Home Depot 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

Table of contents

-

Page 1

-

Page 2

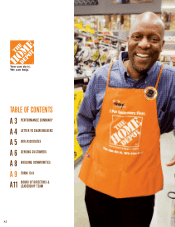

TABLE OF CONTENTS A 3 PERFORMANCE SUMMARY A 4 LETTER TO SHAREHOLDERS A 5 OUR ASSOCIATES A 6 SERVING CUSTOMERS A 8 BUILDING COMMUNITIES A 9 FORM 10-K OF DIRECTORS & LEADERSHIP TEAM A11 BOARD

A2

-

Page 3

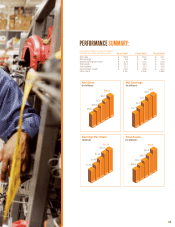

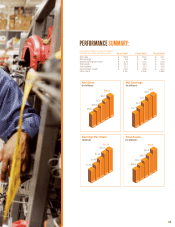

PERFORMANCE SUMMARY:

(amounts in billions, except for diluted earnings per share and store count) Net sales Net earnings Diluted earnings per share Total assets Total liabilities Stockholders' equity Store count Fiscal 2006 90.8 5.8 2.79 52.3 27.2 25.0 2,147 Fiscal 2005 81.5 5.8 2.72 44.4 17.5 26...

-

Page 4

...that culture:

Associate engagement: Deliver differentiated

customer service and the know-how our customers have come to expect from The Home Depot.

Product excitement: Drive value, price leadership

and innovation through merchandising.

Product availability: Improve in-stock positions so customers...

-

Page 5

... they are our most important asset. We offer our associates extensive training programs, Success Sharing and Orange Juiced rewards and bonuses, as well as industry-leading benefits for full- and parttime associates. Taking care of our people is one of our core values - it's part of our culture.

A5

-

Page 6

...

ever since we Opened Our first stOre, Our fOcus has been On prOviding Our custOmers with Outstanding custOmer service, as well as cOnvenience, value, quality, and prOduct and prOject knOw-hOw.

In 2006, we continued to improve our customer shopping experience by upgrading the appearance of many...

-

Page 7

... of quality name brand merchandise at a great price, and they need knowledgeable associates to help them select everything they need to complete their project. We create value for our DIY customers by helping them achieve their home improvement dreams.

Visit us online at www.homedepot.com

A7

-

Page 8

... tO make a difference.

When disaster strikes a community, The Home Depot and its associates are the first to step forward with response and recovery efforts. In 2006, we were the lead contributor of Hands On Network's Corporate Month of Service. Working with our partners, such as KaBOOM! and the...

-

Page 9

... (Address of Principal Executive Offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (770) 433-8211 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

TITLE

OF

EACH CLASS

NAME OF EACH EXCHANGE ON WHICH REGISTERED

Common Stock, $0.05 Par Value Per Share

New York Stock...

-

Page 10

...PART III Item 10. Item 11. Item 12. Item 13. Item 14. PART IV Item 15. Exhibits, Financial Statement Schedules Signatures 62 68 Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters...

-

Page 11

...fiscal 2006, we were operating 2,147 stores, most of which are The Home Depot stores. The Home Depot stores sell a wide assortment of building materials, home improvement and lawn and garden products and provide a number of services. The Home Depot stores average approximately 105,000 square feet of...

-

Page 12

...undertaken, its terms or timing. The Home Depot, Inc. is a Delaware corporation that was incorporated in 1978. Our Store Support Center (corporate office) is located at 2455 Paces Ferry Road, N.W., Atlanta, Georgia 30339. Our telephone number is (770) 433-8211. We maintain an Internet website at www...

-

Page 13

... located in Milan, Italy and we have product development merchants, as well as a sourcing office, in Monterrey, Mexico. We currently source products from more than 800 factories in approximately 35 countries. Services. The Home Depot and EXPO Design Center stores offer a variety of installation...

-

Page 14

... highly competitive, based in part on price, store location, customer service and depth of merchandise. In each of the markets we serve, there are a number of other home improvement stores, electrical, plumbing and building materials supply houses and lumber yards. With respect to some products, we...

-

Page 15

... covers home improvement products and building materials, serving the consumer, professional handyman and light remodeler markets. Inventories. We maintain extensive inventories to meet the rapid delivery requirements of our customers. Our inventories are based on the needs, delivery schedules and...

-

Page 16

... in store technology, we upgraded our order management system, which improves the speed and accuracy of online order processing and provides customers the ability to check special order status on the internet. We also defined a set of common enterprise system platforms for our HD Supply wholesale...

-

Page 17

... share, stock-based compensation expense, store openings and closures, capital allocation and expenditures, the effect of adopting certain accounting standards, return on invested capital, management of our purchasing or customer credit policies, strategic direction, including whether or not a sale...

-

Page 18

... leases or real estate purchase agreements on acceptable terms, • attract and train qualified employees, and • manage pre-opening expenses, including construction costs. Our ability to open new stores also will be affected by environmental regulations, local zoning issues and other laws related...

-

Page 19

... associates while controlling related labor costs. Our ability to control labor costs is subject to numerous external factors, including prevailing wage rates and health and other insurance costs. In addition, many of our associates are in hourly positions with historically high turnover rates...

-

Page 20

... on price, store location, customer service and depth of merchandise. Our HD Supply business competes principally based on ability to provide and deliver supplies, product knowledge and expertise, advisory services and availability of credit. In each market we serve, there are a number of other home...

-

Page 21

... and the 228 The Home Depot stores and the 63 HD Supply locations outside of the U.S. at the end of fiscal 2006:

U.S. Locations Number of Locations Retail HD Supply U.S. Locations Number of Locations Retail HD Supply

Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District...

-

Page 22

... 2006, we had 47 other retail store locations, which included 34 EXPO Design Center stores located in Arizona, California, Florida, Georgia, Illinois, Maryland, Massachusetts, Missouri, New Jersey, New York, Tennessee, Texas and Virginia; 11 The Home Depot Landscape Supply stores located in Georgia...

-

Page 23

...in Canada to support other HD Supply locations. The HD Supply locations, warehouses and distribution centers utilized approximately 23.7 million square feet, of which approximately 2.8 million is owned and approximately 20.9 million is leased at the end of fiscal 2006. Our executive, corporate staff...

-

Page 24

... actions were filed against the Company, The Home Depot FutureBuilder Administrative Committee and certain of the Company's current and former directors and employees in federal court in Brooklyn, New York alleging breach of fiduciary duty in violation of the Employee Retirement Income Security Act...

-

Page 25

... K-Mart Corporation, a mass merchandising company, from 1999 through May 2002. JOSEPH J. DeANGELO, age 45, has been Executive Vice President and Chief Operating Officer since January 2007. From August 2005 through December 2006, he served as the Company's Executive Vice President - Home Depot Supply...

-

Page 26

...´ e serves as a director of United Parcel Service, Inc. ANNETTE M. VERSCHUREN, age 50, has been President, The Home Depot Canada since March 1996 and President, The Home Depot Asia since September 2006. From February 2003 through October 2005, she also served as President, EXPO Design Center.

16

-

Page 27

... 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. Since April 19, 1984, our common stock has been listed on the New York Stock Exchange, trading under the symbol ''HD.'' The Company paid its first cash dividend on June 22, 1987, and has...

-

Page 28

...4, 2002, the first trading day of Fiscal 2002, and ending on January 26, 2007, the last trading day of Fiscal 2006. The graph assumes $100 invested at the closing price of the Company's common stock on the New York Stock Exchange and each index on February 1, 2002 and assumes that all dividends were...

-

Page 29

... share repurchase programs. For the quarter ended January 28, 2007, the following shares of The Home Depot common stock were surrendered by participants in the Plans and included in the total number of shares purchased: Oct. 30, 2006 - Nov. 26, 2006 - 36,621 shares at an average price per share...

-

Page 30

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Executive Summary and Selected Consolidated Statements of Earnings Data For fiscal year ended January 28, 2007 (''fiscal 2006''), we reported Net Earnings of $5.8 billion and Diluted Earnings per Share of ...

-

Page 31

... TAXES Provision for Income Taxes NET EARNINGS SELECTED SALES DATA(2) Number of Retail Customer Transactions (millions) Average Ticket Weighted Average Weekly Sales per Operating Store (000s) Weighted Average Sales per Square Foot Retail Comparable Store Sales (Decrease) Increase (%)(3)

100.0% 32...

-

Page 32

... the operation of retail stores located in the United States, Canada, Mexico and our recently acquired stores in China. The HD Supply segment distributes products and sells installation services to business-to-business customers, including home builders, professional contractors, municipalities and...

-

Page 33

... of our private label credit sales was 28.0% compared to 25.6% for fiscal 2005. Also impacting our SG&A in fiscal 2006 is expense associated with executive severance of $129 million and the adoption of Statement of Financial Accounting Standards (''SFAS'') No. 123(R), ''Share-Based Payment'' (''SFAS...

-

Page 34

...from new stores opened during fiscal 2005 and fiscal 2004 and sales from our newly acquired businesses within HD Supply. The increase in retail comparable store sales in fiscal 2005 reflects a number of factors. Our average ticket, which increased 5.6% to $57.98, increased in all selling departments...

-

Page 35

... on cost take-out initiatives and driving productivity gains throughout the Company. We also continue to see benefits from our private label credit card, which carries a lower discount rate than other forms of credit, like bank cards. In fiscal 2005, we recorded $52 million of income related to gift...

-

Page 36

..., including our stores, distribution centers, HD Supply locations and store support centers. The net present value of capital lease obligations is reflected in our Consolidated Balance Sheets in Long-Term Debt. In accordance with generally accepted accounting principles, the operating leases are not...

-

Page 37

...the agreement, the financial institution purchased an equivalent number of shares of our common stock in the open market. The shares repurchased by us were subject to a future purchase price adjustment based upon the weighted average price of our common stock over an agreed period. In March 2007, we...

-

Page 38

... traded Senior Notes as of January 28, 2007, were approximately $10.9 billion. Impact of Inflation, Deflation and Changing Prices We have experienced inflation and deflation related to our purchase of certain commodity products. During fiscal 2006, lumber prices decreased our comparable store sales...

-

Page 39

... valued under the cost method was not material to the Consolidated Financial Statements of the Company as of the end of fiscal 2006 and fiscal 2005. Independent physical inventory counts or cycle counts are taken on a regular basis in each store, distribution center and HD Supply location to ensure...

-

Page 40

... of specific, incremental and identifiable costs incurred to promote vendors' products are recorded as an offset against advertising expense. Recent Accounting Pronouncements In September 2006, the Securities and Exchange Commission (''SEC'') issued Staff Accounting Bulletin No. 108, ''Considering...

-

Page 41

... of the management of The Home Depot, Inc. These financial statements have been prepared in conformity with U.S. generally accepted accounting principles and properly reflect certain estimates and judgments based upon the best available information. The financial statements of the Company have been...

-

Page 42

... of the Public Company Accounting Oversight Board (United States), the Consolidated Balance Sheets of The Home Depot, Inc. and subsidiaries as of January 28, 2007 and January 29, 2006, and the related Consolidated Statements of Earnings, Stockholders' Equity and Comprehensive Income, and Cash Flows...

-

Page 43

... Public Accounting Firm The Board of Directors and Stockholders The Home Depot, Inc.: We have audited the accompanying Consolidated Balance Sheets of The Home Depot, Inc. and subsidiaries as of January 28, 2007 and January 29, 2006, and the related Consolidated Statements of Earnings, Stockholders...

-

Page 44

THE HOME DEPOT, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS

Fiscal Year Ended(1) January 28, January 29, January 30, 2007 2006 2005

amounts in millions, except per share data

NET SALES Cost of Sales GROSS PROFIT Operating Expenses: Selling, General and Administrative Depreciation and...

-

Page 45

THE HOME DEPOT, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

amounts in millions, except per share data January 28, 2007 January 29, 2006

ASSETS Current Assets: Cash and Cash Equivalents Short-Term Investments Receivables, net Merchandise Inventories Other Current Assets Total Current Assets ...

-

Page 46

...Amount

Total Stockholders' Comprehensive Equity Income

BALANCE, FEBRUARY 1, 2004 Net Earnings Shares Issued Under Employee Stock Plans Tax Effect of Sale of Option Shares by Employees Translation Adjustments Stock Options, Awards and Amortization of Restricted Stock Repurchase of Common Stock Cash...

-

Page 47

... 2007 2006 2005

amounts in millions

CASH FLOWS FROM OPERATING ACTIVITIES: Net Earnings Reconciliation of Net Earnings to Net Cash Provided by Operating Activities: Depreciation and Amortization Impairment Related to Disposition of EXPO Real Estate Stock-Based Compensation Expense Changes in Assets...

-

Page 48

... Depot stores, which are full-service, warehouse-style stores averaging approximately 105,000 square feet in size. The stores stock approximately 35,000 to 45,000 different kinds of building materials, home improvement supplies and lawn and garden products that are sold to do-it-yourself customers...

-

Page 49

... in these securities, they have been classified as current assets in the accompanying Consolidated Balance Sheets. Accounts Receivable The Company has an agreement with a third-party service provider who directly extends credit to customers and manages the Company's private label credit card program...

-

Page 50

...

Buildings Furniture, Fixtures and Equipment Leasehold Improvements Capitalized Software Costs

10-45 years 3-20 years 5-45 years

The Company capitalizes certain costs related to the acquisition and development of software and amortizes these costs using the straight-line method over the estimated...

-

Page 51

... Selling, General and Administrative Expenses (''SG&A''). Services Revenue Net Sales include services revenue generated through a variety of installation, home maintenance and professional service programs. In these programs, the customer selects and purchases material for a project and the Company...

-

Page 52

... interest programs offered through the Company's private label credit card program. The cost of handling and shipping merchandise from the Company's stores, locations or distribution centers to the customer is classified as SG&A. The cost of shipping and handling, including internal costs and...

-

Page 53

... in millions, except per share data):

January 28, 2007 Fiscal Year Ended January 29, January 30, 2006 2005

Net Earnings, as reported Add: Stock-based compensation expense included in reported Net Earnings, net of related tax effects Deduct: Total stock-based compensation expense determined under...

-

Page 54

... the items described below. The Company does not consider these adjustments to have a material impact on the Company's consolidated financial statements in any of the prior years affected. Historical Stock Option Practices During fiscal 2006, the Company requested that its Board of Directors review...

-

Page 55

... have since left the Company, generally followed a practice of reviewing closing prices for a prior period and selecting a date with a low stock price to increase the value of the options to employees on lists of grantees subsequently approved by a committee of the Board of Directors. • The annual...

-

Page 56

... The impact of each of the items noted above, net of tax, on fiscal 2006 beginning balances are presented below (amounts in millions):

Cumulative Effect as of January 30, 2006 Stock Option Vendor Practices Credits Total

Merchandise Inventories Accounts Payable Deferred Income Taxes Other Accrued...

-

Page 57

... costs associated with the December 2006 Issuance are being amortized to interest expense over the term of the related Senior Notes. Additionally in October 2006, the Company entered into a forward starting interest rate swap agreement with a notional amount of $1.0 billion, accounted for as a cash...

-

Page 58

... costs associated with the March 2006 Issuance are being amortized to interest expense over the term of the related Senior Notes. Additionally in March 2006, the Company entered into a forward starting interest rate swap agreement with a notional amount of $2.0 billion, accounted for as a cash...

-

Page 59

... follows (amounts in millions):

January 28, 2007 Fiscal Year Ended January 29, January 30, 2006 2005

Income taxes at federal statutory rate State income taxes, net of federal income tax benefit Foreign rate differences Change in valuation allowance Other, net Total

$3,258 261 5 - 23 $3,547

$3,249...

-

Page 60

...28, 2007 January 29, 2006

Other Current Assets Other Assets Other Accrued Expenses Deferred Income Taxes Net Deferred Tax Liabilities

$

561 7 (30) (1,416)

$ 221 29 (60) (946) $(756)

$ (878)

The Company believes that the realization of the deferred tax assets is more likely than not, based upon...

-

Page 61

... FIN 48 in fiscal 2007 is not expected to have a material impact on the financial condition of the Company. 6. EMPLOYEE STOCK PLANS

The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan (''2005 Plan'') and The Home Depot, Inc. 1997 Omnibus Stock Incentive Plan (''1997 Plan'') (collectively the...

-

Page 62

... million, $117 million and $71 million of stock-based compensation expense in fiscal 2006, 2005 and 2004, respectively, related to stock options. Under the Plans, as of January 28, 2007, the Company had issued 12 million shares of restricted stock, net of cancellations (the restrictions on 2 million...

-

Page 63

... of Shares Weighted Average Grant Date Fair Value

Outstanding at January 29, 2006 Granted Restrictions lapsed Canceled Outstanding at January 28, 2007 7. LEASES

5,308 7,575 (1,202) (1,551) 10,130

$35.76 41.37 38.03 39.00 $39.20

The Company leases certain retail locations, office space, warehouse...

-

Page 64

... under a structured financing arrangement and involves two special purpose entities. The Company financed a portion of its new stores opened in fiscal years 1997 through 2003 under this lease agreement. Under this agreement, the lessor purchased the properties, paid for the construction costs and...

-

Page 65

... in Current Installments of Long-Term Debt and Long-Term Debt, respectively. The assets under capital leases recorded in Property and Equipment, net of amortization, totaled $340 million and $304 million at January 28, 2007 and January 29, 2006, respectively. 8. EMPLOYEE BENEFIT PLANS

The Company...

-

Page 66

... dilutive securities: Stock Plans Diluted weighted average common shares

2,054 8 2,062

2,138 9 2,147

2,207 9 2,216

Stock plans include shares granted under the Company's employee stock plans as described in Note 6 to the Consolidated Financial Statements. Options to purchase 45.4 million...

-

Page 67

... of retail stores located in the United States, Canada, Mexico and the Company's recently acquired stores in China. The HD Supply segment distributes products and sells installation services to business-to-business customers, including home builders, professional contractors, municipalities and...

-

Page 68

... the fiscal year ended January 28, 2007 includes $129 million of cost associated with executive severance and separation agreements. The following tables present financial information by segment for the fiscal years ended January 28, 2007, January 29, 2006 and January 30, 2005, respectively (amounts...

-

Page 69

... The following is a summary of the quarterly consolidated results of operations for the fiscal years ended January 28, 2007 and January 29, 2006 (dollars in millions, except per share data):

Basic Earnings per Share Diluted Earnings per Share

Net Sales

Gross Profit

Net Earnings

Fiscal Year Ended...

-

Page 70

...likely to materially affect, the Company's internal control over financial reporting. Management's Report on Internal Control over Financial Reporting The information required by this item is incorporated by reference to Item 8. ''Financial Statements and Supplementary Data'' of this report. Item 9B...

-

Page 71

...''Compensation Discussion & Analysis,'' ''Leadership Development and Compensation Committee'' and ''Director Compensation'' in the Company's Proxy Statement. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. The information required by this item...

-

Page 72

... on January 8, 2007, Exhibit 3.1] Indenture dated as of September 16, 2004 between The Home Depot, Inc. and The Bank of New York. [Form 8-K filed September 17, 2004, Exhibit 4.1] Indenture, dated as of May 4, 2005, between The Home Depot, Inc. and The Bank of New York Trust Company, N.A., as Trustee...

-

Page 73

...of Deferred Share Award (Non-Employee Director) Pursuant to The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan. [Form 8-K filed on March 27, 2007, Exhibit 10.2] Form of Deferred Share Award (U.S. Officers) Pursuant to The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan. [Form 8-K filed on May...

-

Page 74

... of Nonqualified Stock Option (Non-Employee Directors) Pursuant to The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan. [Form 8-K filed on March 27, 2007, Exhibit 10.5] Form of Nonqualified Stock Option Pursuant to The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan. [Form 8-K filed on March...

-

Page 75

... Incentive Plan Fiscal Year 2007 Performance Measures. [Form 8-K filed on March 27, 2007, Exhibit 10.11] The Home Depot, Inc. Non-Employee Directors' Deferred Stock Compensation Plan. [Form 10-K for the fiscal year ended February 2, 2003, Exhibit 10.37] Separation Agreement Between the Company...

-

Page 76

... Corporation as Agent Bank. [Form 10-K for the fiscal year ended January 31, 1999, Exhibit 10.13] Statement of Computation of Ratio of Earnings to Fixed Charges. List of Subsidiaries of the Company. Consent of Independent Registered Public Accounting Firm. Certification of Chief Executive Officer...

-

Page 77

(This page has been left blank intentionally.)

67

-

Page 78

...Executive Vice President - Corporate Services (Principal Financial Officer and Principal Accounting Officer) Director Director Director Director Director Director Director Director Director Director Director

March 23, 2007

March 23, 2007

March 23, 2007 March 23, 2007 March 23, 2007 March 23, 2007...

-

Page 79

(This page has been left blank intentionally.)

-

Page 80

...605 Long-term debt 25.0 11,643 Stockholders' equity 15.4 25,030 Book value per share ($) 16.5 12.71 Long-term debt-to-equity (%) - 46.5 Total debt-to-equity (%) - 46.6 Current ratio - 1.39:1 Inventory turnover - 4.7x Return on invested capital (%) - 20.5 STATEMENT OF CASH FLOWS DATA Depreciation and...

-

Page 81

... following their 365th day of operation. Comparable store sales is intended only as supplemental information and is not a substitute for Net Sales or Net Earnings presented in accordance with generally accepted accounting principles. (6) Comparable store sales in fiscal years prior to 2002 were...

-

Page 82

Corporate and Shareholder Information

STORE SUPPORT CENTER

The Home Depot, Inc. 2455 Paces Ferry Road, NW Atlanta, GA 30339-4024 Telephone: (770) 433-8211

THE HOME DEPOT WEB SITE

To obtain enrollment materials, including the prospectus, access The Home Depot web site, or call (877) HD-SHARE or (...

-

Page 83

... Mexico

Brad Shaw Senior Vice President Corporate Communications & External Affairs

James C. Snyder Vice President Secretary & Acting General Counsel

Carol B. Tomé Chief Financial Officer & Executive Vice President Corporate Services

Annette M. Verschuren President The Home Depot Canada...

-

Page 84

The Home Depot, Inc. 2455 Paces Ferry Road, N.W. Atlanta, GA 30339-4024 USA 770.433.8211 www.homedepot.com