tax expense.

In July 2006, the Financial Accounting Standards Board (‘‘FASB’’) issued FASB Interpretation No. 48,

‘‘Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109’’ (‘‘FIN

48’’). FIN 48 clarifies the accounting for uncertainty in income tax reporting by prescribing a

recognition threshold and measurement attribute for the financial statement recognition and

measurement of a tax position taken or expected to be taken in a tax return. FIN 48 requires that

companies recognize tax benefits in their financial statements for a tax position only if that position is

more likely than not of being sustained on audit, based on the technical merits of the position.

Additionally, FIN 48 provides guidance on de-recognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. FIN 48 becomes effective for fiscal years

beginning after December 15, 2006, and will therefore be effective for The Home Depot in fiscal 2007.

The cumulative impact of adopting FIN 48 in fiscal 2007 is not expected to have a material impact on

the financial condition of the Company.

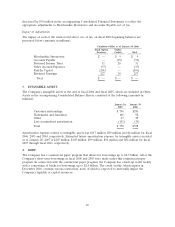

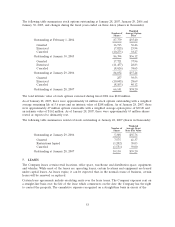

6. EMPLOYEE STOCK PLANS

The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan (‘‘2005 Plan’’) and The Home Depot, Inc.

1997 Omnibus Stock Incentive Plan (‘‘1997 Plan’’) (collectively the ‘‘Plans’’) provide that incentive,

non-qualified stock options, stock appreciation rights, restricted shares, performance shares,

performance units and deferred shares may be issued to selected associates, officers and directors of

the Company. Under the 2005 Plan, the maximum number of shares of the Company’s common stock

authorized for issuance is 255 million shares, with any award other than a stock option reducing the

number of shares available for issuance by 2.11 shares. As of January 28, 2007, there were 236 million

shares available for future grant under the 2005 Plan. No additional equity awards may be issued from

the 1997 Plan after the adoption of the 2005 Plan on May 26, 2005.

Under the Plans, as of January 28, 2007, the Company had granted incentive and non-qualified stock

options for 184 million shares, net of cancellations (of which 120 million have been exercised). Under

51