Home Depot 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

17The Home Depot, Inc.

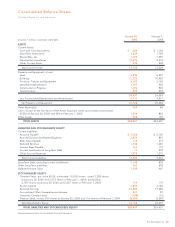

The following table provides the number of stores with these initiatives:

Fiscal Year

2005 Fiscal Year

Estimate 2004 2003 2002

Store Count 2,065 1,890 1,707 1,532

Initiatives:

Pro 1,728 1,563 1,356 1,135

Appliance 1,952 1,787 1,569 743

DesignplaceSM 1,952 1,787 1,625 873

Tool Rental Centers 1,186 1,061 825 601

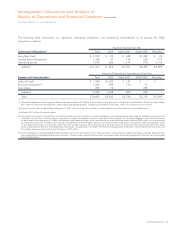

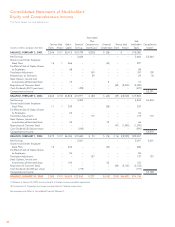

Gross Profit

Gross Profit increased 18.7% to $24.4 billion for fiscal 2004 from

$20.6 billion for fiscal 2003, an increase of 167 basis points. Gross

Profit as a percent of Net Sales was 33.4% for fiscal 2004, the

highest annual rate in our company’s history, compared to 31.8%

for fiscal 2003. The adoption of Emerging Issues Task Force (“EITF”)

02-16, “Accounting by a Customer (Including a Reseller) for Certain

Consideration Received from a Vendor” (“EITF 02-16”), reduced

our Cost of Merchandise Sold by co-op advertising allowances of

$891 million, or 122 basis points, in fiscal 2004 and $40 million, or

6 basis points, in fiscal 2003. See section “Impact of the Adoption of

EITF 02-16.” Excluding the impact of the adoption of EITF 02-16, our

gross margin would have been 32.2% for fiscal 2004 compared with

31.7% for fiscal 2003. Improved inventory management, which

resulted in lower shrink levels, contributed 18 basis points of our

increase in gross profit. Finally, 33 basis points resulted from benefits

arising from a change in merchandising mix, offset by the cost of our

deferred interest programs, as the cost of these programs is reflected

in our gross margin. Our deferred interest programs offer no interest

and no payment programs over a six or twelve-month period

through our private label credit card. We believe these programs

deliver long-term benefits, including higher average tickets and

customer loyalty.

Operating Expenses

Operating Expenses increased 20.2% to $16.5 billion for fiscal

2004 from $13.7 billion for fiscal 2003. Operating Expenses as a

percent of Net Sales were 22.6% for fiscal 2004 compared to

21.2% for fiscal 2003.

Selling and Store Operating Expenses, which are included in

Operating Expenses, increased 20.0% to $15.1 billion for fiscal

2004 from $12.6 billion for fiscal 2003. As a percent of Net Sales,

Selling and Store Operating Expenses were 20.7% for fiscal 2004

compared to 19.4% for fiscal 2003. The increase in Selling and

Store Operating Expenses in fiscal 2004 includes $1.0 billion of

advertising expense related to the adoption of EITF 02-16.

Excluding the impact of EITF 02-16, Selling and Store Operating

Expenses increased 12.1% to $14.1 billion, or 19.2% of Net Sales,

in fiscal 2004 compared with 19.4% of Net Sales in fiscal 2003.

The decrease in Selling and Store Operating Expenses as a percent

of Net Sales for fiscal 2004, excluding the impact of EITF 02-16,

was due to an increase in labor productivity and benefits from our

private label credit card, which carries a lower discount rate than

other forms of credit, like bank cards. Labor productivity, as meas-

ured by sales per labor hour, reached an all-time high in fiscal

2004, as we moved our associates from tasking to selling activities.

This reduction in costs was partially offset by higher expenses asso-

ciated with incentive programs, like our success sharing program

and our management incentive plan. In addition, our planned

investment in store modernization and technology caused remodel

and repair expenses as well as depreciation expense to rise at a

faster rate than our sales growth.

General and Administrative Expenses, which are included in

Operating Expenses, increased 22.1% to $1.4 billion for fiscal

2004 from $1.1 billion for fiscal 2003. General and Administrative

Expenses as a percent of Net Sales were 1.9% for fiscal 2004 and

1.8% for fiscal 2003. The increase in fiscal 2004 was primarily due

to expenses associated with incentive programs and stock-based

compensation expense.

While we will continue to drive productivity, our expenses will be under

pressure in fiscal 2005 for two primary reasons. Given our continued

reinvestment in our business in prior years and our capital expenditure

forecast of $3.7 billion for fiscal 2005, our total depreciation expense

is estimated to increase by approximately $250 million to approxi-

mately $1.6 billion for fiscal 2005, of which approximately $1.3 billion

and $300 million are included in Selling and Store Operating

Expenses and General and Administrative Expenses, respectively. Stock-

based compensation expense is estimated to increase by $125 million

in fiscal 2005 with approximately $65 million of the increase due

to the adoption of Statement of Financial Accounting Standards

(“SFAS”) No. 123(R), “Share-Based Payment” (“SFAS 123(R)”). See

section “Recent Accounting Pronouncements.”

Interest, net

In fiscal 2004, we recognized $14 million of net Interest Expense

compared to $3 million in fiscal 2003. Net Interest Expense as a

percent of Net Sales was less than 0.1% for both fiscal 2004 and

fiscal 2003. Interest Expense increased 12.9% to $70 million for fiscal

2004 from $62 million for fiscal 2003 primarily due to an increase

in outstanding indebtedness and a reduction in the amount of capi-

talized interest. Interest Expense also increased due to the addition of

$38 million in capital leases during the year. Interest and Investment

Income decreased 5.1% to $56 million for fiscal 2004 from $59 mil-

lion for fiscal 2003 primarily due to a lower interest rate environment.