Home Depot 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

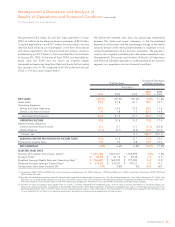

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

18

Provision for Income Taxes

Our combined federal and state effective income tax rate

decreased to 36.8% for fiscal 2004 from 37.1% for fiscal 2003.

The majority of this reduction was due to the reversal of a

$31 million valuation allowance as we were able to recognize

previous capital losses for which no tax benefit had been recorded

at the time the capital loss was incurred.

Diluted Earnings per Share

Diluted Earnings per Share were $2.26 and $1.88 for fiscal 2004

and fiscal 2003, respectively. The adoption of EITF 02-16 nega-

tively impacted Diluted Earnings per Share for fiscal 2004 by $0.04

per share. Diluted Earnings per Share were favorably impacted

in fiscal 2004 as a result of the repurchase of shares of our

common stock in fiscal 2003 and fiscal 2004. Over the past three

fiscal years, we have repurchased 200.5 million shares of our

common stock for a total of $6.7 billion. In fiscal 2005, we

estimate Diluted Earnings per Share growth of 10% to 14%.

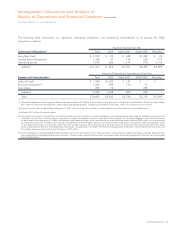

Fiscal 2003 Compared to Fiscal Year Ended

February 2, 2003 (“Fiscal 2002”)

Net Sales

Net Sales for fiscal 2003 increased 11.3% to $64.8 billion from

$58.2 billion for fiscal 2002. Fiscal 2003 Net Sales growth was

driven by an increase in comparable store sales of 3.8%, sales from

the 175 net new stores opened during fiscal 2003 and sales from the

203 net new stores opened during fiscal 2002.

The increase in comparable store sales in fiscal 2003 reflects a

number of factors. Comparable store sales growth in fiscal 2003

was positive in all selling departments. Our lawn and garden cate-

gory was the biggest driver of the increase in comparable store

sales for fiscal 2003, reflecting strong sales in outdoor power

equipment, including John Deere®tractors and walk-behind

mowers, as well as snow throwers and snow blowers. Lumber was

another strong category during fiscal 2003, driven primarily by

commodity price inflation. Additionally, we had strong sales growth

in our kitchen and bath categories and in our paint department

reflecting the positive impact of new merchandising initiatives.

During fiscal 2003, we added our Appliance initiative to 826 of our

stores bringing the total number of stores with our Appliance initia-

tive to 1,569 as of the end of fiscal 2003. Additionally, during fiscal

2003, each store was set with our new Color Solutions Center,

which drove sales growth in interior and exterior paint, as well as

pressure washers. Finally, our comparable store sales growth in

fiscal 2003 reflects the impact of cannibalization.

As of the end of fiscal 2003, certain new stores cannibalized

approximately 17% of our existing stores and we estimate that store

cannibalization reduced fiscal 2003 comparable store sales by

approximately 2.7%.

The growth in Net Sales for fiscal 2003 reflects growth in services

revenue, which increased 40% to $2.8 billion in fiscal 2003 from

$2.0 billion in fiscal 2002, driven by strength in a number of areas

including countertops, HVAC, kitchens and our flooring companies.

Gross Profit

Gross Profit increased 13.7% to $20.6 billion for fiscal 2003 from

$18.1 billion for fiscal 2002. Gross Profit as a percent of Net Sales

was 31.8% for fiscal 2003 compared to 31.1% for fiscal 2002. The

increase in the gross profit rate was attributable to changing customer

preferences and continuing benefits arising from our centralized

purchasing group. Improved inventory management, which resulted

in lower shrink levels, increased penetration of import products, which

typically have a lower cost, and benefits from Tool Rental Centers also

positively impacted the gross profit rate. The adoption of EITF 02-16

also contributed to the increase in Gross Profit in fiscal 2003. The one-

month impact of EITF 02-16 in fiscal 2003 resulted in a reduction of

Cost of Merchandise Sold of $40 million.

Operating Expenses

Operating Expenses increased 11.9% to $13.7 billion for fiscal

2003 from $12.3 billion for fiscal 2002. Operating Expenses as

a percent of Net Sales were 21.2% for fiscal 2003 compared to

21.1% for fiscal 2002.

Selling and Store Operating Expenses, which are included in

Operating Expenses, increased 11.6% to $12.6 billion for fiscal

2003 from $11.3 billion for fiscal 2002. As a percent of Net Sales,

Selling and Store Operating Expenses were 19.4% for fiscal 2003

and fiscal 2002. The increase in Selling and Store Operating

Expenses in fiscal 2003 included $47 million of advertising expense

related to the adoption of EITF 02-16. During fiscal 2003, we

experienced rising workers’ compensation and general liability

expense, due to rising medical costs. We also experienced incre-

mental expense associated with our store modernization program.

These rising costs were offset, however, by increasing levels of sales

productivity by our associates and benefits from our new private

label credit program.

General and Administrative Expenses, which are included in Operating

Expenses, increased 14.4% to $1.1 billion for fiscal 2003 from

$1.0 billion for fiscal 2002. General and Administrative Expenses as a

percent of Net Sales were 1.8% for fiscal 2003 and 1.7% for fiscal

2002. The increase in fiscal 2003 was primarily due to increased

spending in technology and other growth initiatives.

Interest, net

In fiscal 2003, we recognized $3 million of net Interest Expense

compared to $42 million of net Interest and Investment Income in

fiscal 2002. Net Interest Expense as a percent of Net Sales was less

than 0.1% for fiscal 2003 and net Interest and Investment Income as

a percent of Net Sales was 0.1% for fiscal 2002. Interest Expense

increased 67.6% to $62 million for fiscal 2003 from $37 million

for fiscal 2002 primarily due to lower capitalized interest expense