Home Depot 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

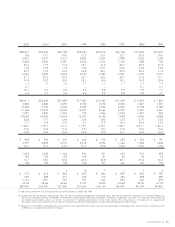

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

38

8|COMMITMENTS AND CONTINGENCIES

At January 30, 2005, the Company was contingently liable for

approximately $1.2 billion under outstanding letters of credit issued

for certain business transactions, including insurance programs,

trade and construction contracts. The Company’s letters of credit are

primarily performance-based and are not based on changes in vari-

able components, a liability or an equity security of the other party.

The Company is involved in litigation arising from the normal

course of business. In management’s opinion, this litigation is not

expected to materially impact the Company’s consolidated results

of operations or financial condition.

9|ACQUISITIONS

The following acquisitions completed by the Company were all

accounted for under the purchase method of accounting. Pro forma

results of operations for fiscal 2004, 2003 and 2002 would not be

materially different as a result of these acquisitions and therefore

are not presented.

In June 2004, the Company acquired all of the common stock of

Home Mart Mexico, S.A. de C.V. (“Home Mart”), the second

largest home improvement retailer in Mexico. The purchase of 20

Home Mart stores increased the total numbers of stores in Mexico

to 44 as of the end of fiscal 2004. This acquisition was part of the

Company’s strategy to expand into new markets.

In May 2004, the Company acquired all of the common stock

of White Cap Industries, Inc. (“White Cap”), a leading distributor of

specialty hardware, tools and materials to construction contractors.

Since the Company’s acquisition of White Cap, White Cap has

completed three small additional acquisitions. These acquisitions

were part of the Company’s strategy to expand the Company’s

professional customer base with value-added products and services.

In January 2004, the Company acquired substantially all of the

assets of Creative Touch Interiors, a flooring installation company

primarily servicing the production homebuilder industry.

In December 2003, the Company acquired all of the common

stock of Economy Maintenance Supply Company (“EMS”) and all

of the common stock of RMA Home Services, Inc. (“RMA”). EMS is

a wholesale supplier of maintenance, repair and operating prod-

ucts. RMA is a replacement windows and siding installed services

business. In October 2003, the Company acquired substantially all

of the assets of Installed Products U.S.A., a roofing and fencing

installed services business.

In October 2002, the Company acquired substantially all of the

assets of FloorWorks, Inc. and Arvada Hardwood Floor Company

and all of the common stock of Floors, Inc., three flooring installa-

tion companies primarily servicing the production homebuilder

industry. In June 2002, the Company acquired the assets of

Maderería Del Norte, S.A. de C.V., a four-store chain of home

improvement stores in Juarez, Mexico.

The total aggregate purchase price for acquisitions in fiscal 2004,

2003 and 2002 was $729 million, $248 million and $202 million,

respectively. Accordingly, the Company recorded Cost in Excess of

the Fair Value of Net Assets Acquired related to the acquisitions

of $554 million, $231 million and $109 million for fiscal 2004,

2003 and 2002, respectively, in the accompanying Consolidated

Balance Sheets.