Home Depot 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

20

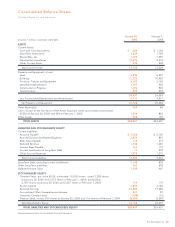

LIQUIDITY AND CAPITAL RESOURCES

Cash flow generated from operations provides us with a significant

source of liquidity. For fiscal 2004, Net Cash Provided by

Operating Activities increased to $6.9 billion from $6.5 billion

for fiscal 2003. This increase was primarily driven by stronger

Net Earnings and an increase in non-cash charges, such as depre-

ciation and amortization.

Net Cash Used in Investing Activities increased to $4.5 billion for

fiscal 2004 from $4.2 billion for fiscal 2003. This increase was

primarily the result of $727 million used to purchase White Cap

and Home Mart. In May 2004, we acquired all of the common

stock of White Cap, a leading distributor of specialty hardware,

tools and materials to construction contractors, and in June 2004,

we acquired all of the common stock of Home Mart, the second

largest home improvement retailer in Mexico. Capital Expenditures

increased to $3.9 billion for fiscal 2004 from $3.5 billion for fiscal

2003. This increase was due to a higher investment in store

modernization, technology and other initiatives. The increase in Net

Cash Used in Investing Activities also reflects lower proceeds from

the sale of property and equipment. In December 2003, we

exercised an option to purchase certain assets under a lease agree-

ment at an original cost of $598 million. There was no similar

transaction in fiscal 2004. As of January 30, 2005, we own 86% of

our stores. We believe our real estate ownership strategy is a

competitive advantage.

We plan to open 175 stores in fiscal 2005, including 19 stores in

Canada and 10 in Mexico, and estimate total Capital Expenditures

to be approximately $3.7 billion, allocated as follows: 64% for new

stores, 13% for store modernization, 12% for technology and 11%

for other initiatives.

Net Cash Used in Financing Activities for fiscal 2004 was $3.1 billion

compared with $1.9 billion for fiscal 2003. During fiscal 2004, 2003

and 2002, the Board of Directors authorized total repurchases of our

common stock of $7.0 billion pursuant to a Share Repurchase

Program. Over the past three fiscal years, we have repurchased

200.5 million shares of our common stock for a total of $6.7 billion.

During fiscal 2004, we repurchased approximately 84 million shares

of our common stock for $3.1 billion and during fiscal 2003 we

repurchased 47 million shares of our common stock for $1.6 billion.

As of January 30, 2005, approximately $300 million remained

under our previously authorized Share Repurchase Program. In

February 2005, our Board of Directors authorized an additional

$2.0 billion in our Share Repurchase Program, bringing the total

remaining authorization to $2.3 billion.

In September 2004, we issued $1.0 billion of 33⁄4% Senior Notes

(see Note 2 in “Notes to Consolidated Financial Statements”) at a

discount of $5 million. The net proceeds of $995 million were used

in part to repay our $500 million 61⁄2% Senior Notes with the

remainder used for general corporate purposes. During fiscal

2004, we also increased dividends paid by 21% to $719 million

from $595 million in fiscal 2003.

In the second quarter of fiscal 2004, we increased the maximum

capacity for borrowing under our commercial paper program to

$1.25 billion as well as increased the related back-up credit facility

with a consortium of banks to $1.0 billion. As of January 30, 2005,

there were no borrowings outstanding under the program. The

credit facility, which expires in May 2009, contains various restric-

tive covenants, none of which are expected to impact our liquidity

or capital resources.

We use capital and operating leases to finance a portion of our

real estate, including our stores, distribution centers and store

support centers. The net present value of capital lease obligations

is reflected in our Consolidated Balance Sheets in Long-Term Debt.

In accordance with generally accepted accounting principles, the

operating leases are not reflected in our Consolidated Balance

Sheets. As of the end of fiscal 2004, our total debt-to-equity ratio

was 8.9% compared to 6.1% at the end of fiscal 2003. This

increase was due in part to the net increase in Senior Notes of

$495 million. The increase in our total debt-to-equity ratio also

reflects the consolidation of a variable interest entity in accordance

with the revised version of Financial Accounting Standards Board

(“FASB”) Interpretation No. 46, “Consolidation of Variable Interest

Entities,” which increased Long-Term Debt by $282 million during

the first quarter of fiscal 2004 but had no economic impact on our

financial condition (see Note 5 in “Notes to Consolidated

Financial Statements”). If the estimated net present value of future

payments under the operating leases were capitalized, our total

debt-to-equity ratio would increase to 30.8%.

As of January 30, 2005, we had $2.2 billion in Cash and Short-

Term Investments. We believe that our current cash position and

cash flow generated from operations should be sufficient to enable

us to complete our capital expenditure programs and any required

long-term debt payments through the next several fiscal years. In

addition, we have funds available from the $1.25 billion commer-

cial paper program and the ability to obtain alternative sources of

financing if required.