Home Depot 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

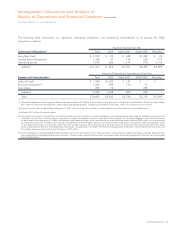

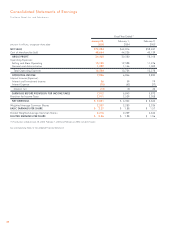

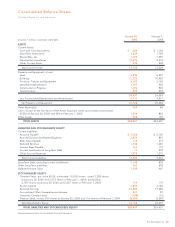

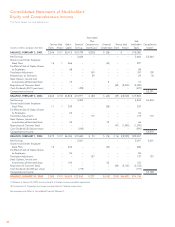

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

30

stores and focus primarily on providing products and services to our

do-it-for-me customers. The Company also arranges for the provi-

sion of flooring, countertop and window coverings installation

services to production homebuilders through HD Builder Solutions

Group, Inc. Under certain programs, when the Company provides

or arranges the installation of a project and the subcontractor

provides material as part of the installation, both the material and

labor are included in services revenue. The Company recognizes

this revenue when the service for the customer is complete.

All payments received prior to the completion of services are

recorded in Deferred Revenue in the accompanying Consolidated

Balance Sheets. Services revenue, including the impact of deferred

revenue, was $3.6 billion, $2.8 billion and $2.0 billion for fiscal

2004, 2003 and 2002, respectively.

Self-Insurance

The Company is self-insured for certain losses related to general

liability, product liability, automobile, workers’ compensation and

medical claims. The expected ultimate cost for claims incurred as

of the balance sheet date is not discounted and is recognized as a

liability. The expected ultimate cost of claims is estimated based

upon analysis of historical data and actuarial estimates.

Prepaid Advertising

Television and radio advertising production costs along with media

placement costs are expensed when the advertisement first

appears. Included in Other Current Assets in the accompanying

Consolidated Balance Sheets are $33 million at the end of both

fiscal 2004 and 2003 relating to prepayments of production costs

for print and broadcast advertising.

Vendor Allowances

The Company currently receives two types of vendor allowances:

volume rebates that are earned as a result of attaining certain

purchase levels and advertising co-op allowances for the promo-

tion of vendors’ products that are typically based on guaranteed

minimum amounts with additional amounts being earned for

attaining certain purchase levels. All vendor allowances are

accrued as earned, and those allowances received as a result of

attaining certain purchase levels are accrued over the incentive

period based on estimates of purchases.

In fiscal 2003, the Company adopted Emerging Issues Task Force

No. 02-16, “Accounting by a Customer (Including a Reseller) for

Certain Consideration Received from a Vendor” (“EITF 02-16”),

which states that cash consideration received from a vendor is

presumed to be a reduction of the prices of the vendor’s products

or services and should, therefore, be characterized as a reduction

of Cost of Merchandise Sold when recognized in the Company’s

Consolidated Statements of Earnings. That presumption is over-

come when the consideration is either a reimbursement of specific,

incremental and identifiable costs incurred to sell the vendor’s

product or a payment for assets or services delivered to the vendor.

The Company received consideration in the form of advertising

co-op allowances from its vendors pursuant to annual agreements,

which are generally on a calendar year basis. As permitted by EITF

02-16, the Company elected to apply the provisions of EITF 02-16

prospectively to all agreements entered into or modified after

December 31, 2002.

The impact of EITF 02-16 in fiscal 2004 and fiscal 2003 resulted

in a reduction of Cost of Merchandise Sold of $891 million and

$40 million, an increase to Selling and Store Operating Expenses of

$1.0 billion and $47 million and a reduction to Earnings before

Provision for Income Taxes of $158 million and $7 million, respec-

tively. The impact on the Company’s Diluted Earnings per Share

was a reduction of $0.04 in fiscal 2004. There was no material

impact on the Company’s Diluted Earnings per Share in fiscal 2003.

Merchandise Inventories in the accompanying Consolidated

Balance Sheets were also reduced by $158 million and $7 million

as of January 30, 2005 and February 1, 2004, respectively.

Volume rebates and advertising co-op allowances earned are

initially recorded as a reduction in Merchandise Inventories and a

subsequent reduction in Cost of Merchandise Sold when the

related product is sold. Prior to the adoption of EITF 02-16 in

January 2004, advertising co-op allowances earned had been

offset against advertising expense to the extent of advertising costs

incurred, with the excess treated as a reduction of Cost of

Merchandise Sold.

The Company continues to earn certain advertising co-op

allowances that are recorded as an offset against advertising

expense as they are reimbursements of specific, incremental

and identifiable costs incurred to promote vendors’ products. In

fiscal 2002, advertising co-op allowances exceeded gross advertis-

ing expense by $30 million. In fiscal 2004 and 2003, net advertising

expense was $1.0 billion and $58 million, respectively, which was

recorded in Selling and Store Operating Expenses.

Cost of Merchandise Sold

Cost of Merchandise Sold includes the actual cost of merchandise

sold and services performed, the cost of transportation of

merchandise from vendors to the Company’s stores, locations or

customers, the operating cost of the Company’s distribution centers

and the cost of deferred interest programs offered through the

Company’s private label credit card program.

The cost of handling and shipping merchandise from the

Company’s stores, locations or distribution centers to the customer

is classified as Selling and Store Operating Expenses. The cost of

shipping and handling, including internal costs and payments to

third parties, classified as Selling and Store Operating Expenses,

was $427 million, $387 million and $341 million in fiscal 2004,

2003 and 2002, respectively.