Home Depot 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

21The Home Depot, Inc.

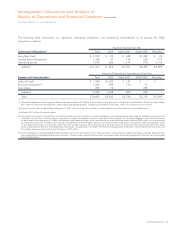

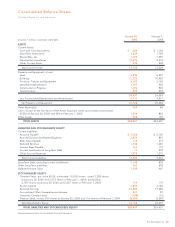

The following table summarizes our significant contractual obligations and commercial commitments as of January 30, 2005

(amounts in millions):

Payments Due by Fiscal Year

Contractual Obligations

(1)

Total 2005 2006–2007 2008–2009 Thereafter

Long-Term Debt(2) $ 2,129 $ 85 $ 638 $1,382 $ 24

Capital Lease Obligations(3) 1,108 67 134 135 772

Operating Leases 7,930 660 1,179 978 5,113

Subtotal $11,167 $ 812 $1,951 $2,495 $5,909

Amount of Commitment Expiration per Fiscal Year

Commercial Commitments

(4)

Total 2005 2006–2007 2008–2009 Thereafter

Letters of Credit $ 1,184 $ 1,057 $ 127 $ – $ –

Purchase Obligations(5) 1,044 299 718 27 –

Guarantees 295 72 – 223 –

Subtotal 2,523 1,428 845 250 –

Total $13,690 $2,240 $2,796 $2,745 $5,909

(1) Contractual obligations include Long-Term Debt comprised primarily of $1.5 billion of Senior Notes further discussed in “Quantitative and Qualitative Disclosures about Market

Risk” and future minimum lease payments under capital and operating leases, including an off-balance sheet lease, used in the normal course of business.

(2) Excludes present value of capital lease obligations of $351 million. Includes $316 million of interest payments and $5 million of unamortized discount.

(3) Includes $757 million of imputed interest.

(4) Commercial commitments include letters of credit from certain business transactions, purchase obligations and a guarantee provided under an off-balance sheet lease. We

issue letters of credit for insurance programs, purchases of import merchandise inventories and construction contracts. Our purchase obligations consist of commitments

for both merchandise and services. Under an off-balance sheet lease for certain stores, office buildings and distribution centers totaling $282 million, we have provided

a residual value guarantee. The lease expires during fiscal 2008 with no renewal option. Events or circumstances that would require us to perform under the guarantee include

(1) our default on the lease with the assets sold for less than the book value, or (2) our decision not to purchase the assets at the end of the lease and the sale of the assets

results in proceeds less than the initial book value of the assets. Our guarantee is limited to 79% of the initial book value of the assets. The estimated maximum amount of

the residual value guarantee at the end of the lease is $223 million.

(5) Purchase obligations include all legally binding contracts such as firm commitments for inventory purchases, utility purchases, capital expenditures, software acquisition and

license commitments and legally binding service contracts. Purchase orders represent authorizations to purchase rather than binding agreements, therefore they are excluded

from the table above.