Home Depot 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

19The Home Depot, Inc.

as we had fewer stores under development in fiscal 2003 as

compared to fiscal 2002. Interest Expense also increased due to the

addition of $47 million in capital leases during the year. Interest

and Investment Income decreased 25.3% to $59 million for fiscal

2003 from $79 million for fiscal 2002 primarily due to lower aver-

age cash balances and a lower interest rate environment.

Provision for Income Taxes

Our combined federal and state effective income tax rate

decreased to 37.1% for fiscal 2003 from 37.6% for fiscal 2002.

The decrease in our effective tax rate in fiscal 2003 from fiscal

2002 was primarily due to the utilization of certain federal, state

and foreign tax benefits not previously recognized.

Diluted Earnings per Share

Diluted Earnings per Share were $1.88 and $1.56 for fiscal 2003

and fiscal 2002, respectively. Diluted Earnings per Share were

favorably impacted in fiscal 2003 as a result of the repurchase of

shares of our common stock in fiscal 2002 and fiscal 2003.

IMPACT OF THE ADOPTION OF EITF 02-16

In fiscal 2003, we adopted EITF 02-16 which states that certain

cash consideration received from a vendor is presumed to be a

reduction of the prices of the vendor’s products or services and

should, therefore, be recorded as a reduction of Cost of

Merchandise Sold when recognized in our Consolidated Statements

of Earnings. That presumption is overcome when the consideration

is either a reimbursement of specific, incremental and identifiable

costs incurred to sell the vendor’s products or a payment for assets

or services delivered to the vendor. We received consideration in

the form of advertising co-op allowances from our vendors

pursuant to annual agreements, which are generally on a calendar

year basis. As permitted by EITF 02-16, we elected to apply its

provisions prospectively to all agreements entered into or modified

after December 31, 2002. Therefore, the impact of us adopting

EITF 02-16 in fiscal 2003 was limited to advertising co-op

allowances earned pursuant to vendor agreements entered into in

late 2003, which became effective in January 2004.

The one-month impact of the adoption of EITF 02-16 in fiscal 2003

resulted in a reduction of Cost of Merchandise Sold of $40 million,

an increase in Selling and Store Operating Expenses of $47 million

and a reduction of Earnings before Provision for Income Taxes of

$7 million. The impact on our Diluted Earnings per Share was

immaterial. Merchandise Inventories in our accompanying

Consolidated Balance Sheets as of February 1, 2004 were also

reduced by $7 million.

The impact of the adoption of EITF 02-16 in fiscal 2004 resulted in

a reduction of Cost of Merchandise Sold of $891 million, an increase

in Selling and Store Operating Expenses of $1.0 billion and a reduc-

tion of Earnings before Provision for Income Taxes of $158 million.

The impact on our Diluted Earnings per Share for fiscal 2004 was a

reduction of $0.04 per share. We do not expect any further impact

on our Diluted Earnings per Share from the adoption of EITF 02-16.

Merchandise Inventories in our accompanying Consolidated Balance

Sheets as of January 30, 2005 were also reduced by $158 million.

Prior to the adoption of EITF 02-16 in fiscal 2003, the entire amount

of advertising co-op allowances received was offset against adver-

tising expense and resulted in a reduction of Selling and Store

Operating Expenses. In fiscal 2002, advertising co-op allowances

exceeded gross advertising expense by $30 million. This excess

amount was recorded as a reduction of Cost of Merchandise

Sold in the accompanying Consolidated Statements of Earnings. We

continue to earn certain advertising co-op allowances that are

recorded as an offset against advertising expenses as they are reim-

bursements of specific, incremental and identifiable costs incurred

to promote vendors’ products. In fiscal 2004 and fiscal 2003, net

advertising expense was $1.0 billion and $58 million, respectively,

which was recorded in Selling and Store Operating Expenses.

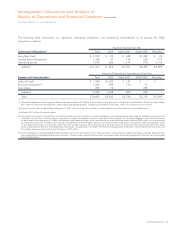

The following table illustrates the full-year effect on Cost of

Merchandise Sold, Gross Profit, Selling and Store Operating

Expenses, Operating Income and Diluted Earnings per Share as if

advertising co-op allowances had always been treated as a reduc-

tion of Cost of Merchandise Sold in accordance with EITF 02-16

(amounts in millions, except per share data):

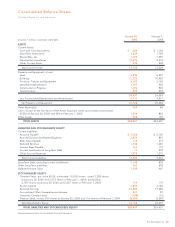

Fiscal Year Ended

January 30, February 1, February 2,

2005 2004 2003

Cost of

Merchandise Sold

As Reported $48,664 $44,236 $40,139

Pro Forma 48,524 43,295 39,284

Gross Profit

As Reported 24,430 20,580 18,108

Pro Forma 24,570 21,521 18,963

Selling and Store

Operating Expenses

As Reported 15,105 12,588 11,276

Pro Forma 15,105 13,529 12,157

Operating Income

As Reported 7,926 6,846 5,830

Pro Forma 8,066 6,846 5,804

Diluted Earnings

per Share

As Reported $2.26 $1.88 $ 1.56

Pro Forma $ 2.30 $ 1.88 $ 1.56