Home Depot 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

32

Derivatives

The Company measures its derivatives at fair value and recognizes

these assets or liabilities on the Consolidated Balance Sheets. The

Company’s primary objective for entering into derivative instru-

ments is to manage its exposure to interest rates, as well as to

maintain an appropriate mix of fixed and variable rate debt. At

January 30, 2005, the Company had several outstanding interest

rate swaps with a notional amount of $475 million that swap fixed

rate interest on the Company’s $500 million 53⁄8% Senior Notes for

variable interest rates equal to LIBOR plus 30 to 245 basis points

and expire on April 1, 2006. At January 30, 2005, the fair market

value of these agreements was $6 million, which is the estimated

amount that the Company would have received to sell similar

interest rate swap agreements at current interest rates.

Comprehensive Income

Comprehensive Income includes Net Earnings adjusted for certain

revenues, expenses, gains and losses that are excluded from Net

Earnings under generally accepted accounting principles. Examples

include foreign currency translation adjustments and unrealized

gains and losses on certain derivatives.

Foreign Currency Translation

Assets and Liabilities denominated in a foreign currency are trans-

lated into U.S. dollars at the current rate of exchange on the last

day of the reporting period. Revenues and Expenses are generally

translated at a daily exchange rate and equity transactions are

translated using the actual rate on the day of the transaction.

Segment Information

The Company operates within a single operating segment within

North America. Net Sales for Canada and Mexico were $4.2 billion,

$3.4 billion and $2.6 billion during fiscal 2004, 2003 and 2002,

respectively. Long-lived assets in Canada and Mexico totaled $1.7 bil-

lion and $1.2 billion as of January 30, 2005 and February 1, 2004,

respectively.

Reclassifications

Certain amounts in prior fiscal years have been reclassified to

conform with the presentation adopted in the current fiscal year.

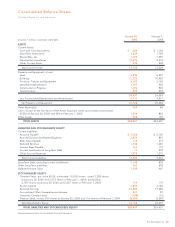

2|LONG-TERM DEBT

The Company’s Long-Term Debt at the end of fiscal 2004 and

fiscal 2003 consisted of the following (amounts in millions):

January 30, February 1,

2005 2004

33⁄4% Senior Notes;

due September 15, 2009;

interest payable semi-annually

on March 15 and September 15 $995 $ –

61⁄2% Senior Notes;

due September 15, 2004;

interest payable semi-annually

on March 15 and September 15 –500

53⁄8% Senior Notes;

due April 1, 2006;

interest payable semi-annually

on April 1 and October 1 500 500

Capital Lease Obligations;

payable in varying installments

through January 31, 2045 351 318

Other 313 47

Total Long-Term Debt 2,159 1,365

Less current installments 11 509

Long-Term Debt, excluding

current installments $2,148 $ 856

In the second quarter of fiscal 2004, the Company increased the

maximum capacity for borrowing under its commercial paper

program to $1.25 billion as well as increased the related back-up

credit facility with a consortium of banks to $1.0 billion. As of

January 30, 2005, there were no amounts outstanding under

the program. The credit facility, which expires in May 2009,

contains various restrictive covenants, none of which are expected

to materially impact the Company’s liquidity or capital resources.

In September 2004, the Company issued $1.0 billion of 33⁄4%

Senior Notes due September 15, 2009 at a discount of $5 million

with interest payable semi-annually on March 15 and September

15 of each year. The net proceeds of $995 million were used in

part for the repayment of the Company’s outstanding 61⁄2% Senior

Notes due September 2004 in the aggregate principal amount of

$500 million. The remainder of the net proceeds was used for

general corporate purposes.