Home Depot 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

33The Home Depot, Inc.

The $5.0 million discount associated with the issuance is being

amortized over the term of the 33⁄4% Senior Notes using the effec-

tive interest rate method. Issuance costs of $6.6 million are being

amortized over the term of the 33⁄4% Senior Notes using the straight-

line method. The Company also had $500 million of unsecured

53⁄8% Senior Notes outstanding as of January 30, 2005, collectively

referred to as “Senior Notes.”

The Senior Notes may be redeemed by the Company at any time,

in whole or in part, at a redemption price plus accrued interest up

to the redemption date. The redemption price is equal to the

greater of (1) 100% of the principal amount of the Senior Notes

to be redeemed, or (2) the sum of the present values of the remain-

ing scheduled payments of principal and interest to maturity.

The Company is generally not limited under these indentures in its

ability to incur additional indebtedness nor required to maintain

financial ratios or specified levels of net worth or liquidity. However,

the indentures governing the Senior Notes contain various restric-

tive covenants, none of which are expected to impact the

Company’s liquidity or capital resources. The Senior Notes are not

subject to sinking fund requirements.

Interest Expense in the accompanying Consolidated Statements of

Earnings is net of interest capitalized of $40 million, $50 million and

$59 million in fiscal 2004, 2003 and 2002, respectively. Maturities

of Long-Term Debt are $11 million for fiscal 2005, $517 million for

fiscal 2006, $12 million for fiscal 2007, $296 million for fiscal

2008, $1.015 billion for fiscal 2009 and $313 million thereafter.

As of January 30, 2005, the market values of the publicly traded

33⁄4% Senior Notes and 53⁄8% Senior Notes were approximately

$989 million and $515 million, respectively. The estimated fair

value of all other long-term borrowings, excluding capital lease

obligations, was approximately $316 million compared to the

carrying value of $313 million. These fair values were estimated

using a discounted cash flow analysis based on the Company’s

incremental borrowing rate for similar liabilities.

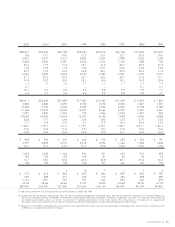

3|INCOME TAXES

The components of Earnings before Provision for Income Taxes for

fiscal 2004, 2003 and 2002 are as follows (amounts in millions):

Fiscal Year Ended

January 30, February 1, February 2,

2005 2004 2003

United States $7,508 $6,440 $5,571

Foreign 404 403 301

Total $7,912 $6,843 $5,872

The Provision for Income Taxes consisted of the following

(amounts in millions):

Fiscal Year Ended

January 30, February 1, February 2,

2005 2004 2003

Current:

Federal $2,153 $1,520 $1,679

State 279 307 239

Foreign 139 107 117

2,571 1,934 2,035

Deferred:

Federal 304 573 174

State 52 27 1

Foreign (16) 5 (2)

340 605 173

Total $2,911 $2,539 $2,208

The Company’s combined federal, state and foreign effective tax

rates for fiscal 2004, 2003 and 2002, net of offsets generated by

federal, state and foreign tax benefits, were approximately 36.8%,

37.1% and 37.6%, respectively.

The reconciliation of the Provision for Income Taxes at the federal

statutory rate of 35% to the actual tax expense for the applicable

fiscal years is as follows (amounts in millions):

Fiscal Year Ended

January 30, February 1, February 2,

2005 2004 2003

Income taxes at

federal statutory rate $2,769 $2,395 $2,055

State income taxes,

net of federal

income tax benefit 215 217 156

Foreign rate differences (17) (29) (1)

Change in valuation allowance (31) ––

Other, net (25) (44) (2)

Total $2,911 $2,539 $2,208