Home Depot 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

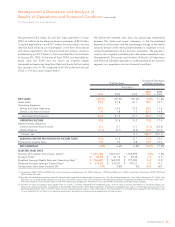

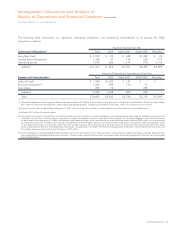

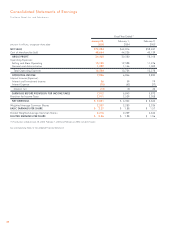

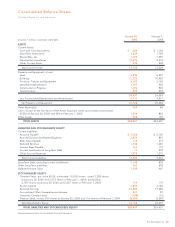

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

23The Home Depot, Inc.

RECENT ACCOUNTING PRONOUNCEMENTS

In December 2004, the FASB issued SFAS 123(R). This statement

revises SFAS Statement No. 123, “Accounting for Stock-Based

Compensation” (“SFAS 123”) and supersedes Accounting Principles

Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to

Employees.” SFAS 123(R) requires all public entities to recognize

compensation expense for all share-based payments as measured

by the fair value on the grant date over the requisite service period.

SFAS 123(R) becomes effective as of the first interim or annual

reporting period that begins after June 15, 2005, therefore we will

adopt SFAS 123(R) in the third quarter of fiscal 2005. Effective

February 3, 2003, we adopted the fair value of recording stock-

based compensation expense in accordance with SFAS 123. We

selected the prospective method of adoption as described in

SFAS No. 148, “Accounting for Stock-Based Compensation –

Transition and Disclosure,” and accordingly, stock-based compen-

sation expense was recorded for all share-based payments granted

or modified after the beginning of fiscal 2003. SFAS 123(R)

requires that all share-based payments granted prior to the adop-

tion date that remain unvested at the adoption date also be

expensed over the remaining service period. We currently intend to

adopt SFAS 123(R) using the modified-prospective method, there-

fore in addition to continuing to recognize stock-based compensa-

tion expense for all share-based payments awarded since our

adoption of SFAS 123 in fiscal 2003, we will also begin expensing

unvested options granted prior to 2003 upon the adoption of

SFAS 123(R). We currently estimate the impact of adopting SFAS 123(R)

will be a reduction of Earnings before Provision for Income Taxes

of $34 million and $31 million for our third and fourth quarters of

fiscal 2005, respectively.

In November 2004, the FASB issued EITF No. 03-13, “Applying

the Conditions in Paragraph 42 of FASB Statement No. 144

in Determining Whether to Report Discontinued Operations”

(“EITF 03-13”). EITF 03-13 clarifies guidance on how an ongoing

entity should evaluate whether the operations and cash flows of a

disposed component have been or will be eliminated from the

ongoing operations of the entity. Additionally, guidance is given on

the types of continuing involvement that constitute significant

continuing involvement in the operations of the disposed company.

EITF 03-13 becomes effective for fiscal periods beginning after

December 15, 2004, therefore we will adopt EITF 03-13 in the first

quarter of fiscal 2005. The adoption of EITF 03-13 will impact our

determination of whether a disposed component of a business

should be reflected as a discontinued operation for any such

disposals occurring after January 30, 2005.