Home Depot 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

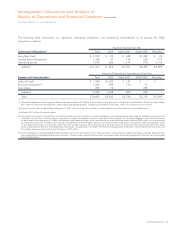

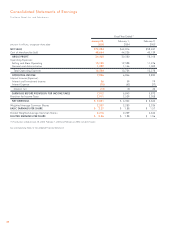

Management’s Discussion and Analysis of

Results of Operations and Financial Condition

The Home Depot, Inc. and Subsidiaries

14

FORWARD-LOOKING STATEMENTS

Certain statements of The Home Depot’s expectations made

herein, including those regarding Net Sales growth, increases in

comparable store sales, impact of cannibalization, commodity

price inflation and deflation, implementation of store initiatives,

Net Earnings performance, including depreciation expense and

stock-based compensation expense, store openings, capital allo-

cation and expenditures, the effect of adopting certain accounting

standards, strategic direction and the demand for our products

and services, constitute “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995. These state-

ments are based on currently available information and are

subject to risks and uncertainties that could cause actual results to

differ materially from our historical experience and expectations.

These risks and uncertainties include economic conditions in North

America, changes in our cost structure, the availability of sourcing

channels consistent with our strategy of differentiation, conditions

affecting new store development, conditions affecting customer

transactions and average ticket, the success of our technology

initiatives in improving operations and customers’ in-store experi-

ence, our ability to identify and respond to evolving trends in

demographics and consumer preferences, the relative success of

our expansion strategy, including our ability to integrate acquisi-

tions and create appropriate distribution channels for key sales

platforms, our ability to attract, train and retain highly-qualified

associates, the impact of new accounting standards and the

impact of competition, decisions by management related to possible

asset impairments, regulation and litigation matters. Undue

reliance should not be placed on such forward-looking statements

as they speak only as of the date made. Additional information

regarding these and other risks is contained in our periodic filings

with the Securities and Exchange Commission.

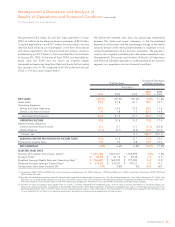

EXECUTIVE SUMMARY AND SELECTED CONSOLIDATED

STATEMENTS OF EARNINGS DATA

For fiscal year ended January 30, 2005 (“fiscal 2004”), we reported

Net Earnings of $5.0 billion and Diluted Earnings per Share of

$2.26 compared to Net Earnings of $4.3 billion and Diluted

Earnings per Share of $1.88 in fiscal year ended February 1, 2004

(“fiscal 2003”). Net Sales for fiscal 2004 increased 12.8% over fiscal

2003 to $73.1 billion. This growth in our business was achieved

through the continued execution of our strategy of enhancing the

core, extending the business and expanding the market. In the execu-

tion of our strategy, we invested $3.9 billion back into our business

and invested $727 million for acquisitions of new businesses during

fiscal 2004.

We enhanced our business by maintaining an aggressive pace of

introducing innovative and distinctive new merchandise, supported

by continued investments in store modernization and technology,

including major merchandising resets that reflect emerging

consumer trends. In fiscal 2004, we continued to invest in technol-

ogy through the installation of human resource and financial

systems to improve our operating systems and enable future

growth. Our technological enhancements also included the

conversion onto a new single point-of-sale platform in all stores in

the United States (“U.S.”), which allowed us to roll out cordless scan

guns to all U.S. stores and self-checkout registers to over 1,000

stores. These enhancements streamlined the front-end of our stores

and eliminated redundant tasks, allowing our associates to spend

more time with our customers. These investments in our core

business are paying off as evidenced by certain key operating

performance measurements, including comparable store sales,

which increased 5.4% in fiscal 2004 and sales per square foot

which increased 1.2% to $375.26. Average ticket also increased

7.3% in fiscal 2004 to $54.89, a company record, with growth in

every selling department. We achieved a record operating margin

of 10.8% for fiscal 2004.

We extended our business by opening new stores and by offering

a variety of installation and home maintenance programs through

our Home Depot and EXPO Design Center stores. We currently

offer 23 national installation programs that provide products and

services to our do-it-for-me customers. We also arrange for the

provision of flooring, countertop and window coverings installation

services to production homebuilders through HD Builder Solutions

Group, Inc. Our services revenue increased 28% to $3.6 billion in

fiscal 2004, and we saw sustained growth in categories such as

carpet, countertops, kitchens, windows, HVAC, roofing and

sheds. We opened 183 net new stores during fiscal 2004, includ-

ing three new urban format stores, two in New York City and

one in Park Royal, West Vancouver, British Columbia, bringing our

total store count to 1,890. We also continued the expansion of

several initiatives including our Tool Rental Centers, Professional

Business Customer (“Pro”), Appliance and DesignplaceSM initiatives.

In response to the growing demand for online shopping, we

revamped our website, homedepot.com, making improvements in

the overall navigability of the site with more than 15,000 products

for sale, including appliances.

We have expanded our market by capturing a growing share of the

professional residential, commercial and heavy construction

markets which operate under our Home Depot Supply brand and

by continuing our expansion outside of the U.S. As part of this

expansion in 2004, we acquired White Cap Industries, Inc. (“White

Cap”), a leading distributor of specialty hardware, tools and mate-

rials to construction contractors. In fiscal 2004, we made several

important moves to expand our market and global presence. We

opened 15 new stores in Canada, bringing the total to 117, and

increased our footprint significantly in Mexico to 44 stores through

both organic growth and the acquisition of 20 Home Mart Mexico,

S.A. de C.V. (“Home Mart”) stores. In fiscal 2004, we also

announced our intention to enter the retail market in China.