Home Depot 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

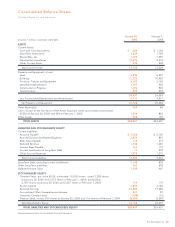

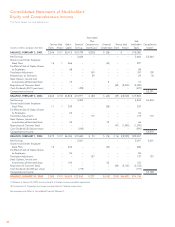

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

16

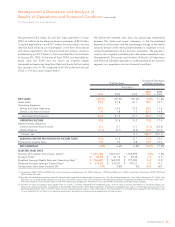

RESULTS OF OPERATIONS

For an understanding of the significant factors that influenced our

performance during the past three fiscal years, the following discus-

sion should be read in conjunction with the Consolidated

Financial Statements and the Notes to Consolidated Financial

Statements presented in this Annual Report.

Fiscal 2004 Compared to Fiscal 2003

Net Sales

Net Sales for fiscal 2004 increased 12.8% to $73.1 billion from

$64.8 billion for fiscal 2003. Fiscal 2004 Net Sales growth was

driven by an increase in comparable store sales of 5.4%, sales

from the 183 net new stores opened during fiscal 2004, sales from

the 175 net new stores opened during fiscal 2003 and sales

from our newly acquired businesses. We plan to open 175 new stores

during the fiscal year ending January 29, 2006, (“fiscal 2005”). We

expect sales growth of 9% to 12% for fiscal 2005, driven by compa-

rable store sales growth, sales from new stores opened during fiscal

2004 and fiscal 2005 and sales from newly acquired businesses.

The increase in comparable store sales in fiscal 2004, our best

performance since 1999, reflects a number of factors. Our average

ticket, which increased 7.3% to a company record of $54.89,

increased in all selling departments and our comparable store

sales growth in fiscal 2004 was positive in all selling departments.

We experienced strong comparable store sales increases in

building materials due in part to the impact of several hurricanes

in the Southeastern U.S. Lumber was another strong category

during fiscal 2004, driven primarily by commodity price inflation.

Additionally, we had strong sales growth in our kitchen and bath

categories, driven by appliances, bath fixtures, vanities and sinks.

Finally, our comparable store sales growth in fiscal 2004 reflects

the impact of cannibalization.

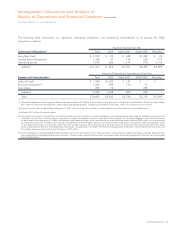

In order to meet our customer service objectives, we strategically

open stores near market areas served by existing stores (“cannibal-

ize”) to enhance service levels, gain incremental sales and increase

market penetration. As of the end of fiscal 2004, certain new stores

cannibalized approximately 17% of our existing stores and we esti-

mate that store cannibalization reduced fiscal 2004 comparable

store sales by approximately 2.2%. Additionally, we believe that our

sales performance has been, and could continue to be, negatively

impacted by the level of competition that we encounter in various

markets. However, due to the highly-fragmented U.S. home

improvement industry, in which we estimate our market share is

approximately 12%, measuring the impact on our sales by our

competitors is extremely difficult.

Comparable store sales in fiscal 2005 are estimated to increase 4%

to 7%. We expect our comparable store sales to be favorably

impacted by the introduction of innovative and distinctive new

merchandise as well as positive customer reaction to our ongoing

store modernization program. Increased customer traffic, traffic

conversion and higher average ticket are key to our 2005 sales

growth forecast. This forecast of comparable store sales growth is

net of an estimated cannibalization impact of about 2%. We do not

believe that changing prices for commodities will have a material

effect on Net Sales or results of operations in fiscal 2005.

The growth in Net Sales for fiscal 2004 reflects growth in services

revenue, which increased 28% to $3.6 billion for fiscal 2004 from

$2.8 billion for fiscal 2003, driven by strength in a number of

areas including countertops, HVAC, kitchens and our flooring

companies. We continued to drive our services programs, which

focus primarily on providing products and services to our do-it-for-

me customers. These programs are offered through Home Depot

and EXPO Design Center stores. We also arrange for the provision

of flooring, countertop and window coverings installation services

to production homebuilders through HD Builder Solutions Group,

Inc. Our services revenue is expected to benefit from the growing

percentage of mature customers as they rely more heavily on

installation services.

During fiscal 2004, we continued the implementation or expansion

of a number of in-store initiatives. We believe these initiatives will

enhance our customers’ shopping experience as they are fully

implemented in our stores. The Pro initiative adds programs to our

stores like job lot order quantities of merchandise and a dedicated

sales desk for our Pro customer base. Our Appliance initiative

offers customers an assortment of in-stock name brand appliances,

including General Electric®and Maytag®, and offers the ability to

special order over 2,300 additional related products through

computer kiosks located in the stores. Our DesignplaceSM initiative

offers our design and décor customers personalized service from

specially-trained associates and provides distinctive merchandise in

an attractive setting. Our Tool Rental Centers, which are located

inside our stores, provide a cost effective way for our do-it-yourself

and Pro customers to rent tools to complete home improvement

projects. During fiscal 2004, we opened our 1,000th Tool Rental

Center, making us the largest in the industry as measured by

number of locations.