Home Depot 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

34

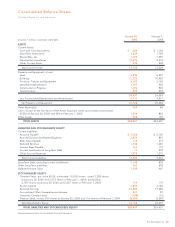

The tax effects of temporary differences that give rise to significant

portions of the deferred tax assets and deferred tax liabilities as of

January 30, 2005 and February 1, 2004, were as follows (amounts

in millions):

January 30, February 1,

2005 2004

Deferred Tax Assets:

Accrued self-insurance liabilities $185 $205

Other accrued liabilities 213 196

Net operating losses 41 19

Net loss on disposition of business –31

Total gross deferred tax assets 439 451

Valuation allowance (23) (50)

Deferred tax assets,

net of valuation allowance 416 401

Deferred Tax Liabilities:

Accelerated depreciation (1,425) (1,114)

Accelerated inventory deduction (234) (218)

Other (66) (36)

Total gross deferred tax liabilities (1,725) (1,368)

Net deferred tax liability $(1,309) $ (967)

At January 30, 2005, the Company had foreign net operating loss

carry-forwards to reduce future taxable income of certain foreign

subsidiaries of $18 million, which will expire at various dates from

2008 to 2014. Management has concluded that it is more likely

than not that these tax benefits related to the net operating losses

will be realized and hence no valuation allowance has been

provided. The Company has not provided for U.S. deferred income

taxes on $772 million of undistributed earnings of international

subsidiaries because of its intention to indefinitely reinvest these

earnings outside the U.S. The determination of the amount of the

unrecognized deferred U.S. income tax liability related to the undis-

tributed earnings is not practicable; however, unrecognized

foreign income tax credits would be available to reduce a portion

of this liability.

At January 30, 2005 and February 1, 2004, the Company had a

valuation allowance against certain deferred tax assets totaling

$23 million and $50 million, respectively. During fiscal 2004,

$31 million of deferred tax assets previously reserved were real-

ized due to the Company’s ability to fully utilize capital losses. The

remainder of the valuation allowance relates to certain deferred

tax assets in jurisdictions where it is management’s opinion that

it is more likely than not that the benefit of the deferred tax assets

will not be realized. The likelihood of realizing the benefit of

deferred tax assets is assessed on an ongoing basis. Consequently,

future changes in the valuation allowance are possible.

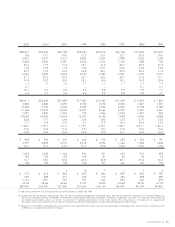

4|EMPLOYEE STOCK PLANS

The Home Depot, Inc. 1997 Omnibus Stock Incentive Plan (“1997

Plan”) provides that incentive stock options, non-qualified stock

options, stock appreciation rights, restricted shares, performance

shares, performance units and deferred shares may be issued to

selected associates, officers and directors of the Company. The

maximum number of shares of the Company’s common stock

authorized for issuance under the 1997 Plan includes the number

of shares carried over from prior plans and the number of shares

authorized but unissued in the prior year, plus one-half percent of

the total number of issued shares as of the first day of each fiscal

year. As of January 30, 2005, there were 113 million shares avail-

able for future grants under the 1997 Plan.

Under the 1997 Plan, as of January 30, 2005, the Company had

granted incentive and non-qualified stock options for 183 million

shares, net of cancellations (of which 99 million had been

exercised). Incentive stock options and non-qualified stock options

are priced at the fair market value of the Company’s stock on the

date of the grant and typically vest at the rate of 25% per year

commencing on the first anniversary date of the grant and expire

on the tenth anniversary date of the grant. The Company recog-

nized $86 million and $40 million of stock-based compensation

expense in fiscal 2004 and 2003, respectively, related to stock

options granted, modified or settled and expense related to the

ESPP after the beginning of 2003 (see Note 1 under the caption

“Stock-Based Compensation”).

Under the 1997 Plan, as of January 30, 2005, 4 million shares of

restricted stock had been issued net of cancellations (the restrictions

on 294,400 shares have lapsed). Generally, the restrictions on the

restricted stock lapse according to one of the following schedules:

(1) the restrictions on 25% of the restricted stock lapse upon

the third and sixth year anniversaries of the date of issuance with

the remaining 50% of the restricted stock lapsing upon the associ-

ate’s attainment of age 62, or (2) the restrictions on 100% of the

restricted stock lapse at three or five years. The fair value of

the restricted stock is expensed over the period during which the

restrictions lapse. The Company recorded stock-based compensa-

tion expense related to restricted stock of $22 million, $13 million

and $3 million in fiscal 2004, 2003 and 2002, respectively.